Weekly Economic Insights

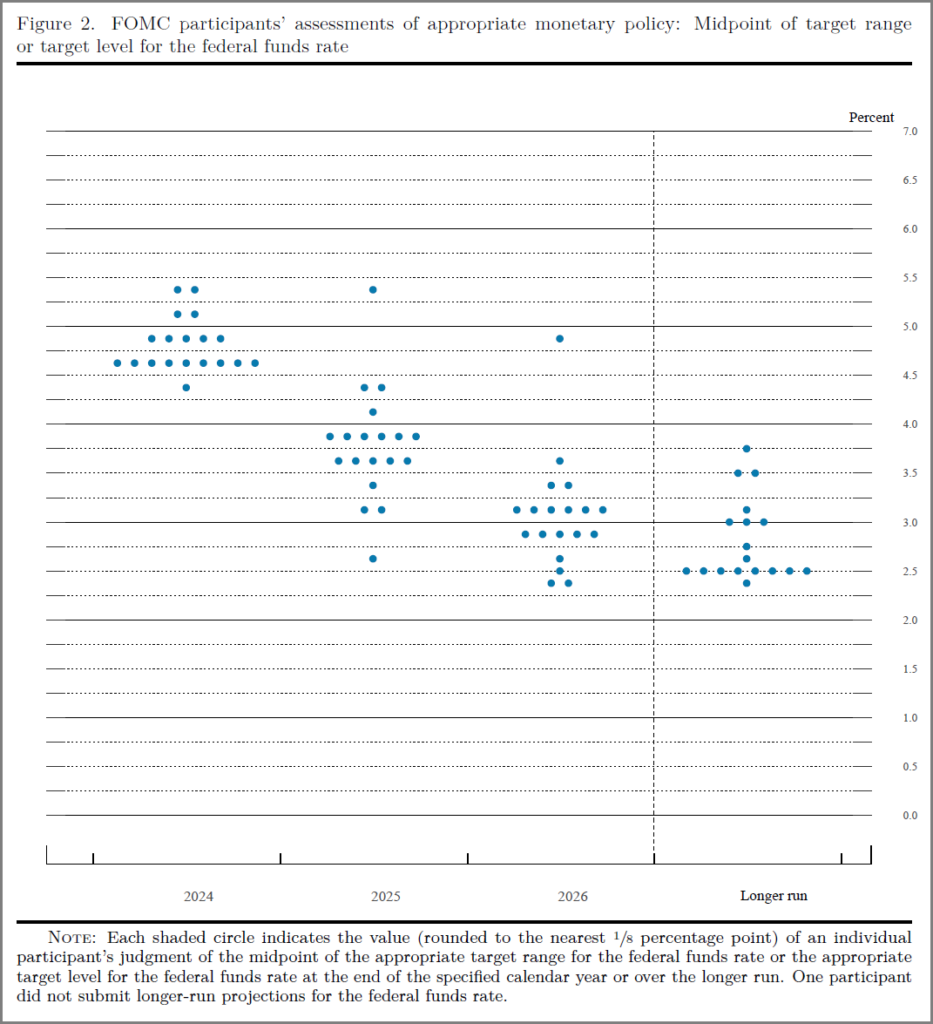

Equity markets were once again fueled by AI (Automated Information) optimism and a seemingly dovish Fed last week. News that Apple is looking to use Google’s AI technology in future phones, Nvidia’s announcement of yet another new AI chip, and Micron’s posting of better-than-expected earnings coupled with the Fed raising their growth forecast and leaving three rate cuts in the dot plots propelled the markets to all-time highs. The goldilocks data just kept pouring in all week as steady jobless claims were reported and FedEx announced strong earnings. With all the good news, it’s no surprise that markets largely ignored inflationary data out of the Composite PMI and a spike in existing home sales. Overseas data was received positively with some foreign central banks cutting rates and taking further hikes off the table. Even China reported positive retail sales and production output. The bond market liked the message and caught a little bid sending longer term rates down several basis points.

Source: FOMC Summary of Economic Projections March 20th, 2024

Key Takeaway:

Last week’s data was undoubtedly supportive of the no/soft landing thesis (Where the Fed uses its tools to combat inflation without destroying the economy) which further supports the rally we’ve seen in equities. AI is alive and firing on all cylinders!

The Week Ahead:

