Weekly Market Insights

Friday’s all-important labor market report came in far above expectations (~60%) with non-farm payrolls rising 256,000 versus expectations of a 165,000 rise, while the unemployment rate fell one=tenth to 4.1% (a historically low level). To the average Joe, this sounds like an excellent report showing a strong jobs market, but Wall Street likes to have a twist on everything… (more on this in the key takeaway section).

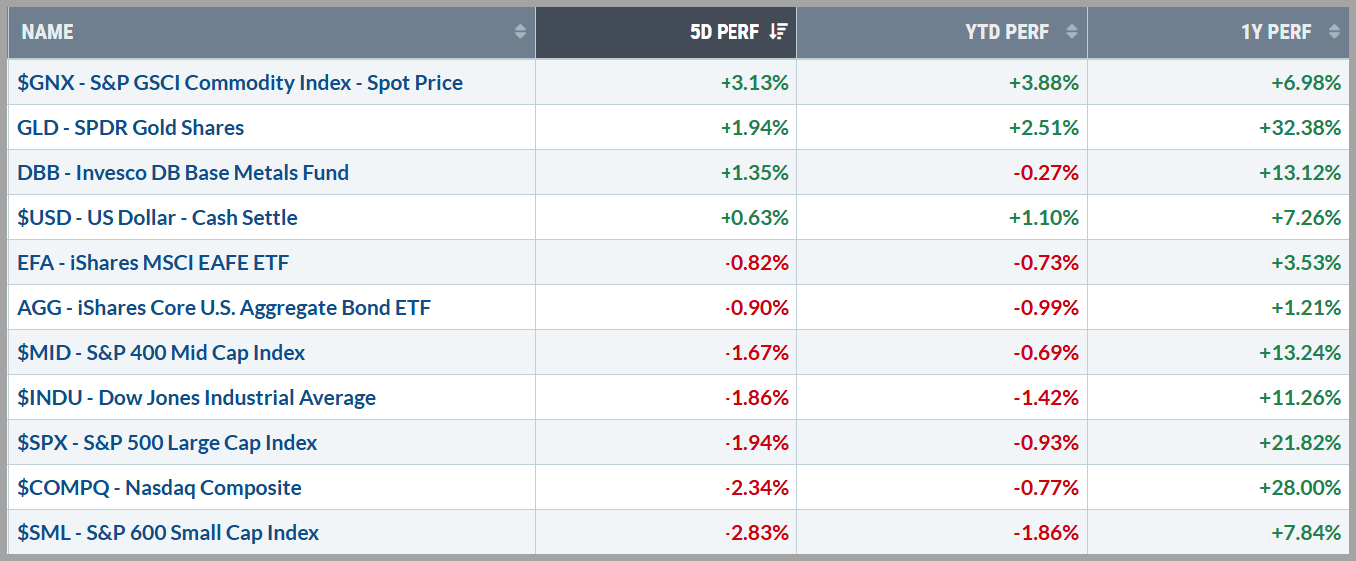

The exceptionally strong data sent the odds of future rate cuts by the Fed circling the drain and longer-term yields soared to their highest levels of the past year, putting pressure on stocks and bonds alike. The NASDAQ and Small Cap stock indices shed more than 2% for the week while the S&P 500, Dow Jones Industrial Average, and Mid-Caps gave up just under 2%.

