Weekly Market Insights

Stocks continued their upward trajectory last week, extending gains for May and edging closer to record highs, with the S&P now less than 1% away from the high-water mark. Helping to fuel this surge over the past few weeks has been a robust earnings season, surpassing expectations and seemingly signaling ongoing profit expansion despite a growing list of short-term economic indicators that appear to be losing some momentum.

With approximately 90% of S&P 500 companies having disclosed their first-quarter earnings, profits may be poised to expand by as much as 10% this year, barring no unexpected events. If so, this would far exceed analysts’ (and many corporate executives’) expectations and reiterates the fact that there is more to the markets narrative than meets the eye. In this era where every piece of data is seemingly scrutinized for its potential impact on Federal Reserve policy, corporate profits tends to get overlooked, but not in the past couple of weeks.

Key Takeaway:

No real surprises here… From a purely technical perspective, markets got overheated, retreated to the potential support zone we’ve had marked for weeks on the chart above, earnings came in better than expected, and investors “bought the dip” provided the sound economic backdrop.

We are now within a stone’s throw of all-time highs and once again facing the valuation wall of worry with equities trading around 21x forward earnings. That’s a pretty high multiple historically and demands a Goldilocks economic scenario to continue, making this week’s data uber important to keep this rally alive.

The Week Ahead:

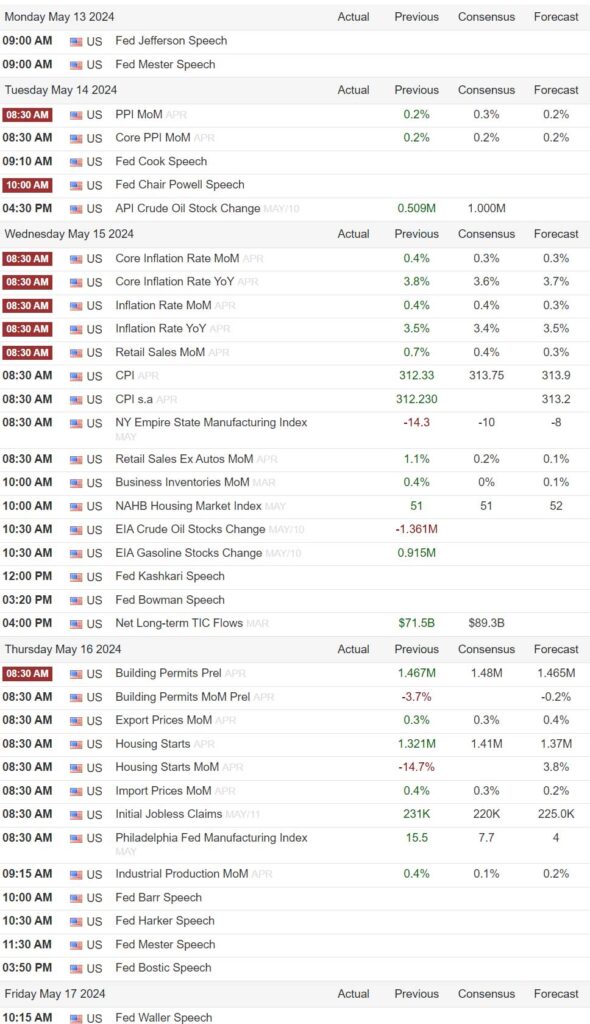

The focal point of this week lies in Wednesday’s Consumer Price Index (CPI) report. Market expectations anticipate a notable decrease in the annual inflation rate from last month’s 3.5%. Any failure to meet this expectation could fuel worries about entrenched inflation and prolonged higher interest rates, potentially reversing recent market gains. Notably as well, we will see the release of the Producer Price Index (PPI) on Tuesday, which may cause brief market volatility but should be overshadowed by the significance of Wednesday’s CPI data.

Additionally, investors’ attention will be on Wednesday’s Retail Sales report, as it provides insights into consumer spending trends crucial for sustaining economic growth, while Thursday’s weekly jobless claims data will be scrutinized to gauge whether last week’s spike to six-month-plus highs was an anomaly or becoming a sustained trend.

Source: Trading Economics (https://tradingeconomics.com/united-states/calendar#)

Tidbits & Technicals: (New developments will be denoted via***)

Current Headwinds:

- Valuations seem frothy given the current rate environment, leaving the markets subject to a potential swift pullback.

- “Higher for Longer” – Risk that the Federal Reserve waits too long to begin lowering rates and threatens economic growth.

- ***10-year Treasury yields recently broke out to new highs for the year signaling that bond investors may be beginning to believe in the “Higher for Longer” thesis but have retreated more than 25 basis points (.25%) in May

Current Tailwinds:

- Optimism surrounding Artificial Intelligence (AI)

- Federal Reserve pivoting from raising rates to potentially cutting in the future.

