Weekly Market Insights

Last Monday saw a downturn fueled by Iran’s direct attack on Israel and China’s promise to support Iran. Tuesday’s market slightly recovered despite negative housing data and mixed bank earnings, but Federal Reserve Chair Powell’s hawkish speech seemingly reversed all gains late in the day. Weakness in the AI sector and big technology leaders dragged parts of the market down into the close on Wednesday and while Thursday started positively with strong economic indicators, things once again turned negative, likely due to cautious guidance from a major semiconductor outfit and another round of hawkish comments from central bank officials. Reports of looming Israeli retaliatory actions against Iran had the newswires talking Friday morning, but markets opened with a relative sense of calm until mega tech companies shares came up for sale yet again, dragging the S&P lower to close out the week just under the psychologically important 5000 mark and closing the big gap from Nvidia’s blowout earnings announcement back in April that sparked the latest leg of the rally.

Key Takeaway:

Stocks traded with a heavy tone again last week due to rising geopolitical risk, weaker than expected corporate guidance, poor tech sector performance, and strong economic data which effectively reduced the number of rate cuts investors are expecting to see out of the Federal Reserve.

Throughout my career I’ve seen geopolitical risk come and go. When uprisings in the Middle East occur, they are typically short-lived market events as they impact the price of oil, which impacts the commodity space, and spills over into all the other metrics temporarily playing havoc with economic indicators. I try not to get too excited. Earnings season just got underway, with about 15% of companies reporting, and earnings have been strong for the most part thus far. Future guidance on the other hand has had a negative tone and investors, by and large, tend to be forward-looking creatures. This is nothing new, guidance has been weak for the past several earnings seasons, but with valuations having equities seemingly priced for perfection, this negative outlook appears to be taking its toll on investor sentiment in the short run. The real undertone that’s driving the markets presently is that investors are pushing their rate cut expectations further out into the future due to strong economic data and hawkish Federal Reserve commentary.

One strong note: As the mega-cap tech companies have risen in valuation, their respective weight in certain indices such as the S&P 500 and NASDAQ has become pretty significant. This handful of stocks does not represent “The Market” as a whole. It is important to look under the hood of the indices and while the past few weeks have seen declines, there are other areas of the market, namely cyclicals like Industrials, Materials, and Financials, that have been taking on a leadership role. This is a healthy rotation in my opinion that supports the strong economic backdrop we are witnessing.

The Week Ahead:

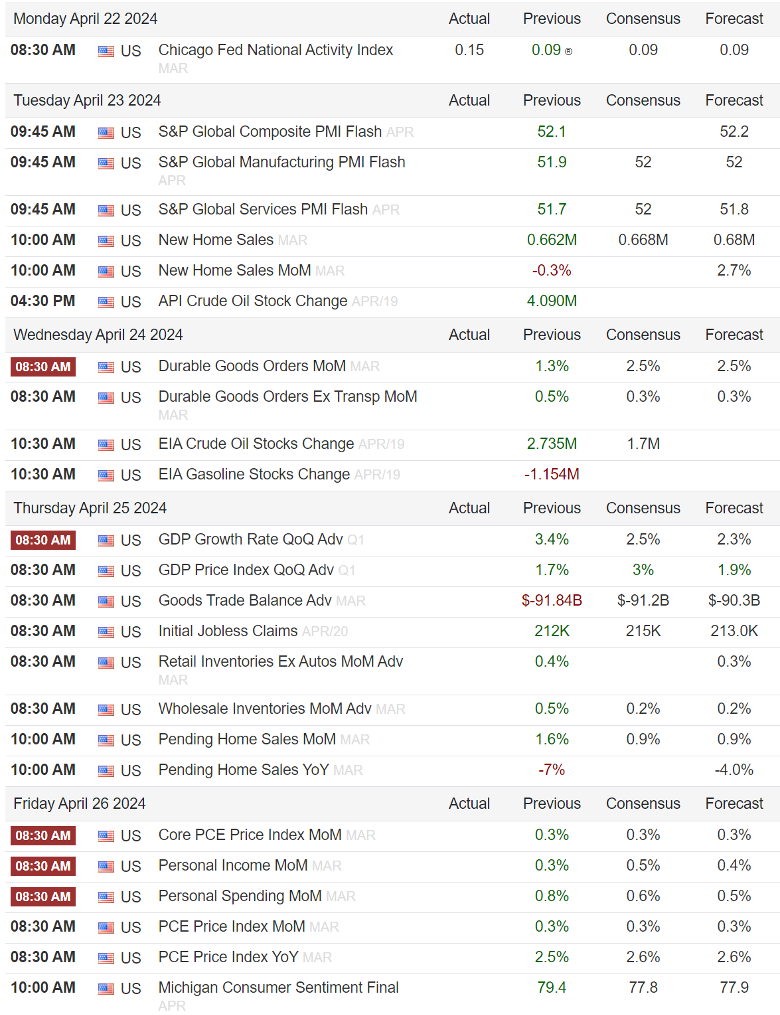

The most crucial economic report this week, vital for short-term market stability, is Friday’s Core PCE Price Index. If the index surpasses expectations, selling pressure will increase in both stocks and bonds, anticipating fewer rate cuts (or none) in 2024. Conversely, meeting, or exceeding expectations, especially with positive surprises on inflation, could lead to a drop in yields and a solid stock market rebound. In short, the Core PCE Price Index is pivotal for short-term market stabilization. This indicator has largely met investor expectations in the past several prints!

Also, this week, investor focus will be on earnings reports from major tech companies such as Microsoft, Google, Tesla, and Meta. I will be paying particular attention to forward guidance… If all that’s not enough, we will get a look at the consumer, sentiment, and growth metrics such as GDP so stay tuned as this week has the potential to be big mover.