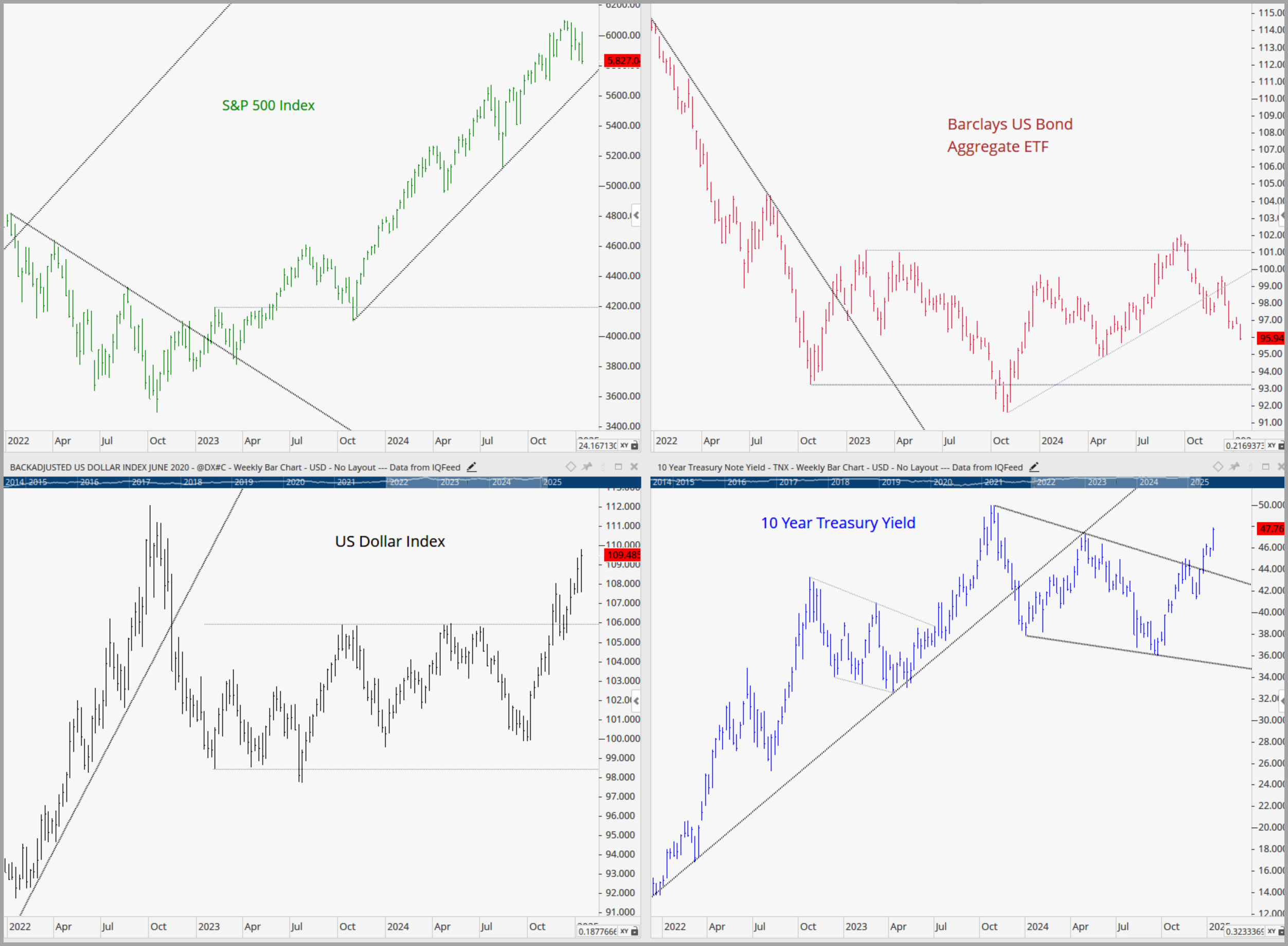

Treasury yields spiked with the benchmark 10-year yield approaching 4.8% level, notably closing above the April ‘24 high mark of 4.7%. Strong yields and positive economic data spilled into the US dollar which has risen a whopping 9+% since the first Fed rate cut back in September ’24. Despite the strong dollar, Gold caught a safe haven bid, while industrial metals largely sat out all the excitement. Cold weather, political and technical dynamics seemingly played an influence on the energy markets, with oil climbing for the second straight week in a row.

Source: Stockcharts.com

Key Takeaway:

There are several key factors driving the markets right now, so let me break them down into simpler concepts. While this might be a bit long, it may help make sense of the big picture:

- The Fed’s Rate Cuts and Market Response

- The Bond Market’s View: When the Fed started cutting rates in September 2024 (including a big 0.5% cut), it signaled they were trying to boost growth during a weakening economy. The bond market — often referred to as “Smart Money”— saw this as a positive signal for future economic prospects.

