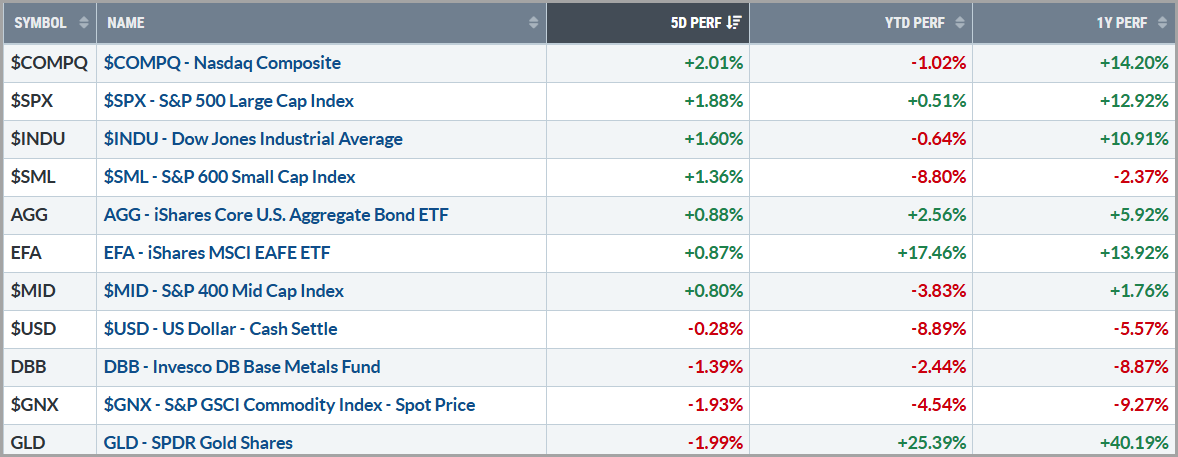

Short Week, Strong Returns

Stocks posted strong gains on the holiday-shortened week, with the S&P 500 rising nearly 2%, but the ride wasn’t exactly smooth. Volatility picked up as investors juggled renewed trade tensions, a mixed economic outlook, and ongoing uncertainty around Federal Reserve policy. Despite the noise, tech earnings from the likes of Nvidia, continued to impress and helped keep broader markets in the green.

Much of the week’s movement was driven by shifting headlines around the U.S.–China trade relationship. Markets initially rallied after the U.S. delayed steep tariffs on the EU, while some decent economic data also helped calm recession worries, with durable goods orders and consumer confidence coming in relatively better than feared. Jitters returned midweek when the White House moved to restrict semiconductor exports to China just before Nvidia’s strong earnings seemingly “saved the day”.

Meanwhile, the Fed’s latest meeting minutes didn’t exactly signal a more dovish shift, keeping rate-cut hopes in check. By the end of the week, a late boost came from encouraging comments about potential talks between Presidents Trump and China’s Xi and a better than feared inflation report, helping stocks close out a volatile stretch with relatively solid gains.

Source: stockcharts.com

Tariff Drama and The Week Ahead

Last week, a major court ruling briefly shook up the outlook for tariffs. The Court of International Trade said President Trump didn’t have the legal authority to put certain 2025 tariffs in place, blocking them, at least for a moment. That sparked hope among investors that some of the trade-related costs for businesses might go away.

But just one day later, another court paused that decision while the case moves through the appeals process. That means the tariffs are still in effect for now, and a final decision, possibly from the Supreme Court, could take a few weeks. So, while things are still up in the air, markets may stay volatile as investors wait for clarity.

This week, the spotlight is on Friday’s Jobs Report, as it will be the first major data to potentially reflect any early impact from tariffs. Strong job growth might calm recession fears and support stocks, while weak numbers could raise concerns about a slowdown.

Also on watch are the ISM Manufacturing and Services reports. The Services PMI (Purchasing Managers’ Index) is especially important, as it’s a reflection of a larger component of the US economy, and staying above 50 signals continued growth. If it dips below, markets may take that as a warning sign. Investors will be watching all of this closely for clues on how tariffs and economic trends are starting to play out.

Tying it all together:

Investor sentiment has apparently taken a welcome turn for the better since reaching historically low levels just a few weeks ago, as encouraging progress on tariffs and the U.S.-China trade front suggests we may finally be moving past the threat of a full-blown trade war.

Despite recent market volatility, the underlying economic picture seemingly remains resilient. Key data like job growth, consumer spending, and inflation have remained relatively strong, reinforcing the purported idea that the economy continues to rest on solid ground. These hard numbers reflect real activity and have seemingly helped markets recover from recent turbulence.

While forward-looking indicators like business surveys and consumer sentiment have shown some weakness, they’re often influenced by short-term uncertainty. As the broader outlook improves, we may see confidence rebound. However, with markets approaching recent highs, valuations are likely to come back into focus. Continued strength in earnings and supportive corporate guidance will be key to justifying current prices.

Going forward, staying disciplined, aligning portfolios with one’s risk tolerance, and focusing on fundamentals will be essential for navigating what remains an evolving and cautiously opportunistic environment.

Please feel free to share these commentaries and, should you have any questions regarding your current strategy or the markets in general, please reach out to your CIAS Investment Adviser Representative.

Important Disclosures:

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The statements contained herein are solely based upon the opinions of Edward J. Sabo and the data available at the time of publication of this report, and there is no assurance that any predicted or implied results will actually occur. Information was obtained from third-party sources, which are believed to be reliable, but are not guaranteed as to their accuracy or completeness.

The actual characteristics with respect to any particular client account will vary based on a number of factors including but not limited to: (i) the size of the account; (ii) investment restrictions applicable to the account, if any; and (iii) market exigencies at the time of investment. Capital Investment Advisory Services, LLC (CIAS) reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. The information provided in this report should not be considered a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

CIAS is a registered investment advisor. More information about the advisor, including its investment strategies and objectives, can be obtained by visiting www.capital-invest.com. A copy of CIAS’s disclosure statement (Part 2 of Form ADV) is available, without charge, upon request. Our Form ADV contains information regarding our Firm’s business practices and the backgrounds of our key personnel. Please contact us at (919) 831-2370 if you would like to receive this information.

Capital Investment Advisory Services, LLC

100 E. Six Forks Road, Ste. 200; Raleigh, North Carolina 27609

Securities offered through Capital Investment Group, Inc. & Capital Investment Brokerage, Inc.