Weekly Market Insights

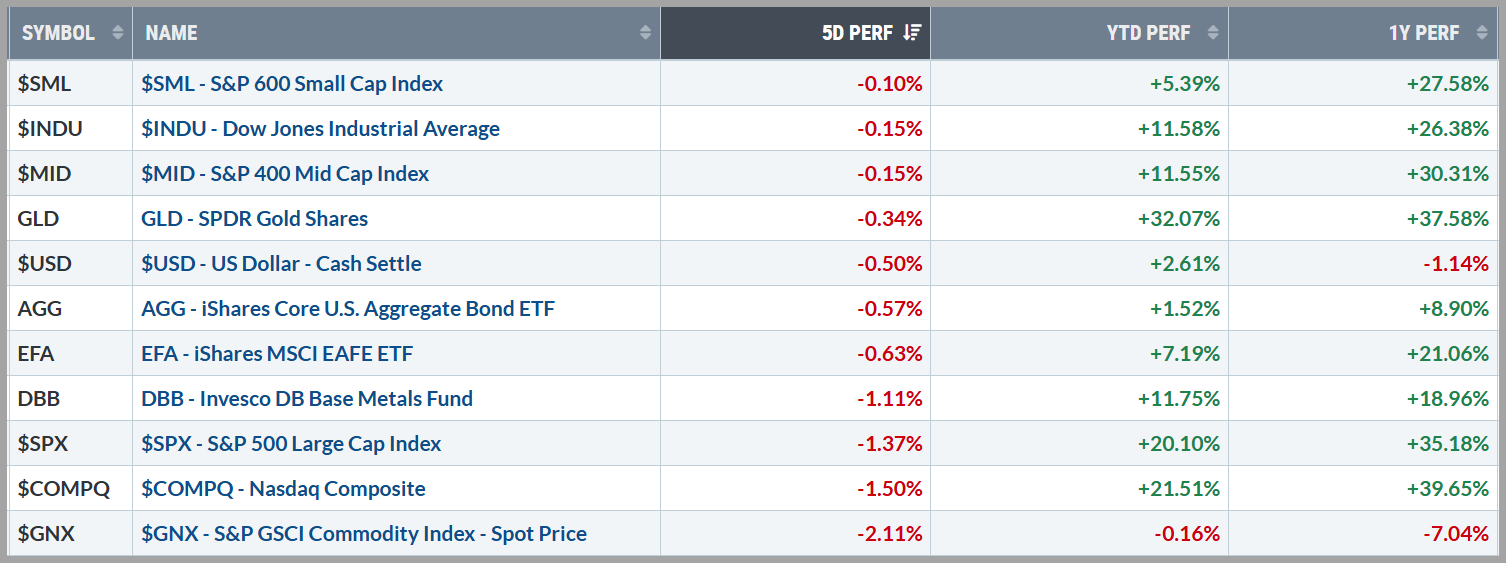

Stocks took another pause last week as major tech companies’ earnings and forward guidance failed to excite investors, while relatively soft economic data seem to have continued to support the idea of more rate cuts from the Fed.

Interestingly, longer-term interest rates rose despite the enhanced odds of the Fed cutting short term rates. This put additional pressure on bonds as the 10-year treasury yield climbed over 4.30% last week, to its highest level since June. The US dollar traded slightly lower last week on firmer than expected European inflation readings, but failed to boost the commodities markets, as the overall takeaway from last week’s data implied a loss of economic momentum.

Source: Stockcharts.com

Source: Optuma and DTN IQ

Key Takeaway:

Last week’s labor reports were surprisingly soft, furthering investors conviction that the Fed should cut rates so that current restrictive policy does not add further pressure on the jobs market. Normally, markets would cheer this type of data, but the truth is, rate cuts have already been priced in and the market typically only discounts the same data once. Seemingly unrealistically high earnings expectations surrounding some of the largest tech companies led to disappointment, despite overall growth in profits and revenues, as the lofty valuations investors have placed upon these companies appear to be in question.