- How This Works: The Fed controls short-term rates, but the market generally sets long-term rates. Since the cuts, long-term rates (yields) have risen, which likely reflects optimism about growth and the expectation of higher inflation in the future. Higher inflation drives bond investors to demand better returns, pushing yields up.

- Why the Fed Cut Rates and What’s Happening Now

- Back Then: In 2024, the labor market looked relatively weak, with rising unemployment and slowing inflation. To relieve economic pressure, the Fed cut rates to support growth.

- Now: Today, the labor market is stronger, but inflation appears “sticky”. This has led the Fed — and investors — to seemingly expect fewer rate cuts in 2025, maybe none. High rates staying longer could slow growth because borrowing costs tend to remain elevated.

- Effects of Higher Long-Term Rates

Higher rates have a rippling through the economy in several ways:

- A. Borrowing Costs: Higher rates make loans more expensive for businesses and individuals. As a result, companies may cancel expansion plans, and people may put off buying homes or cars.

- B. Bonds vs. Stocks: With bonds now offering ~5% returns, they compete with stocks for investment dollars. This is a big shift from the days of “TINA” (“There Is No Alternative” to stocks), when bond yields were near zero.

- C. Stronger Dollar: Higher US yields attract global investors, which tends to strengthen the dollar. But a strong dollar may hurt international companies, as profits earned abroad lose value when converted back into US currency.

- D. Slower Growth: Over time, higher rates could reduce economic growth. Fewer projects may get funded, fewer goods get purchased, production could slow, and companies may eventually cut jobs to maintain profits.

- Year-End Volatility

- Portfolio Adjustments: After two strong years in the market, investors are rebalancing portfolios, harvesting tax gains or losses, and locking in profits. This has been amplified because much of the market’s recent gains were driven by relatively few sectors (like AI), which adds to the volatility.

- Post-Election Uncertainty

- New Administration Concerns: Investors are watching closely as the new Republican-led government begins to implement policies. These include potential tariff changes (which could increase inflation) and tax cuts (which could raise the deficit). According to the Stock Trader’s Almanac, the first quarter of post-election years is typically volatile due to policy uncertainties. However, historically, the second half of these years tends to produce modest market gains.

Higher rates, potentially sticky inflation, a strong dollar, and policy uncertainties are all weighing on the markets. While these factors are creating challenges now, there’s potential for positive momentum to return since the overall economic backdrop remains strong with solid GDP growth, expanding profits and historically low unemployment.

Source: Optuma with DTN IQ data

The Week Ahead:

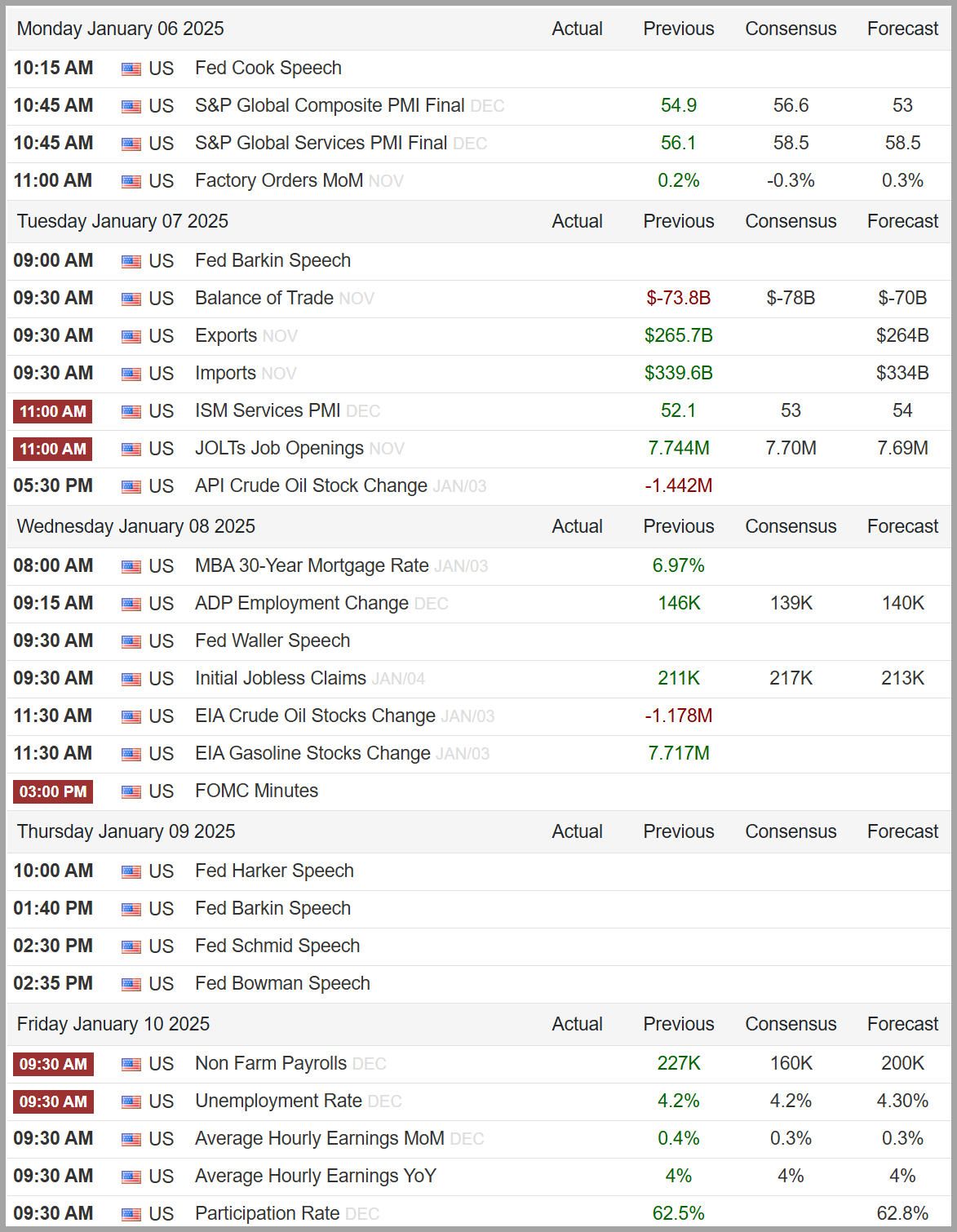

This coming week’s focus will be on inflation, and given recent concerns and strong employment data, investors will likely want to see softer pricing data to calm the nerves of those concerned with the Fed’s next actions. The first of the inflation reports will come on Tuesday with the PPI (Producer Price Index) and will be followed up on Wednesday with CPI (Consumer Price Index) and Core Inflation.

The data keeps flowing on Thursday and Friday with Retail Sales, Weekly Jobless Claims and a host of real estate market data.

Source: www.tradingeconomics.com

Current Observations (Updates denoted by ***)

Economic Growth: The economy appears to be growing at a moderate pace, not too hot. GDP expanded 2.7% year-on-year in the third quarter of 2024, slowing slightly from a 3% rise in the previous period and has averaged 3.16 percent from 1948 until 2024. (source: U.S. Bureau of Economic Analysis)

Inflation: Inflation has been cooling over the past year but appears to be a little “sticky” in recent months. The annual inflation rate in the US rose for a 2nd consecutive month to 2.7% in November 2024 from 2.6% in October, in line with expectations and concerningly above 2.4% in September(which was the lowest rate since February 2021). This marks the second increase in inflation in seven months, while core consumer prices, which exclude volatile items such as food and energy, increased to 2.40 percent in November from 2.30 percent in October of 2024.

( source: U.S. Bureau of Labor Statistics)

Employment: The jobs market remains robust despite the recent rise in unemployment from historically low levels. The US economy added 256K jobs in December 2024, the most in nine months, following a downwardly revised 212K in November, and once again beating market forecasts of 160K. The unemployment rate in the United States went down to 4.1% in December of 2024 from 4.2% in the previous month, below market expectations of 4.2%.

