Market Recap: Inflation Data Sends Mixed Signals, But Stocks Push Higher

Last week brought some conflicting inflation numbers. The Consumer Price Index (CPI), which tracks prices paid by everyday consumers, showed only a modest increase — reassuring news that inflation at the retail level remains under control. But the Producer Price Index (PPI), which measures costs for businesses and producers, jumped much more than expected. This raised some eyebrows because higher producer costs can eventually make their way to consumers.

Even so, the stock market mostly looked past the hotter PPI report as investors seemingly remain fueled by the fact the Federal Reserve still expects to cut interest rates this year, tariffs have been less than feared, and corporate earnings have largely been solid, which provides a cushion for markets.

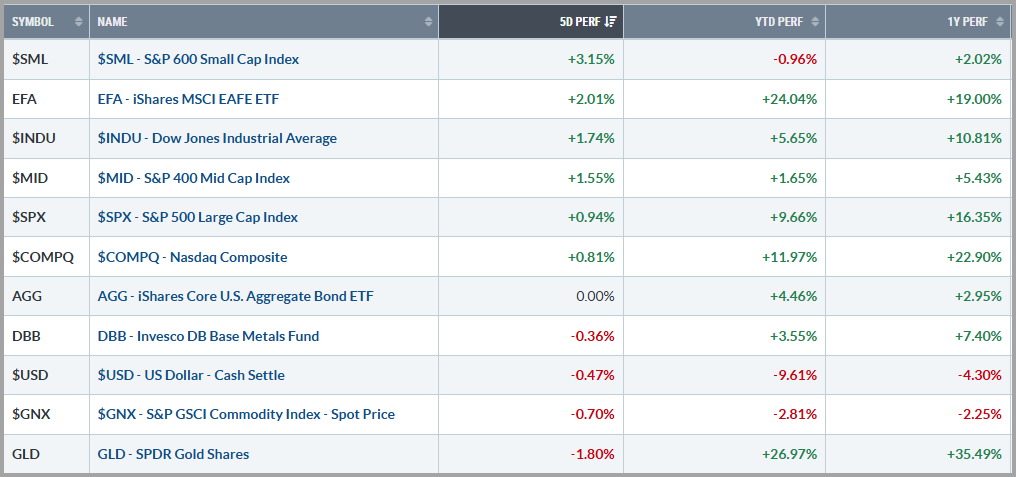

The S&P 500 dipped slightly to start the week but quickly rebounded after the CPI report came in steady and Fed officials reinforced their independence. Stocks climbed to record highs midweek, only to wobble again after the PPI surprise. Still, by week’s end, positive economic data like relatively strong retail sales and solid manufacturing activity helped keep the overall momentum intact. For the week, the S&P 500 gained nearly 1%.

Commodities were mostly weaker last week as gold slipped from record highs after the hotter than anticipated PPI report, and oil fell to multi-month lows, seemingly due to easing geopolitical tensions. Copper remained stuck in a sideways trend after its big July drop. The U.S. dollar edged down as, apparently, investors are increasingly expecting a Fed rate cut in September. Treasury yields stayed steady overall despite bouncing around on the conflicting inflation data, with the 10-year yield finishing near 4.3%.

Bottom line: While inflation remains a bit of a puzzle and commodities have cooled, steady economic growth, strong earnings, and expectations of Fed support seem to be keeping the broader market backdrop constructive. While caution is sensible, the overall trend currently remains positive.

Source: stockcharts.com

On Deck this week: Jackson Hole

The spotlight this week is on the Fed, with Chair Powell’s speech at Jackson Hole on Friday carrying big weight but little certainty. He could hint at a September rate cut or push back against those expectations, and investors will analyze his every word. Wednesday’s Fed meeting minutes will also be scoured over to see how much support there really is for cutting rates, and Thursday’s flash PMI will offer an early read on whether growth is holding steady or slipping further.

Put simply, signs of steady growth and progress toward a September rate cut could keep stocks climbing, while weak data or pushbacks from the Fed may spark some market pressure.

The takeaway: Riding High, Eyes Wide Open

This summer’s market story has been one of resilience and record-setting highs. Currently, consumer spending is holding up, corporate earnings have been relatively impressive, and the possibility of Fed rate cuts later this year has kept optimism on the front burner. All reasons to smile, just not to snooze.

Digging a little deeper, hints of caution are surfacing. Inflation looks mostly tame but hasn’t completely lost its bite thanks to tariff-driven price pressures. Hiring is easing back, household spending may be cooling, and consumer confidence is leveling off. Add in rising producer prices and a Fed that’s striking a careful, deliberate tone, and the picture gets more nuanced.

None of this erases the strength we’re seeing now — but it marks the point where optimism should walk arm‑in‑arm with vigilance. Markets have a way of surprising us most when confidence feels unshakable.

Bottom Line: It’s a good time to be encouraged and optimistic, but an even better time to stay curious, disciplined, and prepared.

Please feel free to share these commentaries and, should you have any questions regarding your current strategy or the markets in general, please reach out to your CIAS Investment Adviser Representative.

Important Disclosures:

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The statements contained herein are solely based upon the opinions of Edward J. Sabo and the data available at the time of publication of this report, and there is no assurance that any predicted or implied results will actually occur. Information was obtained from third-party sources, which are believed to be reliable, but are not guaranteed as to their accuracy or completeness.

The actual characteristics with respect to any particular client account will vary based on a number of factors including but not limited to: (i) the size of the account; (ii) investment restrictions applicable to the account, if any; and (iii) market exigencies at the time of investment. Capital Investment Advisory Services, LLC (CIAS) reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. The information provided in this report should not be considered a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

CIAS is a registered investment advisor. More information about the advisor, including its investment strategies and objectives, can be obtained by visiting www.capital-invest.com. A copy of CIAS’s disclosure statement (Part 2 of Form ADV) is available, without charge, upon request. Our Form ADV contains information regarding our Firm’s business practices and the backgrounds of our key personnel. Please contact us at (919) 831-2370 if you would like to receive this information.

Capital Investment Advisory Services, LLC

100 E. Six Forks Road, Ste. 200; Raleigh, North Carolina 27609

Securities offered through Capital Investment Group, Inc. & Capital Investment Brokerage, Inc.