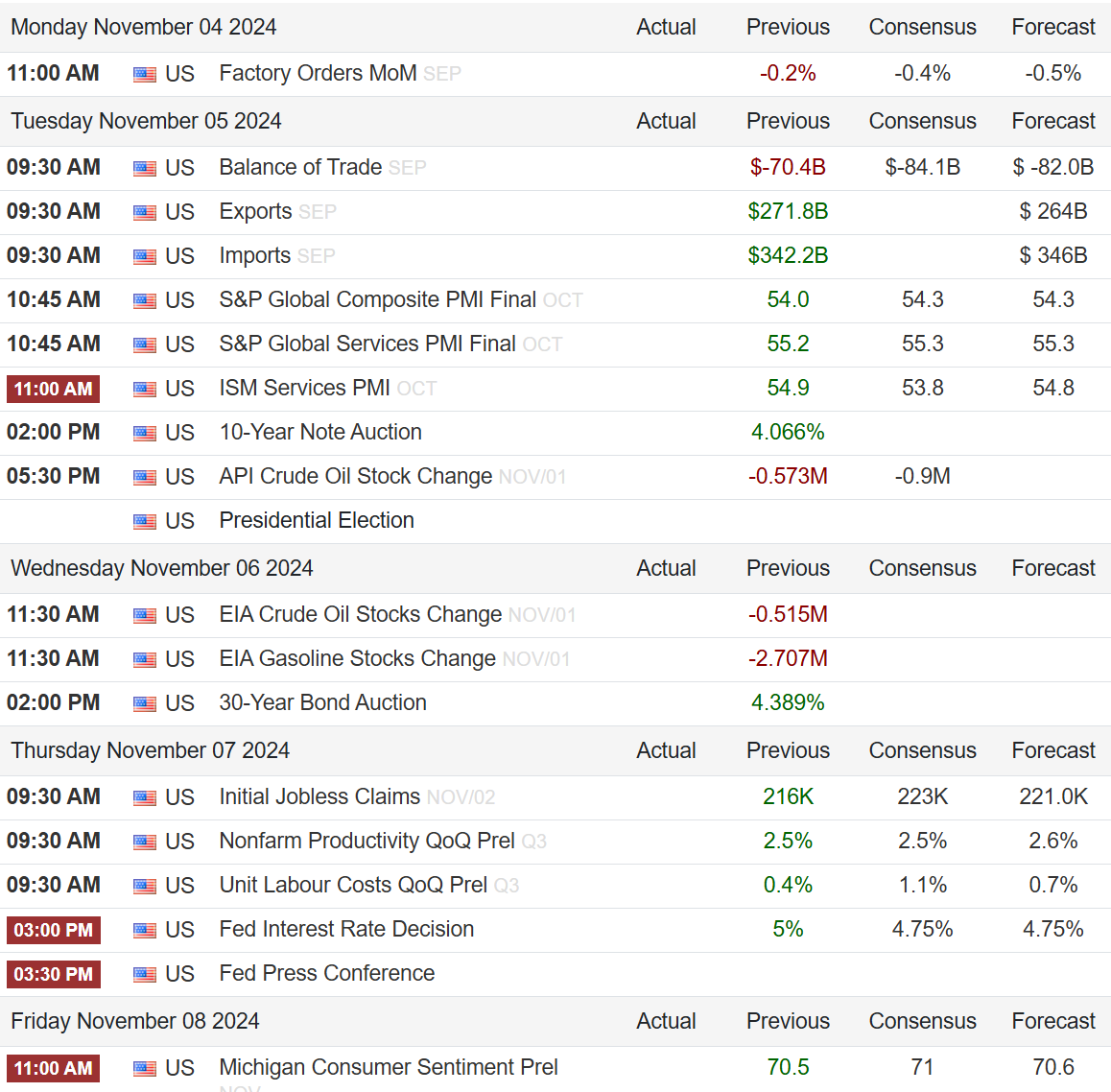

The Week Ahead:

We have another busy week of earnings ahead, along with the elections on Tuesday and the Fed meeting on Thursday. The current odds are fully suggesting the Fed will cut rates by .25%, but all eyes will be analyzing what the Fed sees for futurerate cuts. We will also get a peek at business conditions with Tuesday morning’s S&P Global and ISM PMIs.