(source: U.S. Bureau of Labor Statistics)

Monetary Policy: According to minutes from the December 2024 FOMC meeting, nearly all Federal Reserve officials concluded that the risks of higher inflation had risen, citing the potential effects of changes in trade and immigration policies with the new administration coming in. While participants expected inflation to continue progressing toward the 2% target, they acknowledged that the timeline for achieving this goal might be longer than previously anticipated. Several members voiced concerns that the disinflationary trend may have stalled temporarily or warned of the possibility of further delays. Additionally, officials indicated that the Fed was approaching a point where slowing the pace of policy easing would be appropriate. In December, the Fed implemented another 25-basis-point cut to the federal funds rate, bringing it to a range of 4.25%-4.5%, and signaled plans for just two additional rate cuts in 2025, totaling 50 basis points.

(source: Federal Reserve)

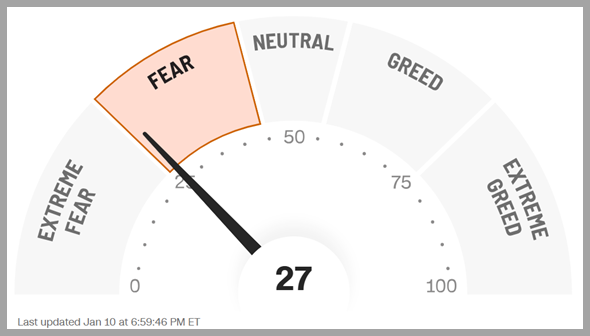

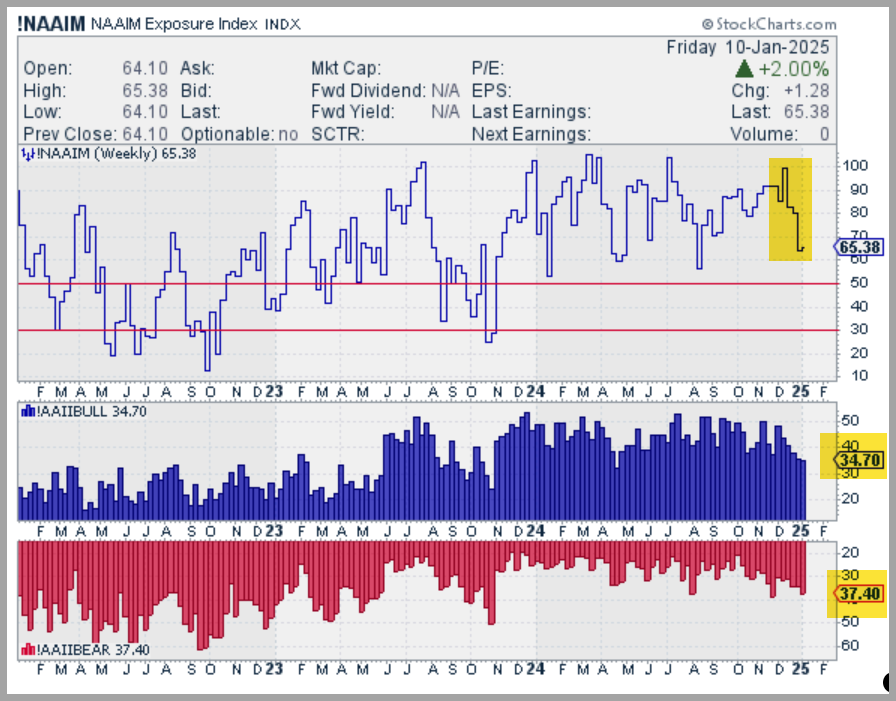

Sentiment: Investors have seemingly been feeling a bit “moody”. According to AAII, retail investor Bears currently outweigh the Bulls and active money managers appear to be pulling money from stocks as the NAAIM Exposure index has been falling rapidly from recent strong levels. The CNN Fear & Greed index, which measures seven different aspects of market behavior to gauge the “mood” of the stock market, shows investors are currently in “Fear”.

Source: https://www.cnn.com/markets/fear-and-greed

Volatility & Speculative Demand: The VIX (CBOE Volatility Index), which is known to be Wall Street’s fear gauge, has been on the rise recently along with high-yield (or “junk”) bond credit spreads which have climbed to multi-month highs from historically low levels. This steady deterioration since Q4 2024 may be signaling growing investor stress—a development worth watching closely.

