Weekly Market Insights

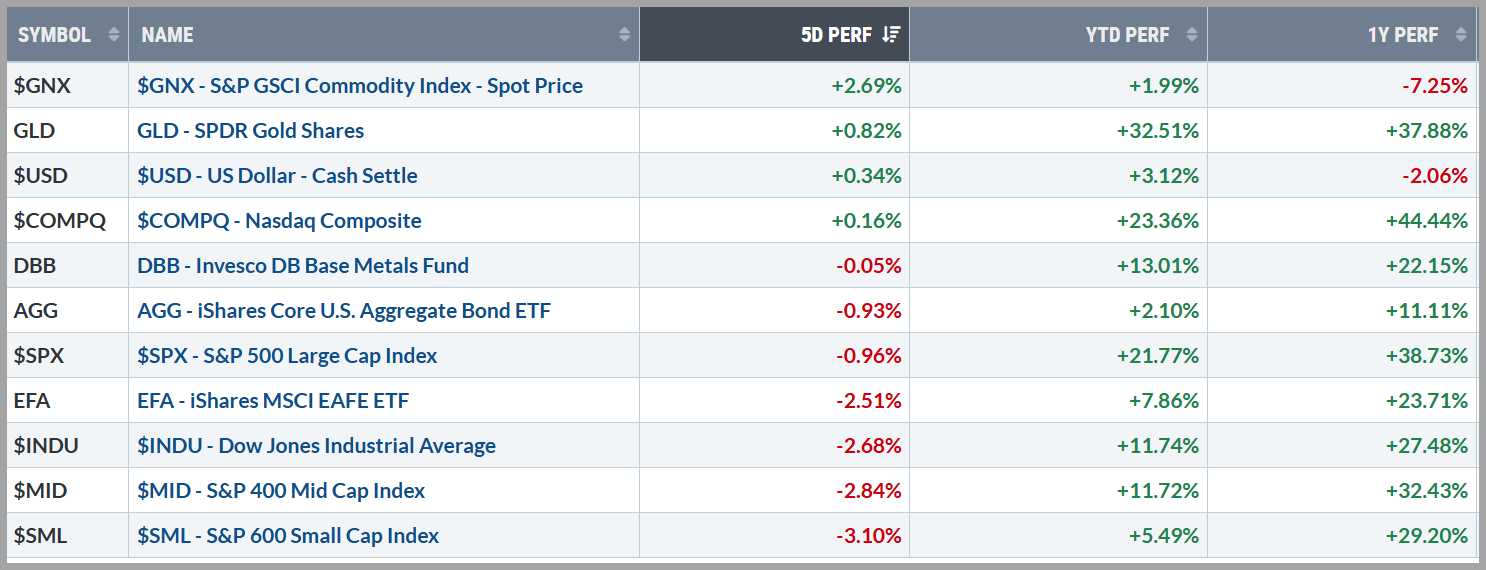

Rising longer-term yields and mixed earnings results prompted moderate declines in the Dow Jones Industrial average and S&P 500 while the NASDAQ Composite eked out a tiny gain for the week as economic data remained Goldilocks.

10-year treasury yields rose above the 4.20% mark last week for the first time since July, as investors continue to reset market-based inflation expectations and the potential magnitude of near-term Fed Rate cuts amid the stronger than anticipated economic data of late. These same forces continued to push the dollar higher as other major central banks are being viewed as more “dovish” than their US counterparts. Continued geopolitical unrest seemingly supported a “fear bid” in oil which, coupled with the rising inflation expectations, drove gold to fresh new highs once again. Industrial metals traded mostly flat on the week.

Source: Stockcharts.com

Source: Optuma and DTN IQ

Key Takeaway:

Altogether, last week’s economic data underscored a favorable environment for stocks and bonds, supporting the Fed’s plan to ease rates gradually. Earnings and revenues came in “fine” but according to Factset, the forward 12-month P/E ratio is 21.7, which is well above the 5- and 10-year average, so it was no surprise to see some relatively mild profit-taking.

