Hope everyone enjoyed the holiday weekend! We wanted to take a quick moment to thank everyone for checking out our newly renovated weekly market updates. We also wanted to thank everyone who donated to the donation drive for the Toledo Humane Society. Team Whetro loves being able to give back to our community. It’s even better that you all are willing to participate in these events with us.

Let’s make it a great week.

Tim Whetro

Weekly Market Insights

During the holiday-shortened week, the primary equity indices (such as the S&P 500, Dow Jones Industrial Average, NASDAQ, etc.) mostly absorbed the gains from the previous week. Several factors influenced trading: Firstly, the release of the Core PCE, which is the Federal Reserve’s preferred inflation indicator, occurred on Good Friday when the markets were closed. Secondly, there was quarterly rebalancing following a fairly significant market surge. Lastly, many traders were leaving their desks ahead of the Easter holiday (I am writing this report on Thursday afternoon, as I too am heading off for a family vacation). It’s common for traders to adjust their positions before major events, resulting in sideways movement in the markets, which is essentially what we witnessed, as most economic data met or exceeded investor expectations.

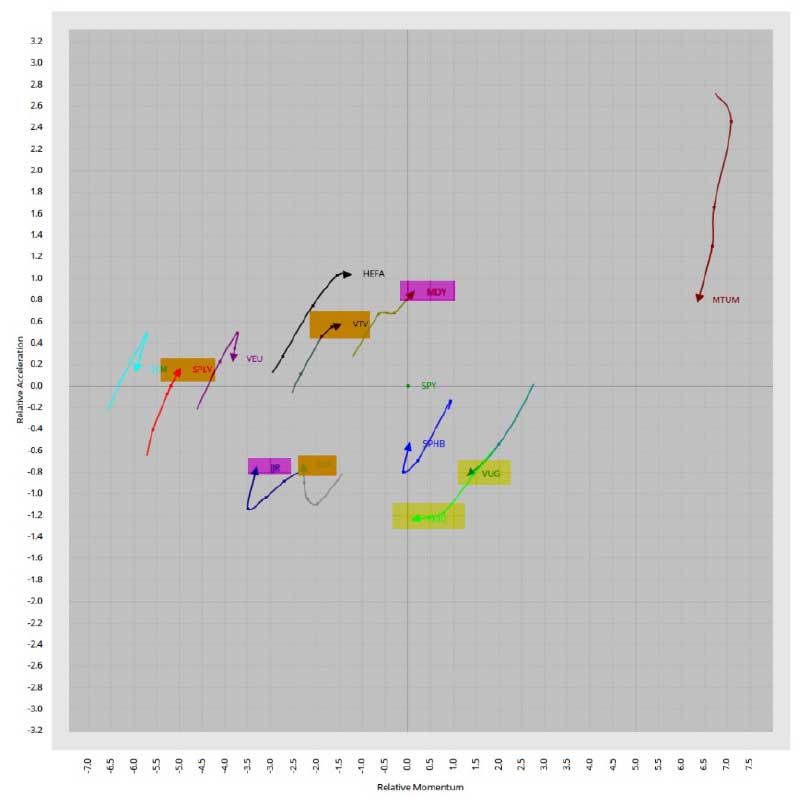

Of particular interest were the rotations occurring behind the scenes. Money appeared to be coming out of the relatively higher growth areas and rotating into value and cyclicals. Some of this can be explained by the month/quarter-end rebalancing (where profits get trimmed and allocated to other areas of the market) this week, but the trend of this rebalancing may be beginning to take shape.

Using our proprietary indicator, the graph below attempts to capture the individual factor’s price momentum (i.e. Growth, Value, Size, Region) and plot the “rotations” over time using tails to show recent history. One quick glance shows the relative momentum of those relatively higher growth areas of the market (shaded yellow) losing ground to value (shaded orange). One can also see from this chart that Mid-Caps (medium sized companies) may be beginning to outperform while Small-Caps are seemingly starting to perk up. Any newfound strength in these areas may make for a much “healthier” market.

Key Takeaway:

Markets with broad participation offer something for everyone to enjoy and are historically better suited to continue advancing than markets where just a few big stocks are doing well. Measures of internal strength, such as the advance decline line, advancing volume and new highs vs. new lows, are all seemingly expanding.

The Week Ahead:

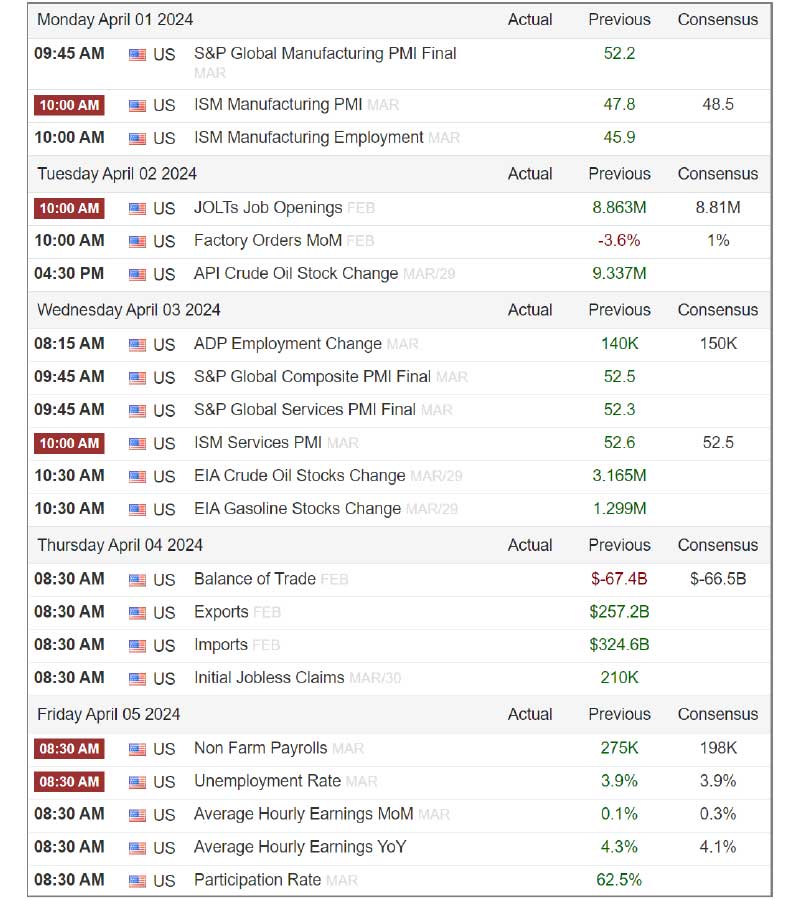

This week is all about employment with a sprinkling of ISM Manufacturing data. The Manufacturing PMI has been in contraction territory for a while now, but one must note that the services sector is larger and really the more important of the two. Barring any major employment surprises, next week’s data shouldn’t be too market-moving (last Fridays PCE data should set the tone once futures begin trading at 6pm Sunday evening — this is being written on Thursday)

Source: Trading Economics (https://tradingeconomics.com/united-states/calendar#)

Tidbits & Technicals: (New developments will be denoted via***)

Current Headwinds:

- Valuations are frothy given the current rate environment, leaving the markets subject to a potential swift pullback.

- “Higher for Longer”- Risk that the Fed waits too long to begin lowering rates and threatens economic growth.

- Seasonally weak period lasts through the end of March

Current Tailwinds:

- Optimism surrounding Artificial Intelligence (AI)

- Fed Pivoting from raising rates to potentially cutting in the future.

- Strong Labor Market

- Solid Economic Growth

- Continued Earnings Growth (the pace of which may be slowing)

- Momentum

- *** Participation is Broadening with value, cyclicals, and smaller sized companies beginning to show a strong upward bias ***

Sentiment:

- Credit Spreads remain tight, signaling the bond market (aka “Smart Money”) is not worried about a recession in the near future.

- The VIX (CBOE Volatility Index) is trading near cycle lows. Note: Periods of low volatility for a long time are often subject to change.

- The CNN FEAR & Greed Index remains above neutral in the “Greed” category showing investors current appetite for risk is strong.

Intermarket Trends:

- The major Indices (Dow Joines Industrial Average, S&P 500, and NASDAQ) all posted new highs last week or the week before.

- Bond investors have been pricing in the idea of higher for longer recently with 10-year treasury yields flirting with the upper middle part of this year’s trading range.

- The US Dollar rallied towards the upper end of this years trading range last week due to foreign central banks being the first to cut rates and others taking further rate hikes off the table

- Gold has recently made all-time highs.

- Industrial Metals caught a bid recently and copper recently broke out of a multi-month trading range.

- Oil is trading near the top of its 2024 range but well below last years highs.

Tying it all together:

What’s not to love about a market that keeps making new highs supported by a positive economic backdrop, strong employment and a consumer that wants to get out and spend? We recently noted that Fed Chair Powell seemed not so concerned about inflation and the board has telegraphed lower rates in the future via their “Dot Plot” tool. AI (Automated Intelligence) has provided the catalyst, momentum has taken control, and optimism is strong. While we must acknowledge valuations have become frothy and be weary of becoming overly complacent should the environment change, this appears to be one of those times where wealth is created in the markets. Should Core PCE (last Friday) meet or exceed expectations, I would expect further advances to come in those areas of the markets mentioned above that are beginning to perk up. On the flip side, a strong inflationary print would likely result in profit taking, but I wouldn’t expect one bad data print to spoil the bull market we are in. I hope everyone enjoys the long holiday weekend and Core PCE comes in under 2.8% year over year tomorrow!

Please feel free to share these commentaries with friends and family and, should you have any questions regarding your current strategy or the markets in general, please reach out to your CIAS Investment Adviser Representative.

Important Disclosures:

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The statements contained herein are solely based upon the opinions of Edward J. Sabo and the data available at the time of publication of this report, and there is no assurance that any predicted or implied results will actually occur. Information was obtained from third-party sources, which are believed to be reliable, but are not guaranteed as to their accuracy or completeness.

The actual characteristics with respect to any particular client account will vary based on a number of factors including but not limited to: (i) the size of the account; (ii) investment restrictions applicable to the account, if any; and (iii) market exigencies at the time of investment. Capital Investment Advisory Services, LLC (CIAS) reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. The information provided in this report should not be considered a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

CIAS is a registered investment advisor. More information about the advisor, including its investment strategies and objectives, can be obtained by visiting www.capital-invest.com. A copy of CIAS’s disclosure statement (Part 2 of Form ADV) is available, without charge, upon request. Our Form ADV contains information regarding our Firm’s business practices and the backgrounds of our key personnel. Please contact us at (919) 831-2370 if you would like to receive this information.

Capital Investment Advisory Services, LLC

100 E. Six Forks Road, Ste. 200; Raleigh, North Carolina 27609

Securities offered through Capital Investment Group, Inc. & Capital Investment Brokerage, Inc.

100 East Six Forks Road; Raleigh, North Carolina 27609

Members FINRA and SIPC