Weekly Market Insights

Markets remained volatile last week as concerns over the trade war, economic growth, and disappointing mega-cap tech earnings weighed on major indices. However, Friday’s Personal Consumption Expenditures (PCE) index, the Federal Reserve’s preferred inflation measure, provided a boost, helping stocks close sharply higher. Despite the rebound, most indices still ended the week lower, except for the Dow, which managed to eke out a positive finish.

The PCE report showed headline inflation at 2.5% year-over-year, down from 2.6% the previous month and in line with expectations. The core rate, which excludes food and energy, eased to 2.6% from 2.8%, also meeting forecasts. This was a relief for investors after the prior week’s Consumer Price Index (CPI) and Producer Price Index (PPI) reports indicated rising inflation pressures.

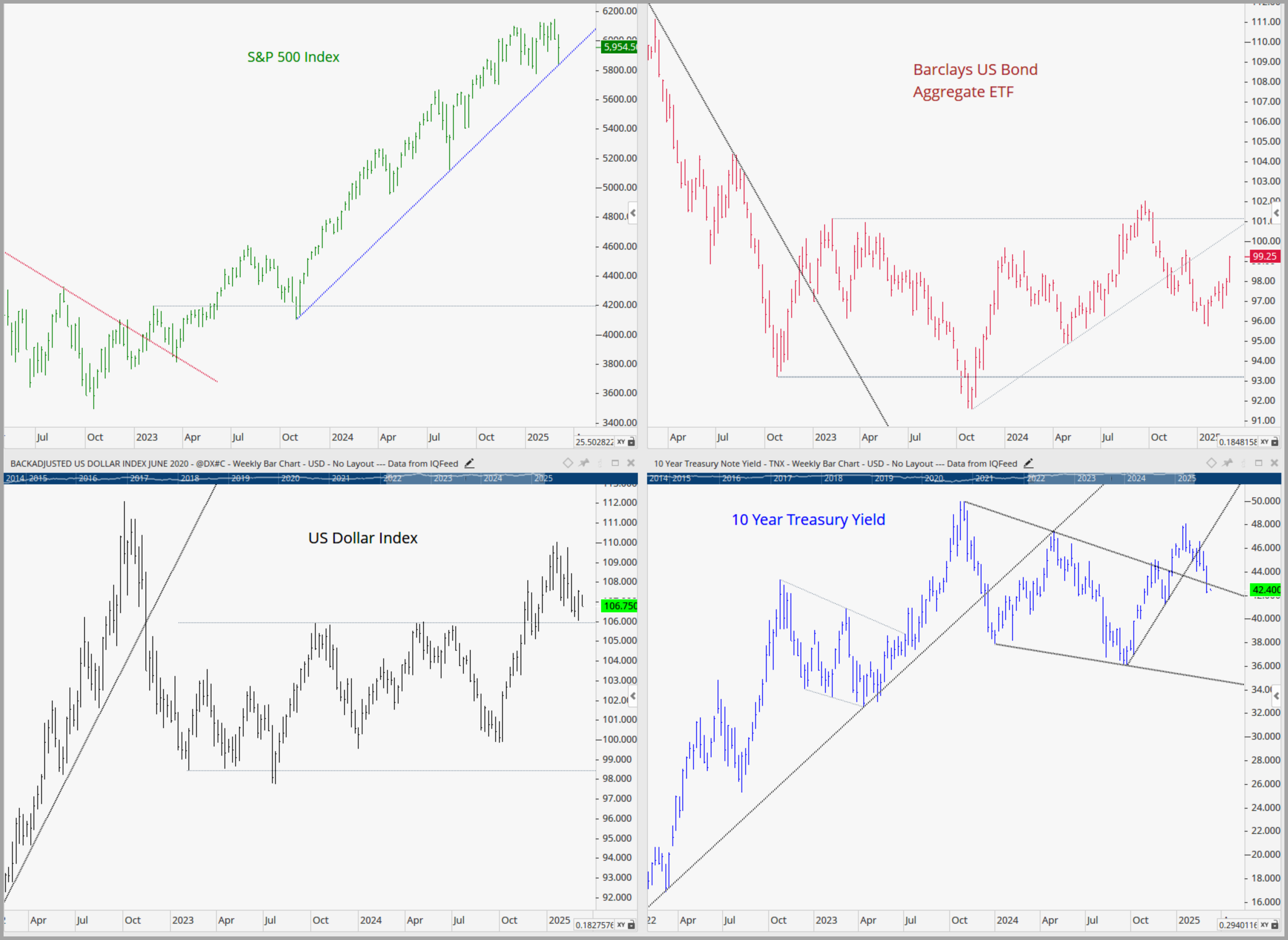

Bond yields and currency markets moved in opposite directions, with growth concerns driving Treasury yields lower while the dollar strengthened on tariff news. The 10-year yield dipped below 4.30% for the first time since December, while the Dollar Index climbed nearly 1%, seemingly fueled by Trump’s announced tariffs on Mexico and Canada. Strong EU inflation data also reinforced expectations of a European Central Bank (ECB) rate cut, further supporting the dollar. Economic uncertainty also weighed on commodities, with oil and industrial metals reacting to growth fears, while gold broke its recent upward trend to close the week lower.

Source: Stockcharts.com

Key Takeaway:

The media has latched onto the narrative that stagflation risks (rising inflation coupled with stagnant growth) are increasing, fueling concerns that the new administration’s policies surrounding tariffs and tax cuts could worsen the situation.