Source: Trading Economics (https://tradingeconomics.com/united-states/calendar#)

Current Observations

Economic Growth: The economy appears to be growing at a moderate pace, not too hot. GDP expanded 2.7% year-on-year in the third quarter of 2024, slowing slightly from a 3% rise in the previous period and has averaged 3.16 percent from 1948 until 2024. (source: U.S. Bureau of Economic Analysis)

Inflation: Inflation has been cooling over the past year but appears to be a little “sticky” in recent months. The annual inflation rate in the US slowed for a sixth consecutive month to 2.4% in September 2024, the lowest since February 2021, from 2.5% in August. The monthly core inflation rate (which excludes volatile items such as food and energy) remained at 0.3%, the same as in August.

( source: U.S. Bureau of Labor Statistics)

Employment: The jobs market remains robust despite the recent rise in unemployment from historically low levels and the decreasing number of job openings. Put simply, the labor market was on fire just a few months ago and is cooling off to sustainable levels. The unemployment rate in the United States fell to 4.1% in September 2024, the lowest in three months, down from 4.2% in the previous month.

(source: U.S. Bureau of Labor Statistics)

Monetary Policy: Federal Reserve officials cut rates for the first time since 2020 in September by a large 0.50% in an effort to balance inflation confidence with labor market concerns. A fed Funds Rate of 4.75-5% is still considered “restrictive policy”, yet the fed has telegraphed this is only the beginning of a rate cut cycle.

(source: Federal Reserve)

Sentiment: Investor psychology is presently neutral with a slight bullish tilt. According to AAII, retail investor Bulls currently outweigh the Bears by a small margin, down considerably from recent euphoric observations. Active money managers appear to be near fully invested in stocks with the NAAIM Exposure index sitting near 80% while the CNN Fear & Greed index, which measures seven different aspects of market behavior to gauge the “mood” of the stock market, resides in Neutral territory.

Volatility & Speculative Demand: Since returning down from its pronounced August spike, the VIX (CBOE Volatility Index) has been trending upwards with a series of higher highs and lows and currently resides at elevated historical levels- signifying heightened volatility expectations in the near term among investors. Alternately, the difference (or spread) between yields for junk bonds and safer government bonds is near historical lows at the present time- a sign that investors are willing to take on more risk with regards to their fixed income investments and confidence in the overall economy.

Stocks

The major Indices (Dow Jones Industrial Average, S&P 500, and NASDAQ) are trading at or near all-time highs signifying a positive trend. Small Caps have recently broken out to new highs but have rejoined Mid-Caps by trading back into the consolidation zone that’s persisted since July. Outside of the US, Developed and Emerging Markets Indices which peaked in late September have spent the last month retreating with their currency hedged counterparts holding up much better.

Bonds & Interest Rates

Bonds have had a rough time since the Fed cut rates in September. A wave of overwhelmingly positive economic data and election concerns has rekindled inflation fears and caused investors to recalibrate their upcoming rate cut expectations sending interest rates up and bond prices down. (Just a reminder, bond prices and interest rates have an inverse relationship)

Commodities & Currencies

The weak Chinese economy (2nd largest in the world) and strong US dollar continue to weigh on commodities. Oil, the largest component in the commodities space, has felt the demand pressure from China similar to industrial metals, while precious metals have been the standout having recently traded to new highs.

The Federal Reserve is currently being viewed as the least dovish major central bank (read- keeping rates higher for longer), the US dollar has remained strong vs. foreign currencies having recently traded back up into the higher end of the past two years trading range.

Breadth & Technicals

One of the major themes since the markets sold off in August has been expanding breadth. More and more stocks have joined the parade to higher prices and that’s a good thing. Recent economic data supports this breadth expansion to the more cyclical areas of the market while the trend towards lower interest rates and historically high valuations is supporting money flows into the more conservative sectors that typically include higher dividend paying stocks.

Over the past couple of weeks, we’ve witnessed fewer stocks advancing on their charts while new 52-week highs continue to outpace new lows. Over the same time period, the percentage of NYSE stocks on point & figure “buy” signals has declined about 10% from the previously overly exuberant levels. Overall, breadth still looks good, but there is no question that momentum has waned in the short term.

Tying it all together:

Stock market momentum remains strong, and for good reason. Inflation is gradually cooling, and interest rate cuts are providing a boost, while economic growth is robust, and the job market is showing steady resilience. On top of that, corporate earnings projections are climbing.

