Weekly Market Insights

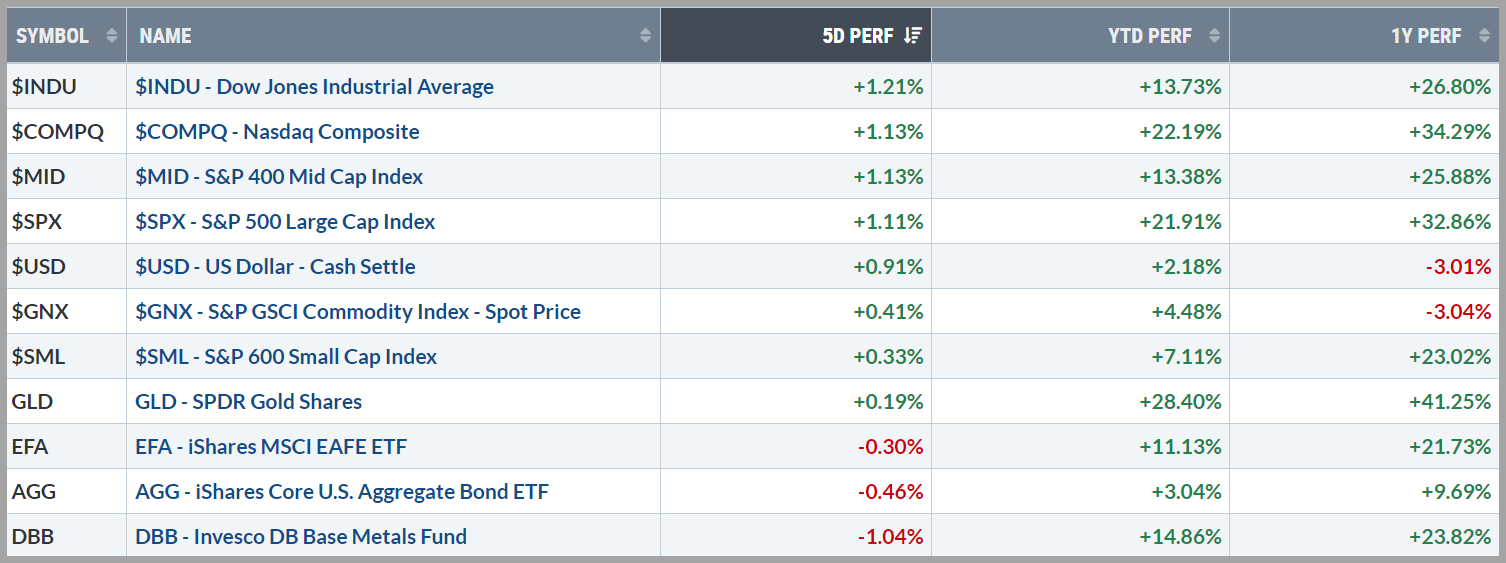

Stocks rallied last week, bolstered by impressive earnings from major banks and relatively mixed economic data. Both the S&P 500 and Dow Jones reached new highs, reflecting broad investor confidence. This positive momentum was fueled by mixed economic data: unchanged wholesale inflation (PPI) signals potential progress in controlling price increases, while hotter-than-expected inflation data (CPI) earlier in the week kept uncertainty alive around the Federal Reserve’s future rate decisions. A negative jobless claims report was shrugged off as “temporary” due to recent storms and strikes, and investor sentiment remained upbeat, with all major indices posting weekly gains.

In currency markets, the dollar index climbed to nearly two-month highs as the yield on the 10-year US Treasury note held near its highest level since late July, around 4.1%. The mixed inflation data, coupled with relatively strong economic growth data, lowered investor expectations of the Fed cutting by another .50% at the next meeting. Gold traded relatively flat due to the strong dollar and rising treasury yields while Industrial metals and oil traded lower over Chinese growth concerns.

Source: Stockcharts.com

Source: Optuma and DTN IQ

Key Takeaway:

Last week’s economic data highlighted firmer inflation alongside slower growth, a combination that would typically lead to a significant dip in stock prices. However, the Federal Reserve’s clear preference for lower rates has tempered the market’s reaction to weak data. Additionally, current jobless claims data may be skewed by temporary factors, such as recent hurricanes and labor strikes, reducing the impact of these figures. As a result, neither the inflation uptick, nor the softer growth trajectory, weighed on stocks as heavily as they might have under different conditions.