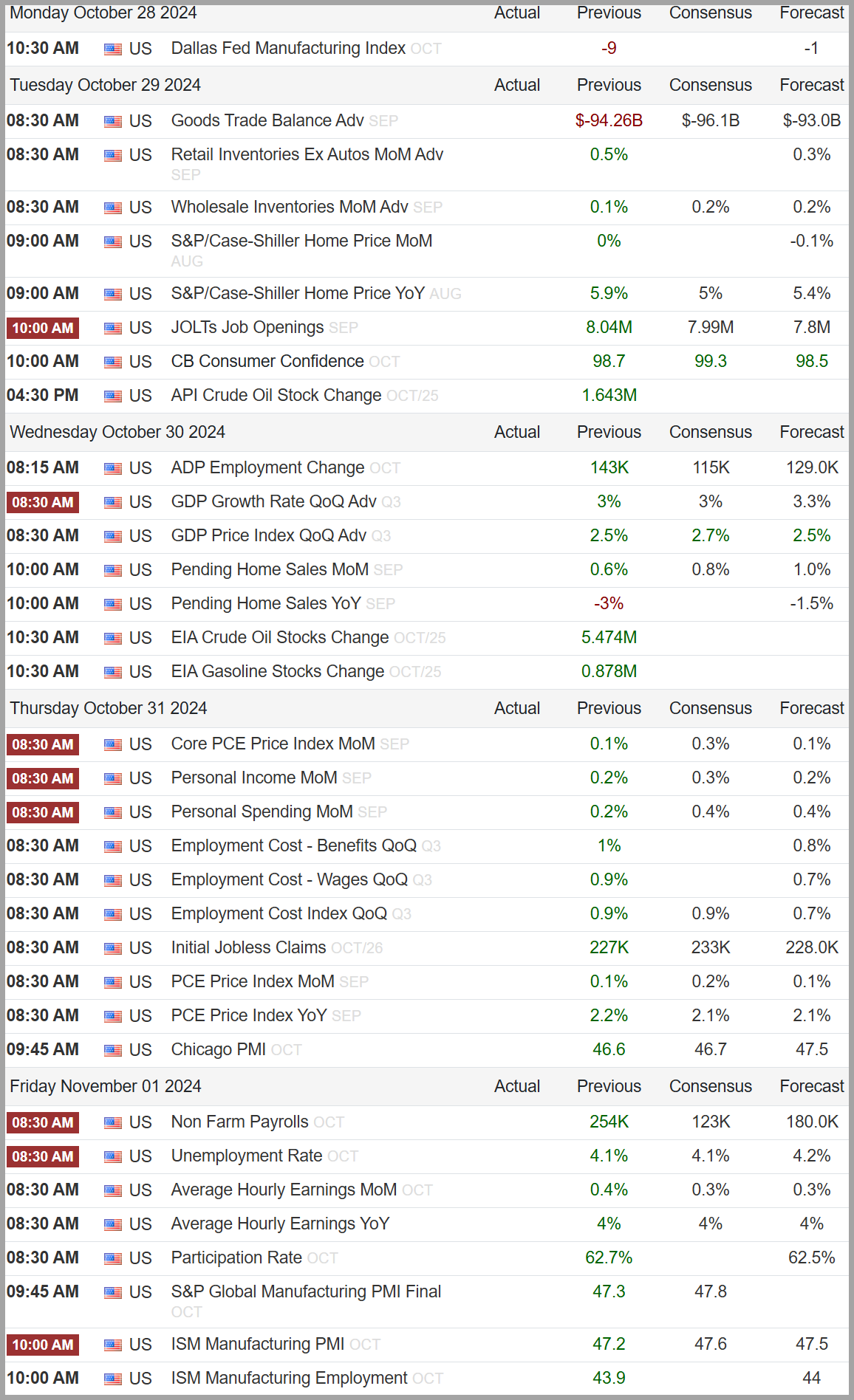

The Week Ahead:

We have a full calendar this week with one-third of the S&P 500 companies reporting earnings. This includes 5 of the “Magnificent Seven” stocks that make up a large portion of the major indices. If that weren’t enough to get things moving, we also have key employment, growth and inflation data hitting the newswires.

