Weekly Market Insights

Major stock indices got off to a good start last week until weaker than expected earnings out of Tesla and Alphabet (Google) sent the markets in a tizzy on Wednesday. Yes, Alphabet growing revenues by 15% over the last year wasn’t good enough to meet investors’ expectations, this demonstrates how the tech space is priced to perfection with little room for error… That downward momentum continued Thursday morning before sentiment changed as investors embraced the solid Q2 GDP estimate which came in well above expectations at 2.8% vs. views for 2.0% growth on a YoY basis. Keeping the soft-landing thesis alive, the Federal Reserve’s key inflation gauge, Core PCE (Personal Consumption Expenditure Price Index), met expectations Friday morning giving stocks an additional boost going into the weekend.

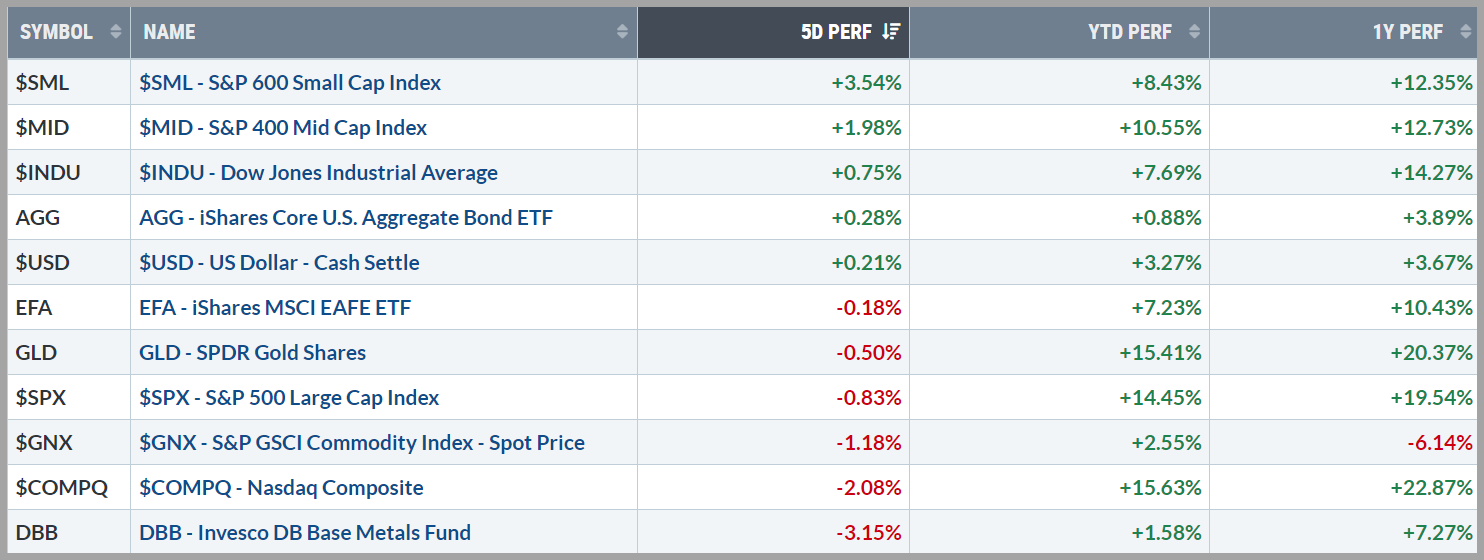

Treasury yields stayed in a tight range last week with the 10-year yield closing down just a few basis points at 4.20%. With no surprises and the data largely reinforcing investors’ current mantra, the dollar index closed flat, and gold was little changed. The strong GDP report was not enough to help industrial metals which have been in a free fall the past couple of weeks due to Chinese economic growth concerns.

Source: www.stockcharts.com

Key Takeaway:

The rotation out of tech and into other areas of the market was apparent all week and is evidenced by the fact the “tech heavy” NASDAQ and S&P 500 were the biggest losers while small and mid-caps stole the show. The Dow Jones Industrial Average, which is not as heavily influenced by the technology sector, showed impressive gains for the week after revisiting the previous technical resistance level around the 40,000 mark. Revisiting a key level after a breakout is a textbook move and one might expect momentum to build now that this level has offered new support.

The past couple of weeks’ heavy price action has thus far essentially brought the S&P 500 back down to its 50-day moving average which coincided with an upwardly sloping trendline. Price action tends to overshoot targets such as these by a small amount to push out the weak hands and, in this case, it did just that by filling in the gap I’ve had highlighted on the chart above for several weeks.

