Weekly Market Insights

The S&P 500 extended its rally to new highs last week, gaining 1.08% when the closing bell rang on Friday afternoon. Disappointing economic reports once again increased expectations for Fed rate cuts, which seems to be the market’s primary concern at this point in time. A Goldilocks ISM Manufacturing print, a headline miss in the June ISM Services Index, a softer than anticipated June jobs report, and dovish commentary from Fed Chair Powell all boosted sentiment in the holiday-shortened week with low volumes. The rally was also supported by easing European political worries as the political extremist failed to gain the traction people were expecting in the French elections.

The dollar and Treasury yields both dropped last week, presumably as a result of soft economic data and rising Fed rate cut expectations. Treasuries were volatile, initially rising due to political concerns in Europe, but later declining due to rate cut expectations. The 10-year yield closed down 12 basis points, just above 4.30%.

Key Takeaway:

Last week’s growth data revealed a notable slowdown in economic expansion. The ISM Services purchasing managers’ index (PMI) unexpectedly fell to 48.8, marking the second time in three months it dipped below 50. The ISM Manufacturing PMI also decreased to 48.5. Sustained sub-50 readings in both PMIs often indicate an impending economic slowdown. Friday’s jobs report presented a mixed picture, with job additions slightly surpassing estimates, but an increase in the unemployment rate to 4.1%, which was a near-three-year high. Other employment indicators also pointed to a weakening labor market. Overall, last week’s data suggests that the economy, though not yet weak, is showing signs of cooling off.

The Week Ahead:

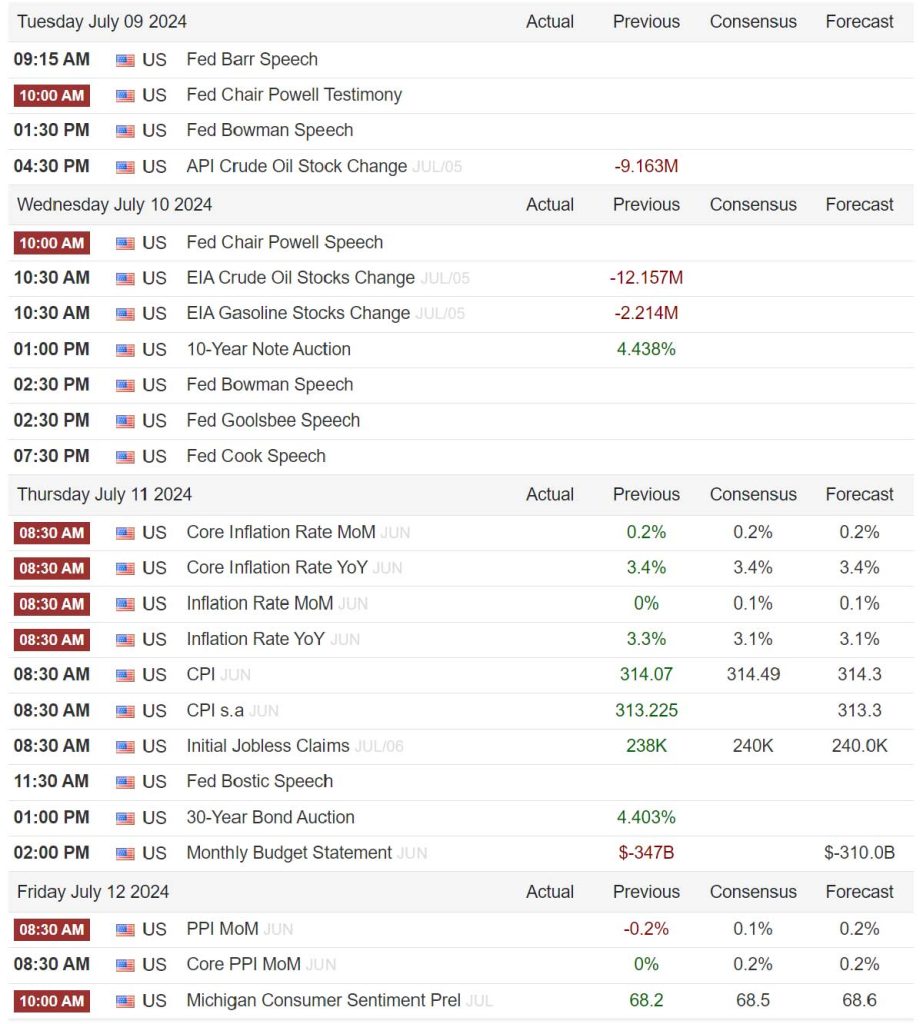

The key data point this week is Thursday’s Consumer Price Index (CPI) report, which is anticipated to show a continued decline in inflation. Before that we will hear from Fed Chair Powell at his semiannual testimony to Congress, but nobody is expecting any surprises there. Continuing this week’s inflation data theme, we will get a look at Producer Price Inflaion on Friday along with the University of Michigan’s Preliminary Consumer Sentiment report.

Source: Trading Economics (https://tradingeconomics.com/united-states/calendar#)

Tidbits & Technicals: (New developments will be denoted via***)

Current Headwinds:

- Valuations seem frothy given the current rate environment, leaving the markets subject to a potential swift pullback!

- “Higher for Longer” – Risk that the Federal Reserve waits too long to begin lowering rates and threatens economic growth.