- Strong Labor Market

- Solid Economic Growth

- Continued Earnings Growth (the pace of which may be slowing)

- Momentum

- Participation is broadening with cyclicals taking a leadership role while the tech-trade begins to fade

Sentiment:

- ***Credit Spreads remain tight, hitting their lowest levels since peaking in 2022 signaling the bond market (aka “Smart Money”) is not worried about a recession in the near future.

- ***The VIX (CBOE Volatility Index) has completely reversed it tone and is back to the lower levels of the complacency zone

- ***The CNN FEAR & Greed Index got a boost showing Investor Optimism has returned to Neutral form its prior Fear state.

Intermarket Trends:

- The major Indices (Dow Jones Industrial Average, S&P 500, and NASDAQ) all posted new highs in the past few weeks signifying a positive trend.

- ***Bond investors have accepted the recently soft data as potentially impactful and rates have retreated recently

- The US Dollar is trading near the upper end of this year’s trading range due to foreign central banks being the first to cut rates and others taking further rate hikes off the table while the Fed continues its campaign of tough rhetoric.

- Gold is trading near record highs

- Industrial Metals caught a bid recently and copper recently broke out of a multi-month trading range.

- Oil futures have pulled back from recent highs and are trading in the middle of their one-year trading band.

Tying it all together:

Following the unexpected surge in March’s CPI report that rekindled talks of inflation sticking around longer than anticipated, many recent economic indicators suggest a loss of momentum in the economy. Both the ISM Manufacturing and Services PMIs have dipped below 50, a relatively rare occurrence that signals contraction, while durable goods, often viewed as a gauge for business investment, have remained stagnant for over a year. The unemployment rate remains relatively low, yet there’s a looming possibility of it surpassing 4% for the first time in years. While these metrics don’t indicate economic growth has halted, they do suggest a slowing momentum which is something both the equity and bond markets have not currently priced in.

Folks are beginning to bring up “stagflation” which rekindles thoughts of the 1970’s when economic growth halted (Stag) and Inflation soared into the mid-teens (Flation). Words like these get people on edge, but I will add that any conditions we could possibly face in the near future must be looked at through the lens of our current situation. In my opinion, our biggest risk at the present time is the lofty valuations present in pockets of the stock market. Should the economy slow, or interest rates remain higher for longer, these valuations seem unreasonable from a historical perspective. Please keep in mind all of this recent data is short term in nature and in no way signifies an imminent collapse, but rather a situation that requires our attention and close monitoring. Also keep in mind that corporate profits don’t tend to surpass expectations when things are turning for the worse!

When assessing the current situation, one must also consider the underlying strength of the U.S. economy which is being supported by robust consumer demand and a healthy job market, along with signs of stabilization in global economic growth and the fact that inflation is trending downward despite the recent deceleration. These are the variables that will shape future market dynamics and should play a far more important role in shaping one’s allocation decisions. Very recent data has been soft and warrants our attention, however, we must gather more clues and not attempt to make any rash predictions based off a few weak data points. We will follow all future developments closely and report our findings to you here.

Please feel free to share these commentaries with friends and family and, should you have any questions regarding your current strategy or the markets in general, please reach out to your CIAS Investment Adviser Representative.

Important Disclosures:

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The statements contained herein are solely based upon the opinions of Edward J. Sabo and the data available at the time of publication of this report, and there is no assurance that any predicted or implied results will actually occur. Information was obtained from third-party sources, which are believed to be reliable, but are not guaranteed as to their accuracy or completeness.

The actual characteristics with respect to any particular client account will vary based on a number of factors including but not limited to: (i) the size of the account; (ii) investment restrictions applicable to the account, if any; and (iii) market exigencies at the time of investment. Capital Investment Advisory Services, LLC (CIAS) reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. The information provided in this report should not be considered a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

CIAS is a registered investment advisor. More information about the advisor, including its investment strategies and objectives, can be obtained by visiting www.capital-invest.com. A copy of CIAS’s disclosure statement (Part 2 of Form ADV) is available, without charge, upon request. Our Form ADV contains information regarding our Firm’s business practices and the backgrounds of our key personnel. Please contact us at (919) 831-2370 if you would like to receive this information.

Capital Investment Advisory Services, LLC

100 E. Six Forks Road, Ste. 200; Raleigh, North Carolina 27609

Securities offered through Capital Investment Group, Inc. & Capital Investment Brokerage, Inc.

100 East Six Forks Road; Raleigh, North Carolina 27609

Members FINRA and SIPC