Market Recap: Tech Strength – Labor Market Weakness

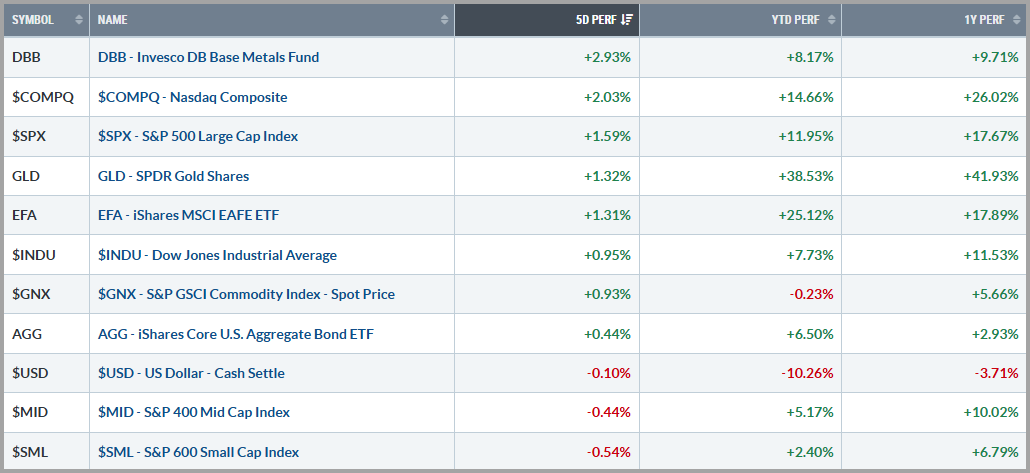

U.S. equities pushed to fresh record highs last week, with the S&P 500 gaining more than 1.5%. Strong mega-cap tech earnings and renewed optimism for a year-end Fed rate cut fueled the rally, helping investors look past softer global data. Oracle was a standout, with shares surging nearly 30% after reporting a massive jump in its contracted AI-cloud backlog, reinforcing the sector’s leadership in this year’s advance. Interesting tidbit — Larry Ellison’s net worth exploded, as the co-founder of Oracle Corporation gained something on the order of $101 billion in a single day after the blowout forecasts were reported — briefly making him the richest person in the world.

Economic data continued to highlight a cooling labor market alongside sticky inflation. Initial jobless claims rose to their highest since 2021, and revisions showed that nearly one million fewer jobs were created over the past year than first reported. Consumer sentiment dropped to a four-month low, while long-term inflation expectations ticked higher. Inflation data was mixed as the CPI (Consumer Price Index) remained firm, but softer producer prices seemingly eased worries of a renewed flare-up, thus reinforcing expectations that the Federal Reserve will cut rates soon and deliver more cuts in the future.

Macro currents rippled across markets: the 10-year Treasury yield slid to multi-month lows as easing bets built (talk of the Fed cutting .50%), while the U.S. dollar dropped to a seven-week low. That combination boosted gold toward record highs and supported other precious metals. Oil traded choppily, lifted by supply risks but capped by demand worries, while industrial metals sagged on weak Chinese trade and output data.

The tug-of-war between softer growth data and still-firm inflation expectations continue to shape Fed policy speculation and, by extension, the market’s momentum. For now, investors appear content to ride the AI-driven wave of earnings optimism, with lower bond yields, a softer dollar, and buoyant gold prices providing additional tailwinds to risk assets, despite increasing growth and labor market concerns.

Source: stockcharts.com

The Week Ahead: Federal Reserve Meeting — Rate Cuts Resume

This week’s spotlight is on the Federal Reserve meeting (Sept 16–17), where markets are currently pricing in a 25-bps (0.25%) rate cut with certainty. Investors will be watching the statement, updated “dot plot”, and Chair Powell’s remarks for hints on whether this is the start of a broader easing cycle or a cautious, one-and-done move. Alongside the Fed, we’ll get fresh data on retail sales, import prices, and industrial production, offering insight into the health of consumer demand and cost pressures.

Markets will likely be choppy around these releases. A dovish Fed message and softer data could push Treasury yields lower, weaken the dollar, and lift gold and other precious metals, while a hotter inflation tone or hawkish Fed guidance could do the opposite.

Broad Overview: High Valuations, Some Economic Cracks and Positive Technicals

Markets remain caught between optimism over potential Fed-easing and lingering concerns about economic resilience. Equity valuations are stretched by historical standards, with the S&P 500 trading near record highs despite mixed earnings trends and forward guidance. The backdrop of elevated multiples makes stocks particularly sensitive to incoming data on economic growth and inflation. Tech and growth names continue to lead the stock market, but their momentum tends to depend heavily on the path of interest rates and whether investors remain willing to pay up for future earnings streams.

Economically, inflation remains a central driver, and while consumer price pressures have currently moderated from their peaks, they remain stubborn in key categories. Importantly, signs of cost increases often emerge first in the Producer Price Index (PPI), reflecting input and supply chain dynamics, before showing up in consumer inflation measures like the CPI. That sequence will be closely watched this week as investors look for early warnings of a re-acceleration. Treasury yields have already shifted lower on expectations of Fed rate cuts, but volatility in bond markets highlights the uncertainty around whether inflation will cooperate with the Fed’s timeline.

At the same time, the labor market is showing cracks. Job creation slowed sharply in 2025, unemployment ticked higher, and wage growth has cooled. These trends typically suggest the economy is losing momentum, which complicates the Fed’s balancing act: easing too soon risks reigniting inflation, while waiting too long could deepen labor market weakness. Consumer spending, still the engine of U.S. growth, has held up but is showing more signs of fatigue at present, as borrowing costs stay elevated and confidence has softened.

From a technical perspective, however, the market’s trends remain positive. Major indexes are currently trading above key moving averages, and breadth (the participation of more stocks in the rally) has been expanding, suggesting underlying strength beyond just the megacap tech names. That resilience needs to be respected, even in the face of macro uncertainties. Together, valuations, yields, inflation, consumer health, and now improving market breadth, are presently setting the tone for the next leg of market direction. Staying on top of developing trends and not overreacting to any one data point while adhering to one’s overall risk policy will be prudent to success in the coming months.

Should you have any questions regarding your current strategy or the markets in general, please reach out to your CIAS Investment Adviser Representative.

Important Disclosures:

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The statements contained herein are solely based upon the opinions of Edward J. Sabo and the data available at the time of publication of this report, and there is no assurance that any predicted or implied results will actually occur. Information was obtained from third-party sources, which are believed to be reliable, but are not guaranteed as to their accuracy or completeness.

The actual characteristics with respect to any particular client account will vary based on a number of factors including but not limited to: (i) the size of the account; (ii) investment restrictions applicable to the account, if any; and (iii) market exigencies at the time of investment. Capital Investment Advisory Services, LLC (CIAS) reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. The information provided in this report should not be considered a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

CIAS is a registered investment advisor. More information about the advisor, including its investment strategies and objectives, can be obtained by visiting www.capital-invest.com. A copy of CIAS’s disclosure statement (Part 2 of Form ADV) is available, without charge, upon request. Our Form ADV contains information regarding our Firm’s business practices and the backgrounds of our key personnel. Please contact us at (919) 831-2370 if you would like to receive this information.

Capital Investment Advisory Services, LLC

100 E. Six Forks Road, Ste. 200; Raleigh, North Carolina 27609

Securities offered through Capital Investment Group, Inc. & Capital Investment Brokerage, Inc.