Stocks

The major Indices (Dow Jones Industrial Average, S&P 500, and NASDAQ) are near all-time highs, signifying a positive trend. Outside of the US, Developed and Emerging Markets Indices, which peaked in late September, have spent the last month retreating with their currency-hedged counterparts holding up much better.

***Bonds & Interest Rates

Bonds have had a relatively rough time since the Fed cut rates in September. A wave of overwhelmingly positive economic data and governmental policy concerns have rekindled inflation fears, causing investors to recalibrate their upcoming rate cut expectations, sending yields soaring. (Just a reminder, bond prices and interest rates have an inverse relationship).

Commodities & Currencies

The weak Chinese economy (2nd largest in the world) and strong US dollar continue to weigh on commodities. Oil, the largest component in the commodities space, along with industrial metals (a key global growth gauge), have been under pressure while precious metals are trading near all-time highs.

The US Federal Reserve is currently being viewed as the most “hawkish” (high rates) central bank in the world. This stance is keeping a bid under the US Dollar as it trades near cycle highs.

***Breadth & Technicals

One of the major themes since the markets sold off in August has been expanding breadth. Recently, fewer sectors and industries are contributing to overall gains, signaling a lack of widespread support for the rally and potential underlying weakness

This can be witnessed by looking at:

- Advancing vs. Declining Stocks

- Bullish Percent Charts (the percentage of stocks on a Point & Figure “Buy” signal)

- Net new 52-week highs vs. lows

- Percentage of stocks above/below critical moving averages

Tying it all together:

The stock market has been historically strong, and for good reason. Inflation is steadily cooling, interest rate cuts are taking place, economic growth remains robust, and the job market has shown impressive resilience along with corporate earnings projections.

The markets have responded positively to the Fed’s strategy to steer the economy toward a “soft landing”— where they slow things down just enough to tame inflation without tipping into a recession utilizing their monetary policy tools. Those “tools” mostly involve the Fed changing short-term interest rates in an effort to promote full employment and price stability (i.e. low inflation). Monetary policy changes often come with confounding ramifications and it’s difficult for the Fed to foresee all the nuances their strategies will invoke.

Prudent investors must attempt to predict the potential outcomes of the Fed’s decisions (along with many other variables) and allocate capital according to their thesis. When Wall Street’s collective theses align, price trends emerge.

While recent price trends in the stock market have been positive, overall valuations have become historically stretched, warranting a dose of caution. It’s important to understand that bull markets don’t end due to stretched valuations (in fact, sometimes valuations can exceed even the most optimistic expectations) but they do eventually fall victim to concerns over future monetary policy implications and growth deterioration, so it is important to look for cautionary signals during the later stages of a bull cycle to mitigate unnecessary risks. Of course, we will continue monitoring the markets and economic trends in an effort to help make informed decisions and report our findings in these briefings weekly.

Please feel free to share these commentaries with friends and family and, should you have any questions regarding your current strategy or the markets in general, please reach out to your CIAS Investment Adviser Representative.

Important Disclosures:

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The statements contained herein are solely based upon the opinions of Edward J. Sabo and the data available at the time of publication of this report, and there is no assurance that any predicted or implied results will actually occur. Information was obtained from third-party sources, which are believed to be reliable, but are not guaranteed as to their accuracy or completeness.

The actual characteristics with respect to any particular client account will vary based on a number of factors including but not limited to: (i) the size of the account; (ii) investment restrictions applicable to the account, if any; and (iii) market exigencies at the time of investment. Capital Investment Advisory Services, LLC (CIAS) reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. The information provided in this report should not be considered a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

CIAS is a registered investment advisor. More information about the advisor, including its investment strategies and objectives, can be obtained by visiting www.capital-invest.com. A copy of CIAS’s disclosure statement (Part 2 of Form ADV) is available, without charge, upon request. Our Form ADV contains information regarding our Firm’s business practices and the backgrounds of our key personnel. Please contact us at (919) 831-2370 if you would like to receive this information.

Capital Investment Advisory Services, LLC

100 E. Six Forks Road, Ste. 200; Raleigh, North Carolina 27609

Securities offered through Capital Investment Group, Inc. & Capital Investment Brokerage, Inc.

100 East Six Forks Road; Raleigh, North Carolina 27609

Members FINRA and SIPC