The Week Ahead:

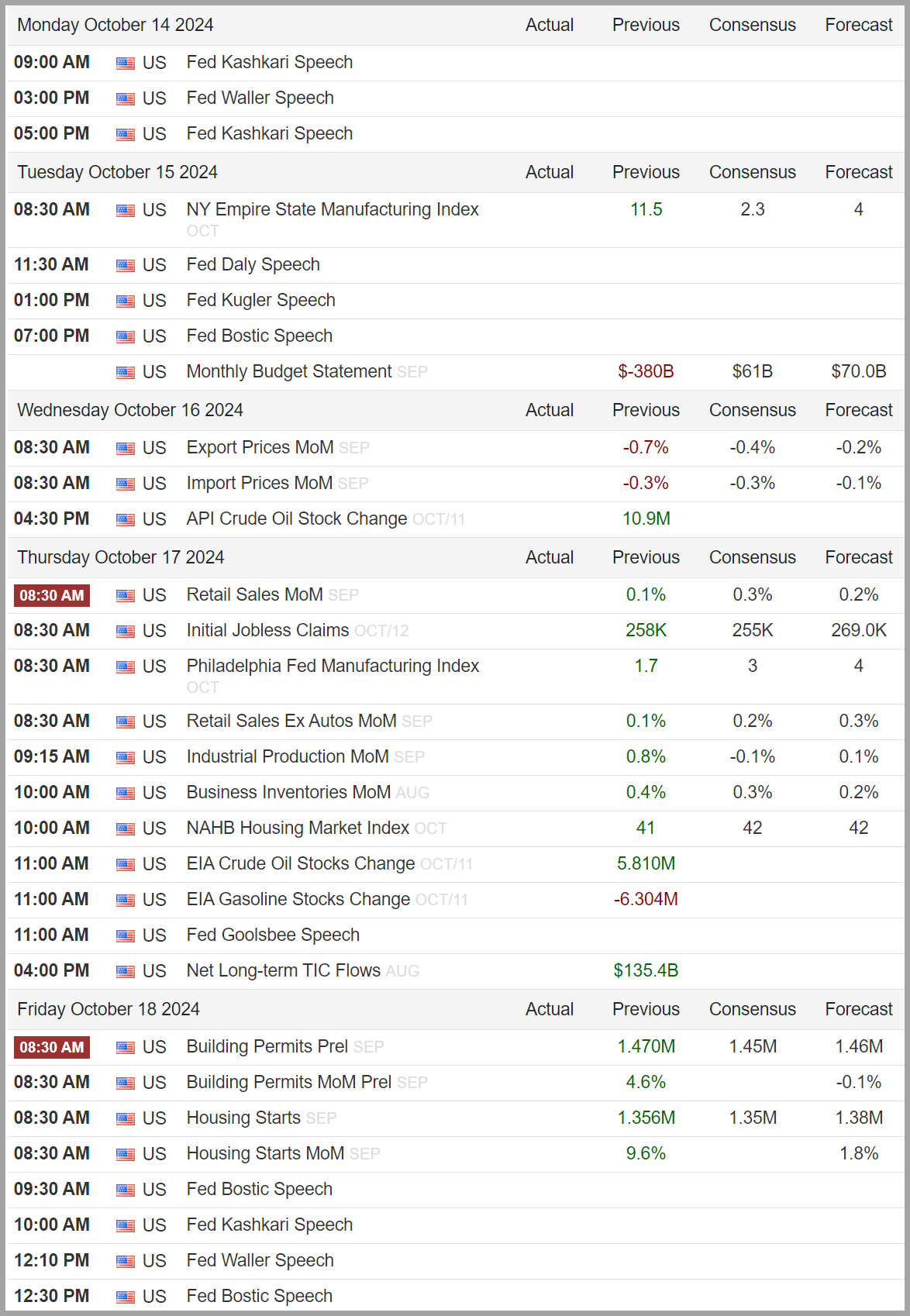

Thursday’s retail sales report will be a hot topic this week. It is expected to show a 0.3% increase in September, which would help bolster investor sentiment and alleviate concerns over slowing consumer spending trends. Other key economic data out this week include the typically volatile NY Empire State Manufacturing Index and Philadelphia Fed Manufacturing Index before it’s all about housing on Friday. You’ll also notice that several Fed members are speaking this week. In addition to the Economics calendar, the earnings season will enter full swing with several companies reporting quarterly results including UnitedHealth, J&J, Bank Of America, Goldman Sachs, Citigroup, Charles Schwab, Abbott, Morgan Stanley, Netflix, Blackstone, P&G and American Express.