I firmly believe the AI trade has years left to run, however, one can expect some unwinding of said trade along the way when it gets a little too frothy. Recent economic data supports the more cyclical sectors of the market and with lower rates expected in the future, one might anticipate the higher dividend paying stocks of defensive sectors to begin looking more attractive as well. A market with many sectors driving positive returns is a much healthier market than one being led by just a handful of stocks.

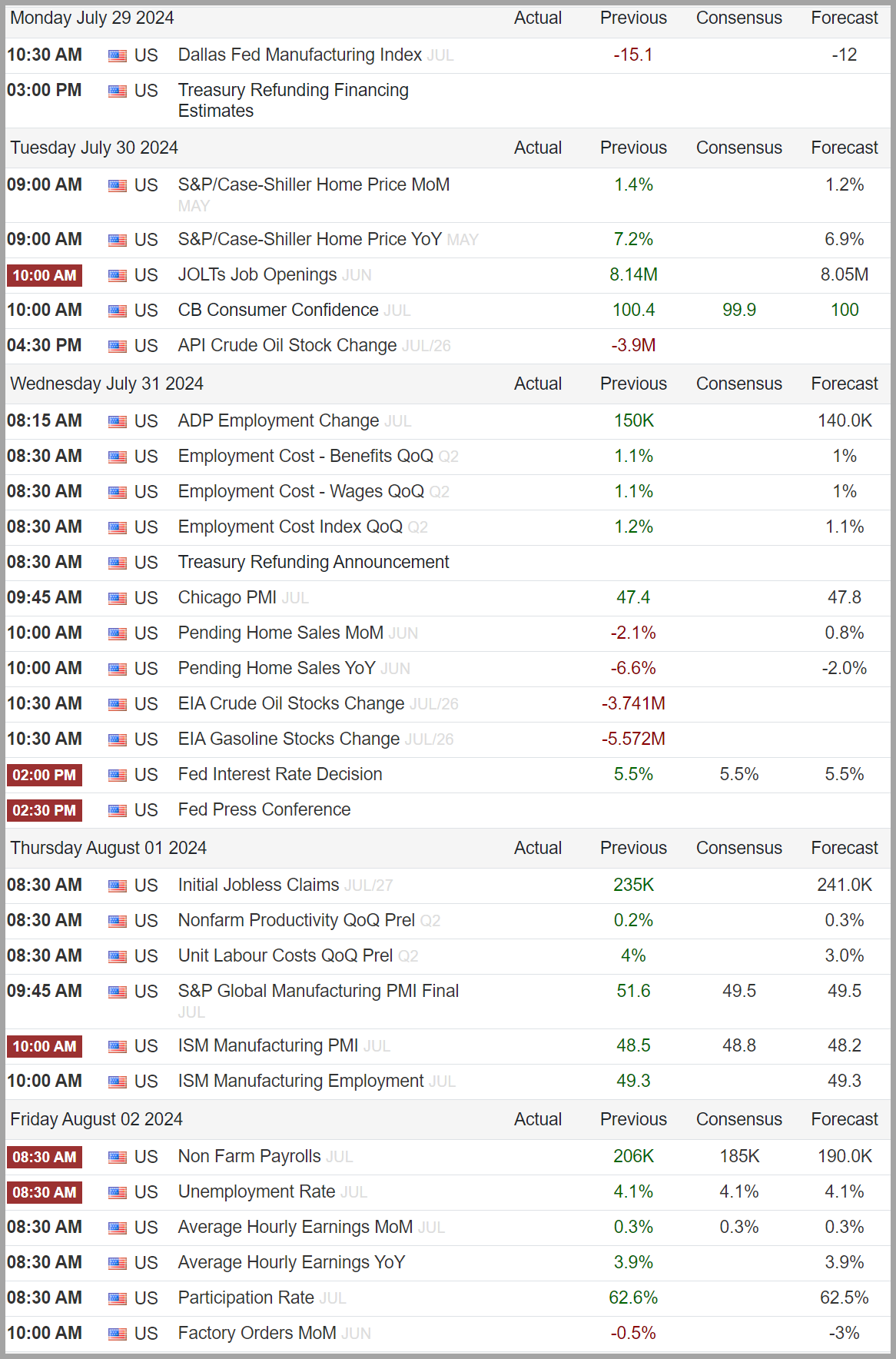

The Week Ahead:

It’s jobs week and investors will be looking for insights into the current employment situation as the unemployment rate recently ticked above the 4% level; however, the “event of the week” will be the Federal Reserves’ Press Conference since an interest rate change is not seen as likely this go around. The ISM Manufacturing PMI, which has been in contraction territory for a while, will also be closely watched and earnings season comes into full swing with several of the Magnificent 7 stocks reporting.