On the employment front, key reports this week will be Friday’s Non-Farm Payrolls and Tuesdays JOLTs (Job Openings and Labor Turnover) reports. Unemployment reports of late have been wrought with volatility, so investors will be looking for any revisions and fresh perspectives, as this could impact the Fed’s rate decisions. For growth, not much is more important than Thursday’s Personal Income and Spending reports, Friday’s ISM Manufacturing numbers and Wednesdays GDP Advanced Estimates. Lastly, Thursday’s Core PCE data is the Fed’s preferred measure of inflation and with recent concerns ticking back up, this one will certainly garner investors’ attention.

Source: Trading Economics (https://tradingeconomics.com/united-states/calendar#)

Tidbits & Technicals: (New developments will be denoted via***)

Current Headwinds:

- Valuations seem frothy leaving the markets subject to a potential swift pullback.

- “Higher for Longer” – Risk that the Federal Reserve waited too long to begin lowering rates or leaves rates too high and threatens economic growth.

- Recent employment trends have “cooled” with major revisions to past data

- ***Recently rising longer-term interest rates

Current Tailwinds:

- Optimism surrounding Artificial Intelligence (AI) (recently waning)

- The Federal Reserve has begun their rate-cutting cycle and vows more cuts in the future

- Strong Labor Market (signs of rising unemployment are showing up, yet jobs are available)

- Solid Economic Growth

- Continued Earnings Growth (the pace of which may be slowing)

- Momentum

Sentiment:

- Credit Spreads have retreated to near cycle lows

- The VIX (CBOE Volatility Index) remains elevated at this time

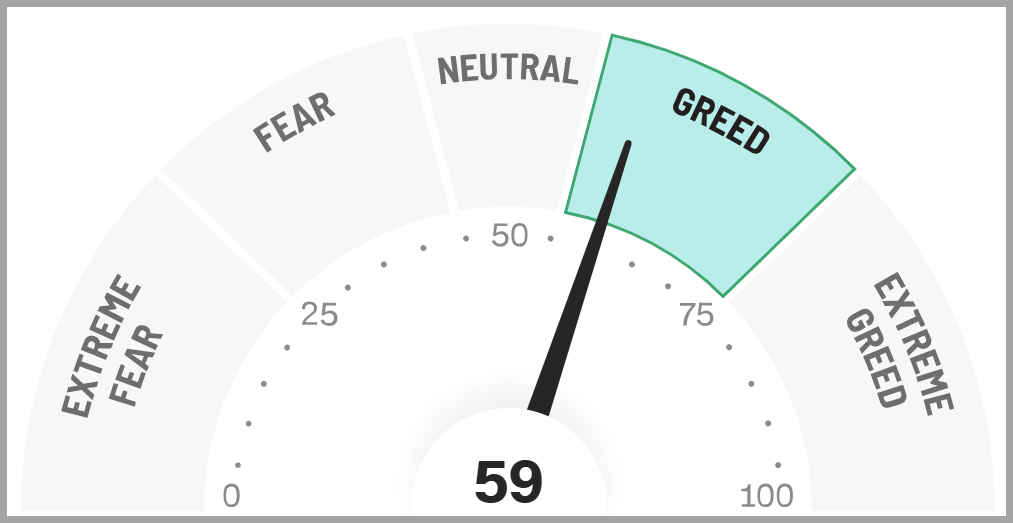

- ***The CNN FEAR & Greed Index has returned to a more modest Greed Status

Source: https://www.cnn.com/markets/fear-and-greed

Intermarket Trends:

- ***The major Indices (Dow Jones Industrial Average, S&P 500, and NASDAQ) are trading at or near all-time highs signifying a positive trend

- ***Dow Theory – The transports have recently broke out to fresh highs, confirming the industrials bullish conviction

- Interest rates have been volatile all year and appear to be trending lower.

- ***The US Dollar has broken its upward trend line but has been climbing over the past several weeks

- ***Gold recently broke out of its trading range to record highs

- Industrial Metals, have been trending lower lately

- Oil futures trading near the low end of their one-year trading range

Tying it all together:

Stock market momentum remains strong, and for good reason. Inflation is gradually cooling, and interest rate cuts are providing a boost, while economic growth is robust, and the job market is showing steady resilience. On top of that, corporate earnings projections are climbing.