Source: Trading Economics (https://tradingeconomics.com/united-states/calendar#)

Tidbits & Technicals: (New developments will be denoted via***)

Current Headwinds:

- Valuations seem frothy given the current rate environment, leaving the markets subject to a potential swift pullback.

- “Higher for Longer” – Risk that the Federal Reserve waits too long to begin lowering rates and threatens economic growth.

- 10-year Treasury yields broke out to new highs for the year signaling that bond investors may be beginning to believe in the “Higher for Longer” thesis.

Current Tailwinds:

- Optimism surrounding Artificial Intelligence (AI)

- Federal Reserve pivoting from raising rates to potentially cutting in the future.

- Strong Labor Market

- Solid Economic Growth

- Continued Earnings Growth (the pace of which may be slowing)

- Momentum

- ***Participation is Broadening with cyclicals taking a leadership role while the tech-trade begins to fade

Sentiment:

- Credit Spreads remain tight, signaling the bond market (aka “Smart Money”) is not worried about a recession in the near future.

- The VIX (CBOE Volatility Index) has broken through this years “complacency zone”.

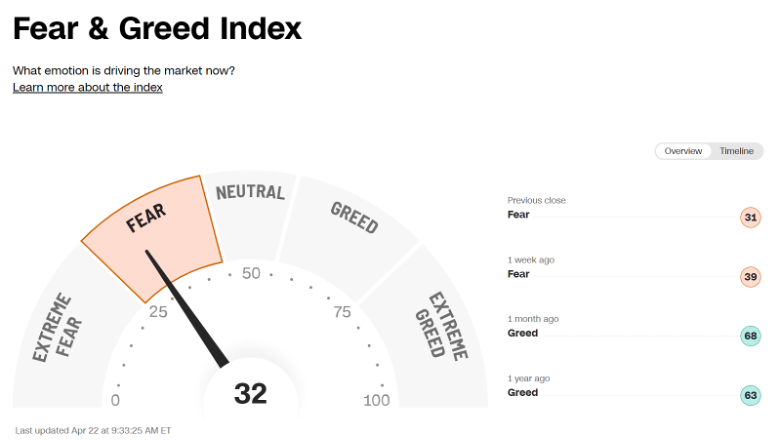

- ***The CNN FEAR & Greed Index fell into the “FEAR” territory last week. “Buy when others are Fearful” should ring a bell.

Intermarket Trends:

- The major Indices (Dow Joines Industrial Average, S&P 500, and NASDAQ) all posted new highs in the past few weeks signifying a positive trend.

- Bond investors have been pricing in the idea of higher for longer recently with 10-year treasury yields above this year’s trading range to make new highs.

- The US Dollar is trading near the upper end of this year’s trading range due to foreign central banks being the first to cut rates and others taking further rate hikes off the table while the Fed continues its campaign of tough rhetoric.

- Gold continues to set record highs.

- Industrial Metals caught a bid recently and copper recently broke out of a multi-month trading range.

- Oil is trading near the top of its 2024 range but well below last year’s highs.

Tying it all together:

Following a 25% surge in the S&P 500 over the past several months, it should come as no surprise that recent market sentiment has shifted. The S&P 500 has now closed down for the third consecutive week, while the Nasdaq, heavily focused on technology, saw its fourth straight week of decline. Declines such as these are very common in the marketplace and tend to occur several times per year in a normal bull market cycle. Investors tend to push things too far when optimism prevails and momentum takes over, thus requiring a “cooling period” which allows the fundamentals to play catch up and investors a chance to reallocate funds from those areas of the market that may have gotten ahead of themselves (think AI and tech stocks) into the underappreciated.

This current volatility seems to stem from three main factors: a recalibration of expectations regarding Fed rate cuts, geopolitical tensions in the Middle East affecting oil and commodity prices, and a mixed outlook from companies during the S&P 500 first-quarter earnings season, despite beating forecasts. While these are important factors in determining valuations, they are (for now) considered short term in nature.

When assessing the current situation, one must also consider the underlying strength of the U.S. economy which is being supported by robust consumer demand and a healthy job market, along with signs of stabilization in global economic growth and the fact that inflation is trending downward. These are the variables that will shape future market dynamics and should play a far more important role in shaping one’s allocation decisions.

Please feel free to share these commentaries with friends and family and, should you have any questions regarding your current strategy or the markets in general, please reach out to your CIAS Investment Adviser Representative.

Important Disclosures:

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The statements contained herein are solely based upon the opinions of Edward J. Sabo and the data available at the time of publication of this report, and there is no assurance that any predicted or implied results will actually occur. Information was obtained from third-party sources, which are believed to be reliable, but are not guaranteed as to their accuracy or completeness.

The actual characteristics with respect to any particular client account will vary based on a number of factors including but not limited to: (i) the size of the account; (ii) investment restrictions applicable to the account, if any; and (iii) market exigencies at the time of investment. Capital Investment Advisory Services, LLC (CIAS) reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. The information provided in this report should not be considered a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

CIAS is a registered investment advisor. More information about the advisor, including its investment strategies and objectives, can be obtained by visiting www.capital-invest.com. A copy of CIAS’s disclosure statement (Part 2 of Form ADV) is available, without charge, upon request. Our Form ADV contains information regarding our Firm’s business practices and the backgrounds of our key personnel. Please contact us at (919) 831-2370 if you would like to receive this information.

Capital Investment Advisory Services, LLC

100 E. Six Forks Road, Ste. 200; Raleigh, North Carolina 27609

Securities offered through Capital Investment Group, Inc. & Capital Investment Brokerage, Inc.

100 East Six Forks Road; Raleigh, North Carolina 27609

Members FINRA and SIPC