Source: Trading Economics (https://tradingeconomics.com/united-states/calendar#)

Tidbits & Technicals: (New developments will be denoted via***)

Current Headwinds:

- Valuations seem frothy given the current rate environment, leaving the markets subject to a potential swift pullback!

- “Higher for Longer” – Risk that the Federal Reserve waited too long to begin lowering rates and threatens economic growth.

- Very narrow market participation, apparently driven primarily by mega cap tech and AI-related companies, has dominated the indices; however, over the last several weeks we have witnessed a significant broadening effect with “the rest of the market” participating in returns.

Current Tailwinds:

- Optimism surrounding Artificial Intelligence (AI) (recently waning)

- The Federal Reserve has begun their rate-cutting cycle and vows more cuts in the future

- Strong Labor Market (signs of rising unemployment are showing up, yet jobs are available)

- Solid Economic Growth

- Continued Earnings Growth (the pace of which may be slowing)

- Momentum

- 10-year Treasury yields are just off the lows of the year

Sentiment:

- ***Credit Spreads have retreated to cycle lows

- ***The VIX (CBOE Volatility Index) remains elevated at this time

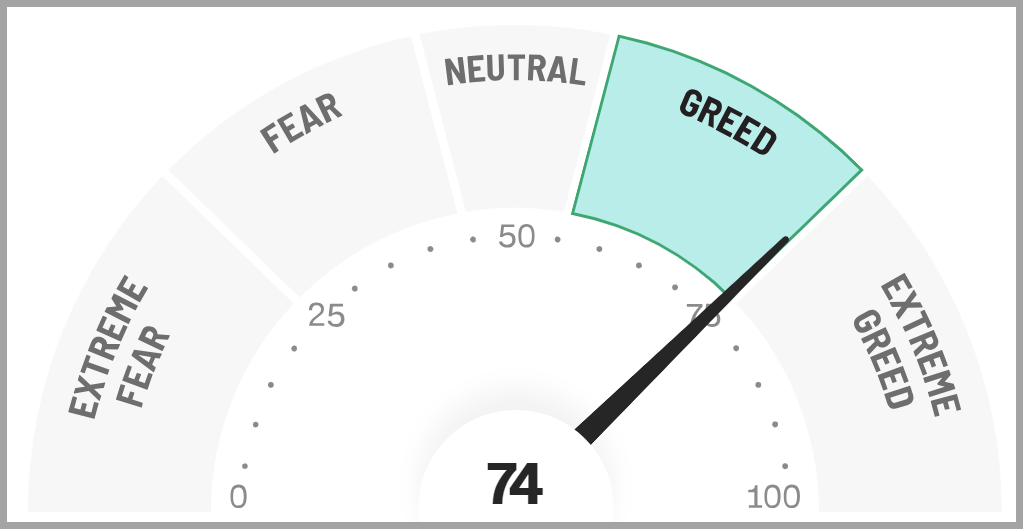

- ***The CNN FEAR & Greed Index is nearing Extreme Greed Status

Source: https://www.cnn.com/markets/fear-and-greed

Intermarket Trends:

- ***The major Indices (Dow Jones Industrial Average, S&P 500, and NASDAQ) are trading at or near all-time highs signifying a positive trend

- Interest rates have been volatile all year and appear to be trending lower.

- The US Dollar has broken its upward trend line over the past several weeks and is trending downward

- Gold recently broke out of its trading range to record highs and is consolidating at lofty levels

- Industrial Metals, which have been trending lower lately, have reversed course and have been gaining traction

- Oil futures are in the middle of their one-year trading band and appear to be stuck in a trading range

Tying it all together:

The markets posted fresh all-time highs recently on the heels of the first rate cut in over four years and new data supporting a solid growth outlook, leaving the bulls with the proverbial torch amid historically high valuations and a solid backdrop.