It looks like the Fed’s strategy to guide the economy toward a “soft landing”, a scenario where an economy slows down just enough to curb inflation without falling into a recession, seem to be bearing fruit, and the market is reacting positively.

The primary driver behind the stock market rally is the seemingly prevailing belief that the economy will avoid a severe downturn, achieving a soft landing instead, which, combined with potential Fed rate cuts, could create an ideal “Goldilocks” scenario for stocks. However, it’s crucial to remain cautious, as challenges persist, and current valuations appear somewhat “frothy.”

Encouragingly, investor sentiment is optimistic, but not yet euphoric, and stock price gains are now extending beyond just the technology sector. Broad sector participation is a positive sign for sustained market growth, and we are seeing this at a time when historically significant seasonal patterns are coming into play. The old adage, “Sell in May and go away” [until October], is ringing in the ears of Wall Street participants as we enter the traditionally “strong” season of November-through-April.

Recently, I have noted that volatility expectations are on the rise. Wall Streets “fear gauge”, the VIX (volatility index), has been spending more time in the upper part of its range, which is somewhat puzzling given the strong investor sentiment readings and potential Goldilocks economic backdrop. Some of this can be attributed to the complex geopolitical landscape with the Israel-Hamas conflict, escalating tensions between Isreal and Iran, the war in Ukraine, and a host of political elections throughout the developed world providing various future economic uncertainties. These types of events are nothing new to the markets, but tend to foster headline reactions in the short-term rather than shape longer-term trends.

Volatility has also been particularly pronounced in the bond market this year, with long-term interest rates showing some of the most significant fluctuations in decades. The 10-year Treasury yield hit a peak of around 5% last October, started the year in the upper 3% range, rallied back to approximately 4.75% around May, and has since returned close to where it began this year. Meanwhile, short-term rates have remained more stable, aligning more closely with Federal Reserve policy and showing signs of easing as the first rate cuts have taken effect. Recently, a shift has occurred in the yield curve: for the first time since mid-2022, long-term Treasury yields (10-year) exceeded short-term rates (2-year), breaking a historic inversion that lasted 783 days.

With the first rate cuts now implemented, it seems that the economic disruptions triggered by the COVID outbreak and governmental stimulus efforts—such as inflation, workforce challenges, and supply chain issues—are receding into the past. The primary focus has shifted back to future growth, earnings, employment, and innovation, signaling a potential return to “normal” in the markets, if such a state is indeed achievable.

Please feel free to share these commentaries with friends and family and, should you have any questions regarding your current strategy or the markets in general, please reach out to your CIAS Investment Adviser Representative.

Important Disclosures:

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The statements contained herein are solely based upon the opinions of Edward J. Sabo and the data available at the time of publication of this report, and there is no assurance that any predicted or implied results will actually occur. Information was obtained from third-party sources, which are believed to be reliable, but are not guaranteed as to their accuracy or completeness.

The actual characteristics with respect to any particular client account will vary based on a number of factors including but not limited to: (i) the size of the account; (ii) investment restrictions applicable to the account, if any; and (iii) market exigencies at the time of investment. Capital Investment Advisory Services, LLC (CIAS) reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. The information provided in this report should not be considered a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

CIAS is a registered investment advisor. More information about the advisor, including its investment strategies and objectives, can be obtained by visiting www.capital-invest.com. A copy of CIAS’s disclosure statement (Part 2 of Form ADV) is available, without charge, upon request. Our Form ADV contains information regarding our Firm’s business practices and the backgrounds of our key personnel. Please contact us at (919) 831-2370 if you would like to receive this information.

Capital Investment Advisory Services, LLC

100 E. Six Forks Road, Ste. 200; Raleigh, North Carolina 27609

Securities offered through Capital Investment Group, Inc. & Capital Investment Brokerage, Inc.

100 East Six Forks Road; Raleigh, North Carolina 27609

Members FINRA and SIPC

Affiliated with Capital Investment Advisory Services, LLC. Securities offered through Capital Investment Group, Inc. 100 E. Six Forks Road, Suite 200; Raleigh, NC 27609 Member FINRA/SIPC