Source: Trading Economics (https://tradingeconomics.com/united-states/calendar#)

Tidbits & Technicals: (New developments will be denoted via***)

Current Headwinds:

- Valuations seem frothy given the current rate environment, leaving the markets subject to a potential swift pullback!

- “Higher for Longer” – Risk that the Federal Reserve waits too long to begin lowering rates and threatens economic growth.

- ***Very narrow market participation, apparently driven primarily by mega cap tech and AI-related companies, has dominated the indices; however, over the last couple of weeks we have witnessed a significant broadening effect with “the rest of the market” showing stronger returns.

Current Tailwinds:

- Optimism surrounding Artificial Intelligence (AI)

- The Federal Reserve potentially cutting rates in the future.

- Strong Labor Market

- Solid Economic Growth

- Continued Earnings Growth (the pace of which may be slowing)

- Momentum

- 10-year Treasury yields continue to hover near their lowest levels since March of this year.

Sentiment:

- Credit Spreads remain tight, hitting their lowest levels recently since peaking in 2022 signaling the bond market (aka “Smart Money”) is not worried about a recession in the near future.

- The VIX (CBOE Volatility Index) moved higher the past in the past couple of weeks on mixed earnings reports out of the tech sector

- The CNN FEAR & Greed Index remains Neutral for the pas couple of weeks

Intermarket Trends:

- The major Indices (Dow Jones Industrial Average, S&P 500, and NASDAQ) recently posted new highs signifying a positive trend.

- Interest rates have been volatile lately but appear to be retreating at the present time.

- The US Dollar is trading near the upper end of this year’s trading range due to foreign central banks being the first to cut rates.

- Gold recently broke out of its trading range to record highs.

- Industrial Metals, which raced higher recently, have retraced all recent gains and are back in the middle of the large consolidation zone of the past year

- Oil futures are in the middle of their one-year trading band and appear to be stuck in a trading range

Tying it all together:

Four main factors have seemingly been supporting the markets — strong growth, falling inflation, expectations of Fed rate cuts, and AI enthusiasm. These drivers remain intact; however, some key economic data points, like rising unemployment, are flashing warning signals at the present time. While the economy is not weak, some of the data suggests a weakening trend and this is a concern given the equity markets are not acknowledging the possibility of any sort of economic contraction. Current valuations have certain equities priced for perfection, so it would be fair to say that any type of growth scare could result in rather extreme volatility in the short run.

The past couple of weeks’ rotation into sectors of the market that have underperformed is a welcomed sight. Markets need broad-based participation to be “healthy”, so we will want to keep an eye on this potential new trend, as it could lead to much higher prices in the future and provide insights into expectations of future economic expansion.

In the long term, economic growth is the primary driver and, while growth remains robust, we must remain vigilant for signs of a slowdown, as this could end the current bull market we are all currently enjoying. For now, the positives meaningfully outweigh the negatives and as long as these conditions persist, the environment remains favorable for risk assets.

Historically, the best approach in such environments is to ensure that one’s overall portfolio aligns with their risk tolerance and long-term goals.

Please feel free to share these commentaries with friends and family and, should you have any questions regarding your current strategy or the markets in general, please reach out to your CIAS Investment Adviser Representative.

Important Disclosures:

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The statements contained herein are solely based upon the opinions of Edward J. Sabo and the data available at the time of publication of this report, and there is no assurance that any predicted or implied results will actually occur. Information was obtained from third-party sources, which are believed to be reliable, but are not guaranteed as to their accuracy or completeness.

The actual characteristics with respect to any particular client account will vary based on a number of factors including but not limited to: (i) the size of the account; (ii) investment restrictions applicable to the account, if any; and (iii) market exigencies at the time of investment. Capital Investment Advisory Services, LLC (CIAS) reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. The information provided in this report should not be considered a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

CIAS is a registered investment advisor. More information about the advisor, including its investment strategies and objectives, can be obtained by visiting www.capital-invest.com. A copy of CIAS’s disclosure statement (Part 2 of Form ADV) is available, without charge, upon request. Our Form ADV contains information regarding our Firm’s business practices and the backgrounds of our key personnel. Please contact us at (919) 831-2370 if you would like to receive this information.

Capital Investment Advisory Services, LLC

100 E. Six Forks Road, Ste. 200; Raleigh, North Carolina 27609

Securities offered through Capital Investment Group, Inc. & Capital Investment Brokerage, Inc.

100 East Six Forks Road; Raleigh, North Carolina 27609

Members FINRA and SIPC