My confidence in this current bull market remains cautiously optimistic, as the general trend is positive, and the overall fundamental backdrop appears to support these levels. My conviction will strengthen if the new all-time highs can be held, and we continue to push even higher. It’s important to recognize at this juncture that the recent rotation out of AI/technology-related stocks and into “other areas of the market’ increases the challenge for the indices to continue to make new highs, since the technology sector represents a huge portion of several of the indices we use to track the markets (S&P 500, NASDAQ, etc.), therefore, it will take a stronger “push” by the other sectors to obtain this goal.

One can measure that “push” by looking under the hood of the market to gauge the broader participation, using measures of “market internals”. The most widely-used measures of internal strength are things such as the Advance-Decline line and its corresponding AD Volume derivative. At the present time, the Advance-Decline metrics are trending upward, which shows that more and more stocks are moving up and they are doing so with strong volume, compared to those that are taking a break or moving downward.

This broad participation is a seemingly healthy attribute and fits well within the context of the current fundamental backdrop where we have robust economic growth, historically low unemployment, and inflation trending down. During periods like this, we may expect companies tied to the more cyclical sectors (Industrials, Materials, Financials, etc.) to perform well, as it would be based on recent earnings reports. Capital is also flowing into these areas, as we see stocks in these categories generally rising; however, we continue to see stronger flows into the more defensive sectors (Utilities, Healthcare and Consumer Staples). This emerging outperformance of defensive sectors is a dynamic we’d generally expect to see during the later stages of the business cycle, when concerns over future growth begin to appear.

This backdrop calls for careful monitoring, especially as stock valuations remain high and appear to be pricing in an optimistic outcome. The Federal Reserve faces the challenging task of achieving a “soft landing”—bringing inflation down to its target without stifling economic growth or increasing unemployment.

Our strategy blends macroeconomic insights with technical and intermarket analysis, and investor sentiment, to inform our tactical decisions in real time. At present, we generally recommend maintaining exposure to equities, with an emphasis on high-quality, low-volatility stocks. We also advocate for holding a healthy allocation to longer-duration, investment-grade bonds, which we believe can reduce portfolio risk while offering compelling returns.

Lastly, I want to emphasize that the most effective strategy in all market environments is to ensure one’s overall portfolio aligns with their risk tolerance and long-term goals while keeping emotions at bay. The markets often overreact to both positive and negative news, so having a sound plan, a cool head, and an understanding of the current sentiment is crucial. Staying disciplined and focused on your long-term objectives, rather than being swayed by short-term volatility, will help navigate uncertainty and capitalize on opportunities as they arise.

Please feel free to share these commentaries with friends and family and, should you have any questions regarding your current strategy or the markets in general, please reach out to your CIAS Investment Adviser Representative.

Important Disclosures:

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The statements contained herein are solely based upon the opinions of Edward J. Sabo and the data available at the time of publication of this report, and there is no assurance that any predicted or implied results will actually occur. Information was obtained from third-party sources, which are believed to be reliable, but are not guaranteed as to their accuracy or completeness.

The actual characteristics with respect to any particular client account will vary based on a number of factors including but not limited to: (i) the size of the account; (ii) investment restrictions applicable to the account, if any; and (iii) market exigencies at the time of investment. Capital Investment Advisory Services, LLC (CIAS) reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. The information provided in this report should not be considered a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

CIAS is a registered investment advisor. More information about the advisor, including its investment strategies and objectives, can be obtained by visiting www.capital-invest.com. A copy of CIAS’s disclosure statement (Part 2 of Form ADV) is available, without charge, upon request. Our Form ADV contains information regarding our Firm’s business practices and the backgrounds of our key personnel. Please contact us at (919) 831-2370 if you would like to receive this information.

Capital Investment Advisory Services, LLC

100 E. Six Forks Road, Ste. 200; Raleigh, North Carolina 27609

Securities offered through Capital Investment Group, Inc. & Capital Investment Brokerage, Inc.

100 East Six Forks Road; Raleigh, North Carolina 27609

Members FINRA and SIPC