Markets End Higher Amid Elevated Volatility

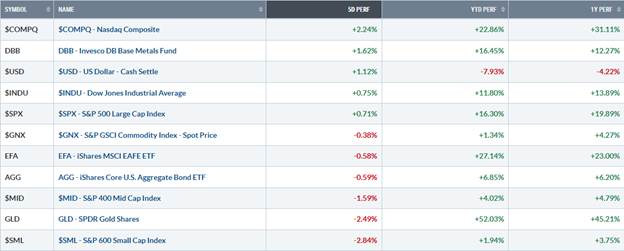

Stocks gapped open and ran up to new highs last week before churning sideways in positive territory amid elevated volatility as some of Wall Street’s favorite names posted “mixed” earnings, Federal Reserve Chairman Powell downplayed further rate cuts, and the Trump–Xi meeting met expectations without major surprises. By the week’s close, the S&P 500 and Dow Jones Industrial Average posted modest gains of less than 1%, as the tech-heavy Nasdaq climbed over 2% and small-cap stocks declined nearly 3%.

Stocks started the week strong on upbeat U.S.-China trade headlines and AI investment news, including Microsoft’s $135B OpenAI stake and Nvidia’s $1B in Nokia and Nvidia became the first company to ever reach a $5 Trillion market cap. Mid-week, Fed Chair Powell’s cautious comments on rate cuts eased optimism and tech sold off following mixed earnings from META and Microsoft. A stronger dollar and rising yields (not good for equities) seemingly poured a little cold water on the party along with weak Canadian GDP and renewed trade tensions. Amazon and Apple’s earnings reports on Friday gave a lift in the morning but the overall optimism faded as the S&P 500 closed out the week almost exactly where it started.

Rates, Dollar & Commodities

Treasury yields spiked as Powell’s hawkish comments sent the 10-year yields back above 4.0%. The U.S. dollar strengthened to multi-week highs while commodities were mixed: Oil prices slipped on U.S.–China energy trade headlines and a strong energy report while Gold dropped about 2.75% amid a stronger dollar and higher yields. Copper and other industrial metals ended the week little changed.

Takeaway

Markets continue to balance mixed earnings, AI optimism, and improving inflation trends against a backdrop of rising yields and renewed Fed hawkishness. While volatility remains elevated, resilient corporate results and strong investor positioning in AI-related sectors continue to support the broader equity narrative. However, recent moves in rates, the dollar, and narrowing market breadth suggest a more selective phase ahead as investors reassess risk and growth expectations.

Source: stockcharts.com

Looking Ahead

The ongoing U.S. government shutdown is expected to postpone several key economic data releases, but private-sector reports and upcoming corporate earnings will still provide valuable insights into economic conditions. Highlights include the ADP Employment Report, ISM manufacturing and services PMIs, and the University of Michigan Consumer Sentiment Index. On the earnings front, major companies set to report include Palantir, AMD, Berkshire Hathaway, McDonald’s, Qualcomm, and ConocoPhillips.

Broad Overview

Markets are dealing with a mix of good and bad signals, but overall optimism remains. Investors are seemingly encouraged by continued spending on artificial intelligence, steady consumer demand, and hopes that the Federal Reserve will eventually lower interest rates. Inflation has come down a lot since 2022 but isn’t falling much further, and the job market is cooling gradually—both signs that the economy may be headed for a “soft landing” rather than a recession.

Still, there are reasons to be cautious. Borrowing costs (credit spreads) are creeping up, the strong U.S. dollar could hurt company profits, and fewer stocks are driving the recent market gains. Historically, these patterns can signal a pause or pullback in the market.

The bond market—which often reflects where investors think the economy is headed—suggests a slow and steady cooling rather than a sharp downturn, even though recent comments from Fed Chair Jerome Powell have dampened hopes for quick rate cuts.

As we move through November, a month that often favors stocks, market gains may remain focused on a few large companies before broader strength returns toward year-end. The big question is whether investor optimism can hold up as valuations continue to push into extremely “lofty” territory and Fed messaging evolves.

We’ll continue to watch these trends closely and keep you updated. If you have any questions about your portfolio or the markets, please contact your CIAS Investment Adviser Representative.

Important Disclosures:

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The statements contained herein are solely based upon the opinions of Edward J. Sabo and the data available at the time of publication of this report, and there is no assurance that any predicted or implied results will actually occur. Information was obtained from third-party sources, which are believed to be reliable, but are not guaranteed as to their accuracy or completeness.

The actual characteristics with respect to any particular client account will vary based on a number of factors including but not limited to: (i) the size of the account; (ii) investment restrictions applicable to the account, if any; and (iii) market exigencies at the time of investment. Capital Investment Advisory Services, LLC (CIAS) reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. The information provided in this report should not be considered a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

CIAS is a registered investment advisor. More information about the advisor, including its investment strategies and objectives, can be obtained by visiting www.capital-invest.com. A copy of CIAS’s disclosure statement (Part 2 of Form ADV) is available, without charge, upon request. Our Form ADV contains information regarding our Firm’s business practices and the backgrounds of our key personnel. Please contact us at (919) 831-2370 if you would like to receive this information.

Capital Investment Advisory Services, LLC

100 E. Six Forks Road, Ste. 200; Raleigh, North Carolina 27609

Securities offered through Capital Investment Group, Inc. & Capital Investment Brokerage, Inc.