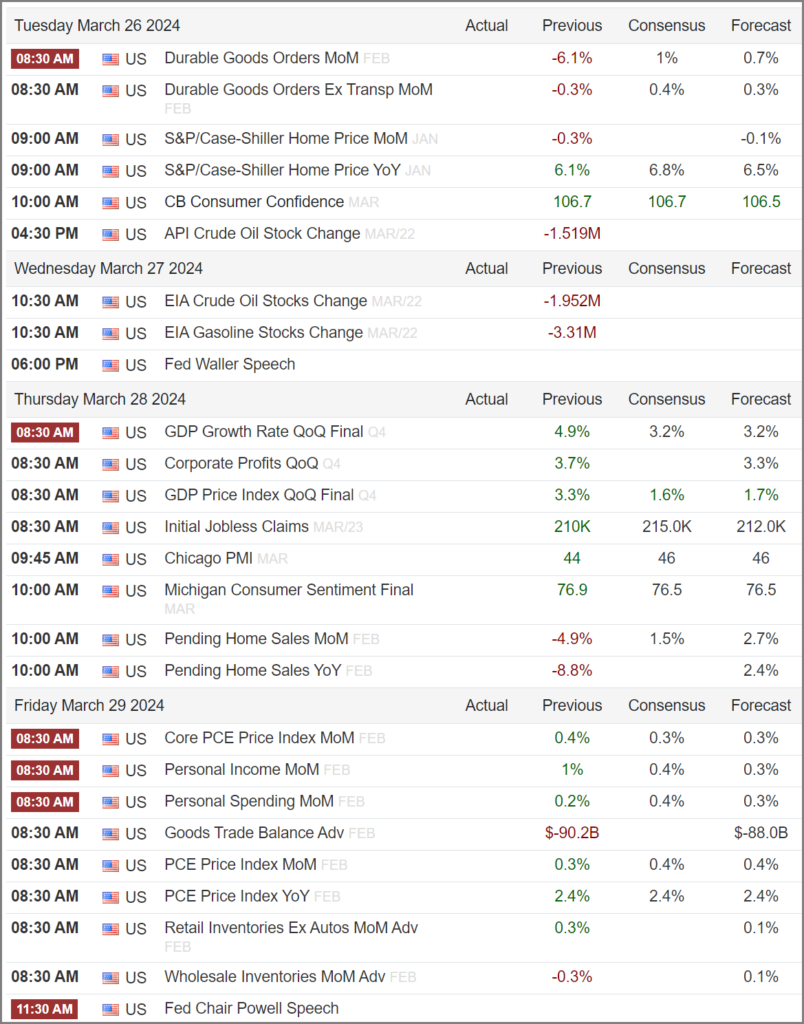

The big event for this week falls on Good Friday (the markets will be closed) when we get PCE data which is the Feds preferred gauge of inflation. We will also get a peek at the consumer on Friday via income and spending and a speech from Fed Chair Powell. Other notables are highlighted on the chart below.

Source: Trading Economics (https://tradingeconomics.com/united-states/calendar#)

Tidbits & Technicals:

Headwinds:

- Valuations are frothy given the current rate environment, leaving the markets subject to a potential swift pullback.

- “Higher for Longer”- Risk that the Fed waits too long to begin lowering rates and threatens economic growth.

- Narrow Leadership with just a few mega cap tech stock leading

- Seasonally weak period lasts through the end of March

Tailwinds:

- Optimism surrounding Artificial Intelligence (AI)

- Fed Pivoting from raising rates to potentially cutting in the future.

- Strong Labor Market

- Solid Economic Growth

- Continued Earnings Growth (the pace of which may be slowing)

- Momentum

Sentiment:

- Credit Spreads remain tight, signaling the bond market (aka “Smart Money”) is not worried about a recession in the near future.

- The VIX (CBOE Volatility Index) is trading near cycle lows. Note: Periods of low volatility for a long time are often subject to change.

- The CNN FEAR & Greed Index remains above neutral in the “Greed” category showing investors current appetite for risk is strong.

Intermarket Trends:

- The major Indices (Dow Joines Industrial Average, S&P 500, and NASDAQ) all posted new highs last week.

- Bond investors have been pricing in the idea of higher for longer recently with 10-year treasury yields flirting with the upper middle part of this year’s trading range.

- The US Dollar rallied towards the upper end of this years trading range last week due to foreign central banks being the first to cut rates and others taking further rate hikes off the table

- Gold has recently made all-time highs.

- Industrial Metals caught a bid recently and copper recently broke out of a multi-month trading range.

- Oil is trading near the top of its 2024 range but well below last years highs.

Tying it all together:

Amidst a solid economic backdrop, reasonably strong earnings, and optimism surrounding AI fueling momentum, it’s not surprising the equity markets made new highs last week. For the rally to continue, we’ll want to see a more accommodative Fed stance and we will want to see that sooner rather than later (exactly what we saw this week). The bond market is beginning to price in “Higher for Longer” and should that sentiment spill over into the equity markets with valuations this lofty, a swift pullback could occur. I’d view any such pullback as a buying opportunity should the overall economic picture remain bright. Keep in mind that 5-10% pullbacks are very common in the stock market and typically happen a couple times per year. I find the breakout in copper very interesting as this typically signifies renewed economic growth is underway. Coupled with rising Oil (also a key growth metric), low volatility, tight credit spreads and bullish momentum, this market could just do what most bull markets do and surprise investors to the upside.

Please feel free to share these commentaries with friends and family and, should you have any questions regarding your current strategy or the markets in general, please reach out to your CIAS Investment Adviser Representative.

Important Disclosures:

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The statements contained herein are solely based upon the opinions of Edward J. Sabo and the data available at the time of publication of this report, and there is no assurance that any predicted or implied results will actually occur. Information was obtained from third-party sources, which are believed to be reliable, but are not guaranteed as to their accuracy or completeness.

The actual characteristics with respect to any particular client account will vary based on a number of factors including but not limited to: (i) the size of the account; (ii) investment restrictions applicable to the account, if any; and (iii) market exigencies at the time of investment. Capital Investment Advisory Services, LLC (CIAS) reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. The information provided in this report should not be considered a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

CIAS is a registered investment advisor. More information about the advisor, including its investment strategies and objectives, can be obtained by visiting www.capital-invest.com. A copy of CIAS’s disclosure statement (Part 2 of Form ADV) is available, without charge, upon request. Our Form ADV contains information regarding our Firm’s business practices and the backgrounds of our key personnel. Please contact us at (919) 831-2370 if you would like to receive this information.

Capital Investment Advisory Services, LLC

100 E. Six Forks Road, Ste. 200; Raleigh, North Carolina 27609

Securities offered through Capital Investment Group, Inc. & Capital Investment Brokerage, Inc.

100 East Six Forks Road; Raleigh, North Carolina 27609

Members FINRA and SIPC