It looks like the Fed’s strategy to guide the economy toward a “soft landing”, a scenario where an economy slows down just enough to curb inflation without falling into a recession, is bearing fruit, and the market is reacting positively.

The primary driver behind the stock market rally is the seemingly prevailing belief that the economy will avoid a severe downturn, achieving a soft landing instead, which, combined with potential Fed rate cuts, could create an ideal “Goldilocks” scenario for stocks. However, it’s crucial to remain cautious, as challenges persist, and current valuations appear somewhat “frothy.”

Encouragingly, investor sentiment is optimistic, but not yet euphoric, and stock price gains are now extending beyond just the technology sector. Broad sector participation is a positive sign for sustained market growth, and we are seeing this at a time when historically significant seasonal patterns are coming into play. The old adage, “Sell in May and go away” [until October], is ringing in the ears of Wall Street participants as we enter the traditionally “strong” season of November-through-April.

Recently, I have noted that volatility expectations are on the rise. Wall Streets “fear gauge”, the VIX (volatility index), has been spending more time in the upper part of its range, which is somewhat puzzling given the strong investor sentiment readings and potential Goldilocks economic backdrop. Some of this can be attributed to the complex geopolitical landscape with the Israel-Hamas conflict, escalating tensions between Isreal and Iran, the war in Ukraine, and a host of political elections throughout the developed world providing various future economic uncertainties. These types of events are nothing new to the markets, but tend to foster headline reactions in the short-term rather than shape longer-term trends.

Volatility has also been particularly pronounced in the bond market this year, with long-term interest rates showing some of the most significant fluctuations in decades. The 10-year Treasury yield hit a peak of around 5% last October, started the year in the upper 3% range, rallied back to approximately 4.75% around May, and has since returned close to where it began this year. Meanwhile, short-term rates have remained more stable, aligning more closely with Federal Reserve policy and showing signs of easing as the first rate cuts have taken effect. Recently, a shift has occurred in the yield curve: for the first time since mid-2022, long-term Treasury yields (10-year) exceeded short-term rates (2-year), breaking a historic inversion that lasted 783 days.

With the first rate cuts now implemented, it seems that the economic disruptions triggered by the COVID outbreak and governmental stimulus efforts—such as inflation, workforce challenges, and supply chain issues—are receding into the past. The primary focus has shifted back to future growth, earnings, employment, and innovation, signaling a potential return to “normal” in the markets, if such a state is indeed achievable.

Please feel free to share these commentaries with friends and family and, should you have any questions regarding your current strategy or the markets in general, please reach out to your CIAS Investment Adviser Representative.

Important Disclosures:

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The statements contained herein are solely based upon the opinions of Edward J. Sabo and the data available at the time of publication of this report, and there is no assurance that any predicted or implied results will actually occur. Information was obtained from third-party sources, which are believed to be reliable, but are not guaranteed as to their accuracy or completeness.

The actual characteristics with respect to any particular client account will vary based on a number of factors including but not limited to: (i) the size of the account; (ii) investment restrictions applicable to the account, if any; and (iii) market exigencies at the time of investment. Capital Investment Advisory Services, LLC (CIAS) reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. The information provided in this report should not be considered a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

CIAS is a registered investment advisor. More information about the advisor, including its investment strategies and objectives, can be obtained by visiting www.capital-invest.com. A copy of CIAS’s disclosure statement (Part 2 of Form ADV) is available, without charge, upon request. Our Form ADV contains information regarding our Firm’s business practices and the backgrounds of our key personnel. Please contact us at (919) 831-2370 if you would like to receive this information.

Capital Investment Advisory Services, LLC

100 E. Six Forks Road, Ste. 200; Raleigh, North Carolina 27609

Securities offered through Capital Investment Group, Inc. & Capital Investment Brokerage, Inc.

100 East Six Forks Road; Raleigh, North Carolina 27609

Members FINRA and SIPC