A Volatile Week, But the Market Stays Steady

Last week delivered plenty of ups and downs for stocks as investors navigated several concerns at once. Softer labor market data, uncertainty around the Federal Reserve’s next moves, weakness in large technology stocks, and ongoing geopolitical tensions all created headwinds.

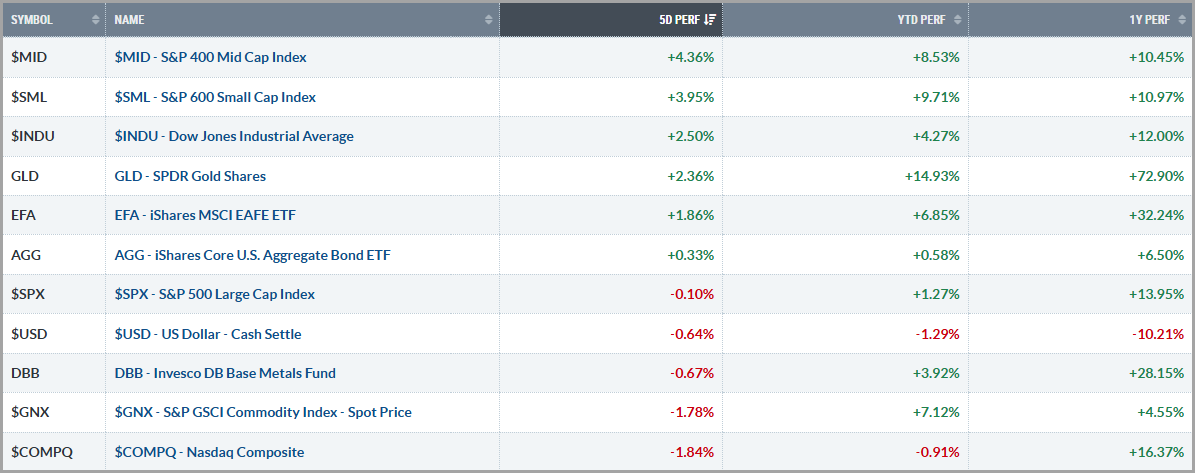

Yet despite the noise, the broader market held up better than it may have felt day to day. The S&P 500 finished the week nearly flat and remains up just over 1% year to date, while less tech-heavy indices posted solid gains.

Technology stocks accounted for most of the pressure. A few AI-related names disappointed investors, and some large-cap tech companies issued softer outlooks, leading the Nasdaq to lag more noticeably.

Importantly, strength outside of tech helped stabilize the market. Many non-technology sectors moved higher, offsetting those declines and keeping the broader indexes on steady footing.

By week’s end, improving consumer confidence and renewed discussion of potential rate cuts brought buyers back in, helping stocks finish stronger on Friday.

The big picture: some turbulence, but no lasting damage.

Rates, Dollar & Commodities

Interest rates moved slightly lower last week as softer jobs data increased hopes that the Federal Reserve could cut rates later this year. The 10-year Treasury yield remained in a comfortable range near 4.2%, which is generally neutral for stocks.

The U.S. dollar strengthened a bit but stayed stable overall. Currency markets were calm and didn’t create major headwinds.

Commodities were mixed. Gold held up well as investors looked for safety, while silver saw bigger swings. Oil prices bounced around on global economic and geopolitical headlines but ended slightly lower. Overall, nothing extreme, just normal volatility.

Takeaway

If there’s one theme right now, it’s resilience.

Even when certain areas, especially big tech, struggle, money isn’t necessarily leaving the market entirely. Instead, it appears investors may be shifting into other sectors like industrials, value stocks, and more defensive areas.

That’s a healthy sign. It shows the market is adjusting rather than breaking down.

The economy also continues to look stable. Business activity is still expanding, and while the job market has cooled down a bit, it’s not showing major cracks.

The main challenge remains inflation and interest rates. If inflation stays sticky, the Fed may delay rate cuts, which can slow the market’s progress. But that’s very different from a recession or serious downturn.

Bottom line: the foundation still looks solid, even if the ride feels bumpy.

This Week – What Matters for Markets

This week, the biggest report is the (delayed) jobs update. After some softer labor numbers recently, the market will likely want to see signs that hiring is steady and the economy remains healthy.

We’ll also get fresh inflation data and retail sales figures. Ideally, we want results that are not too hot and not too cold. Steady growth and cooling inflation would be the best mix for stocks.

If the data comes in stable, markets could stay supported. If there are surprises, expect some short-term swings.

Broad Overview

Right now, the market feels more like sailing through choppy waters. There are plenty of waves and sudden gusts that can rock the boat, but we’re still making steady progress.

Tech stocks are seemingly taking a breather after a strong run, while other parts of the market are picking up the slack. Meanwhile, the economy keeps growing, consumers are still spending, and long-term trends like AI and innovation remain in place.

That doesn’t mean it’s smooth sailing. Stock prices are still somewhat expensive compared to history, and policy uncertainty can create volatility.

But as long as growth continues and the job market stays stable, the bigger picture remains constructive.

If you have any questions about your portfolio or the market outlook, please contact your CIAS Investment Adviser Representative.

Important Disclosures:

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The statements contained herein are solely based upon the opinions of Edward J. Sabo and the data available at the time of publication of this report, and there is no assurance that any predicted or implied results will actually occur. Information was obtained from third-party sources, which are believed to be reliable, but are not guaranteed as to their accuracy or completeness.

The actual characteristics with respect to any particular client account will vary based on a number of factors including but not limited to: (i) the size of the account; (ii) investment restrictions applicable to the account, if any; and (iii) market exigencies at the time of investment. Capital Investment Advisory Services, LLC (CIAS) reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. The information provided in this report should not be considered a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.