- ***10-year Treasury yields collapsed last week to their lowest levels since March of this year.

- Very narrow market participation driven primarily by mega cap tech and AI related companies

Current Tailwinds:

- Optimism surrounding Artificial Intelligence (AI)

- The Federal Reserve potentially cutting rates in the future.

- Strong Labor Market

- Solid Economic Growth

- Continued Earnings Growth (the pace of which may be slowing)

- Momentum

Sentiment:

- Credit Spreads remain tight, hitting their lowest levels recently since peaking in 2022 signaling the bond market (aka “Smart Money”) is not worried about a recession in the near future.

- The VIX (CBOE Volatility Index) is back to the lower levels of the complacency zone.

- The CNN FEAR & Greed Index ticked back into Neutral territory 2 weeks ago.

Intermarket Trends:

- The major Indices (Dow Jones Industrial Average, S&P 500, and NASDAQ) recently posted new highs signifying a positive trend.

- Interest rates have been volatile lately but appear to be retreating at the present time.

- The US Dollar is trading near the upper end of this year’s trading range due to foreign central banks being the first to cut rates and others taking further rate hikes off the table while the Fed continues its campaign of tough rhetoric.

- Gold has been consolidating near record highs.

- Industrial Metals, which raced higher recently, have consolidated gains and are largely trading sideways

- Oil futures are in the middle of their one-year trading band, but have “perked up” lately and are gaining momentum

Tying it all together:

Four main factors have seemingly been supporting the markets — strong growth, falling inflation, expectations of Fed rate cuts, and AI enthusiasm. These drivers remain intact; however, some key economic data points are flashing warning signals at the present time. While the economy is not weak, some of the data suggests a weakening trend and this is a concern given the markets are not acknowledging the possibility of any sort of economic contraction. Current valuations have certain equities priced for perfection, so it would be fair to say that any type of growth scare could result in rather extreme volatility in the short run.

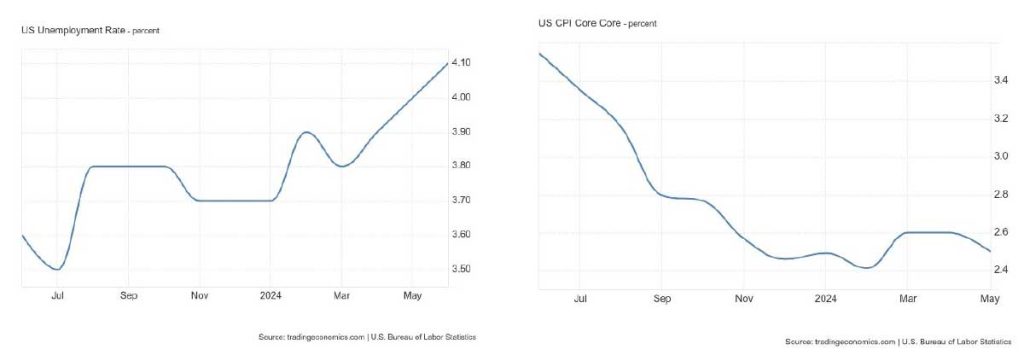

I like to keep an eye on the two charts below as they are the Fed’s primary focus: full employment and stable prices. Watching the unemployment rate tick up is a concern but was a necessary evil in the Fed’s inflation battle which they appear to be winning if you look at the picture on the right. According to the CME FedWatch tool, there is now a 72% probability that our first rate cut here in the US will come in September and I’d have to say that appears to be just in time as we are now seeing some “cracks” developing in the economic growth data.

In the long term, economic growth is the primary driver and while growth remains robust, we must remain vigilant for signs of a slowdown, as this could end the current bull market we are all enjoying. For now, the positives meaningfully outweigh the negatives and as long as these conditions persist, the environment remains favorable for risk assets.

Historically, the best approach in such environments is to ensure that one’s overall portfolio aligns with their risk tolerance and long-term goals.

Please feel free to share these commentaries with friends and family and, should you have any questions regarding your current strategy or the markets in general, please reach out to your CIAS Investment Adviser Representative.

Important Disclosures:

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The statements contained herein are solely based upon the opinions of Edward J. Sabo and the data available at the time of publication of this report, and there is no assurance that any predicted or implied results will actually occur. Information was obtained from third-party sources, which are believed to be reliable, but are not guaranteed as to their accuracy or completeness.

The actual characteristics with respect to any particular client account will vary based on a number of factors including but not limited to: (i) the size of the account; (ii) investment restrictions applicable to the account, if any; and (iii) market exigencies at the time of investment. Capital Investment Advisory Services, LLC (CIAS) reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. The information provided in this report should not be considered a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

CIAS is a registered investment advisor. More information about the advisor, including its investment strategies and objectives, can be obtained by visiting www.capital-invest.com. A copy of CIAS’s disclosure statement (Part 2 of Form ADV) is available, without charge, upon request. Our Form ADV contains information regarding our Firm’s business practices and the backgrounds of our key personnel. Please contact us at (919) 831-2370 if you would like to receive this information.

Capital Investment Advisory Services, LLC

100 E. Six Forks Road, Ste. 200; Raleigh, North Carolina 27609

Securities offered through Capital Investment Group, Inc. & Capital Investment Brokerage, Inc.

100 East Six Forks Road; Raleigh, North Carolina 27609

Members FINRA and SIPC