Weekly Market Recap

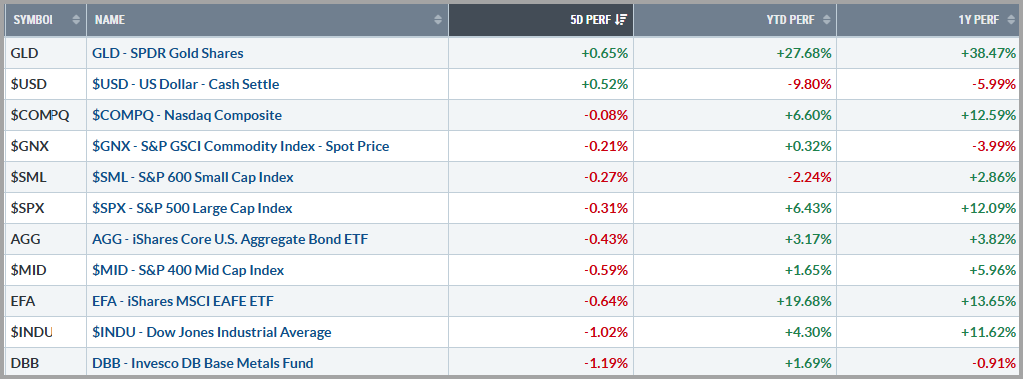

Stocks ended last week slightly lower, with the Dow Jones down 1.0%, while the tech heavy S&P 500 and Nasdaq indices barely budged. Despite the pullback, major indexes hovered near record highs set earlier in the week or the previous week. The primary driver was renewed trade tensions after the U.S. announced new tariffs on more than 20 countries, including steep duties on Brazilian and Canadian goods. Investors also digested the passage of the new tax bill and learned that the US operated in the red for the second time this year with a $27 billion surplus driven by strong tax receipts and tariff revenues.

There really wasn’t much in the reporting of economic data last week, so it was nice to see stocks take a breather, yet hold on to recent gains overall.

Other markets also witnessed volatility last week as geopolitical tensions and trade risks apparently weighed on investors’ minds. Gold prices rose, likely supported by investor demand for “safer” assets amid growing trade uncertainty and inflation concerns. Those tariff-induced inflation concerns seemingly drove Treasury yields higher a good bit, as investors further opined that the Federal Reserve will likely continue with their “wait and see” policy regarding future rate cuts. The same safe haven bid, coupled with stronger yields ostensibly lifted the US Dollar. Industrial metals (especially Copper and Platinum) jumped sharply after the US announced a 50% tariff on Brazilian imports.

Source: stockcharts.com

Key Data and Earnings Season Begins

This week is shaping up to be much busier for markets, with key updates on inflation and economic growth that could influence whether stocks keep climbing. It’s also the unofficial kickoff to earnings season. Perhaps the most important report is Tuesday’s Consumer Price Index (CPI), which measures inflation. Investors are likely hoping for tame inflation numbers and steady economic growth, as this would help keep hopes alive for a Federal Reserve rate cut as soon as September.

On the growth side, Thursday’s Retail Sales report will be closely watched, since strong consumer spending is key to keeping the economy on track. Other reports, like the Empire Manufacturing and Philly Fed surveys, will give an early look at July’s business activity, but these numbers can be jumpy.

Overall, as long as jobless claims remain low and retail sales stay solid, the risk of an economic slowdown would likely remain low, which would be good news for the ongoing market rally that’s getting a little long in the tooth and could require further fuel to keep running.

Tying it all together:

Rather extreme optimism has taken hold and stocks in general may be priced for perfection. Recent economic data shows growth is slowing, but not enough to trigger recession worries or prompt the Fed to cut rates right away. The Federal Reserve has kept interest rates steady for now, but officials have indicated they could lower rates later this year if inflation continues to cool.

The labor market continues to be a steady point for the economy. While job growth has slowed from last year, unemployment remains low and wage growth has moderated without dropping sharply. This balanced situation gives the Federal Reserve more flexibility: there’s seemingly enough strength to avoid a downturn, but not so much that it risks pushing inflation higher. However, the Fed is navigating a narrow path, and any surprises in inflation or jobs data could quickly change the outlook.

Stock market valuations are still relatively high, showing strong investor confidence — or possibly some complacency. Despite ongoing risks from geopolitics, trade tensions, and uncertainty about the Fed’s next moves, markets are apparently betting on a best-case scenario: falling inflation, a strong labor market, Fed rate cuts, and no recession. While this outcome is possible, it leaves little room for disappointment if the data turns less favorable.

Looking ahead, there are both risks and opportunities for investors. If the current outlook shifts, we could see more market ups and downs. However, a steady job market and signs that inflation is easing may help support well-constructed portfolios. In this environment, it’s important to stay diversified, focus on high-quality investments, and be ready to adjust as conditions change. This approach has consistently helped investors navigate uncertain times.

Please feel free to share these commentaries and, should you have any questions regarding your current strategy or the markets in general, please reach out to your CIAS Investment Adviser Representative.

Important Disclosures:

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The statements contained herein are solely based upon the opinions of Edward J. Sabo and the data available at the time of publication of this report, and there is no assurance that any predicted or implied results will actually occur. Information was obtained from third-party sources, which are believed to be reliable, but are not guaranteed as to their accuracy or completeness.

The actual characteristics with respect to any particular client account will vary based on a number of factors including but not limited to: (i) the size of the account; (ii) investment restrictions applicable to the account, if any; and (iii) market exigencies at the time of investment. Capital Investment Advisory Services, LLC (CIAS) reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. The information provided in this report should not be considered a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

CIAS is a registered investment advisor. More information about the advisor, including its investment strategies and objectives, can be obtained by visiting www.capital-invest.com. A copy of CIAS’s disclosure statement (Part 2 of Form ADV) is available, without charge, upon request. Our Form ADV contains information regarding our Firm’s business practices and the backgrounds of our key personnel. Please contact us at (919) 831-2370 if you would like to receive this information.

Capital Investment Advisory Services, LLC

100 E. Six Forks Road, Ste. 200; Raleigh, North Carolina 27609

Securities offered through Capital Investment Group, Inc. & Capital Investment Brokerage, Inc.