People’s views of the administration often shape their expectations for the economy and create a self-reinforcing cycle of concerning sentiment. While some economic indicators, such as jobless claims and retail sales, have softened, they remain far from signaling a stagnating economy. Other metrics, including durable goods orders and manufacturing & Services PMIs (Purchasing Managers’ Index), continue to show expansion. Similarly, inflation concerns are not yet confirmed by the data, with the latest Core PCE Price Index (Personal Consumption Expenditures) declining to 2.6%.

I mention this here as I regularly talk with advisors, and many are noting a divide recently. It seems that clients leaning right politically see the glass half full. while those leaning to the left, see it half empty. It’s important to take a step back from politics and look at the data since that is what truly drives the markets past the short term and thus far, the data is still supporting an overall positive economic backdrop.

Source: Optuma with DTN IQ data

The Week Ahead:

This week brings a slate of economic reports, culminating on Friday with the closely watched Employment Situation Report. With ongoing discussions about government worker layoffs, it remains unclear how the February jobs data will reflect these cuts.

Markets will also be closely monitoring the ISM reports out today and tomorrow for a look at manufacturing and services on the heals of a weak GDP estimate last week.

Beyond economic data, uncertainty looms over the fate of the budget resolution. The Senate’s version excludes the administration’s proposed tax cut extension, while the House version includes it. With a March 14 deadline to pass a resolution and avoid a government shutdown, this remains a critical issue for markets in the coming weeks along with more tariff rhetoric.

Source: www.tradingeconomics.com

Current Observations (Updates denoted by ***)

Economic Growth: The economy appears to be growing at a moderate pace, not too hot. GDP expanded 2.7% year-on-year in the third quarter of 2024, slowing slightly from a 3% rise in the previous period and has averaged 3.16 percent from 1948 until 2024. (source: U.S. Bureau of Economic Analysis)

***Inflation: Inflation has been cooling over the past year but appears to be a little “sticky” in recent months. The annual inflation rate in the US edged up to 3% in January 2025, compared to 2.9% in December 2024, and above market forecasts of 2.9%, indicating stalled progress in curbing inflation. This marks the fourth increase in inflation in recent months, however Core Personal Consumption Expenditures (PCE) index, the Federal Reserve’s preferred inflation measure, recently eased to 2.6% from 2.8% a month earlier.

Source: U.S. Bureau of Labor Statistics

Employment: The jobs market remains robust despite the recent rise in unemployment from historically low levels. The US economy added 143K jobs in January 2025, well below an upwardly revised 307K gain in December and forecasts of 170K.

The US unemployment rate dipped by 0.1 percentage point to 4.0% in January 2025, marking its lowest level since May and coming in just below market expectations of 4.1%. (source: U.S. Bureau of Labor Statistics)

Monetary Policy: According to minutes from the January 2025 FOMC meeting, a majority of Fed policymakers acknowledged that the high level of uncertainty warranted a cautious approach when considering further adjustments to monetary policy, minutes from the January 2025 FOMC meeting showed. Many participants suggested that the Committee could maintain the policy rate at a restrictive level if the economy remained robust and inflation stayed elevated. Conversely, several noted that policy could be eased if labor market conditions weakened, economic activity slowed, or inflation returned to 2% more quickly than expected. Many policymakers stressed the need for additional evidence of sustained disinflation. Participants also highlighted upside risks to inflation, citing potential shifts in trade and immigration policies, geopolitical disruptions to supply chains, and stronger-than-anticipated household spending. The Fed kept the fed funds rate steady at the 4.25%-4.5% range in January, pausing its rate-cutting cycle after three consecutive reductions in 2024.

(source: Federal Reserve)

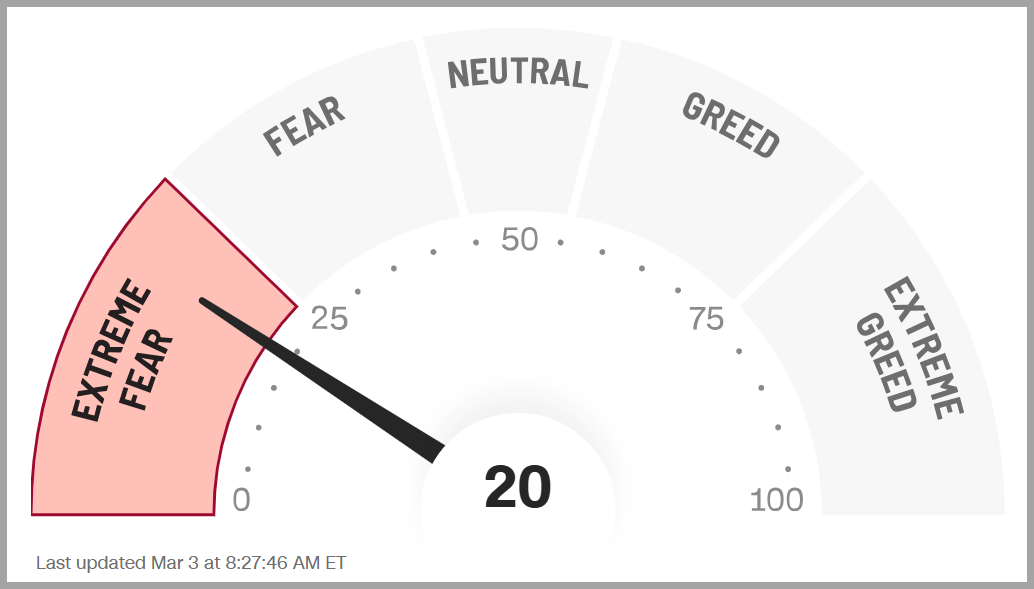

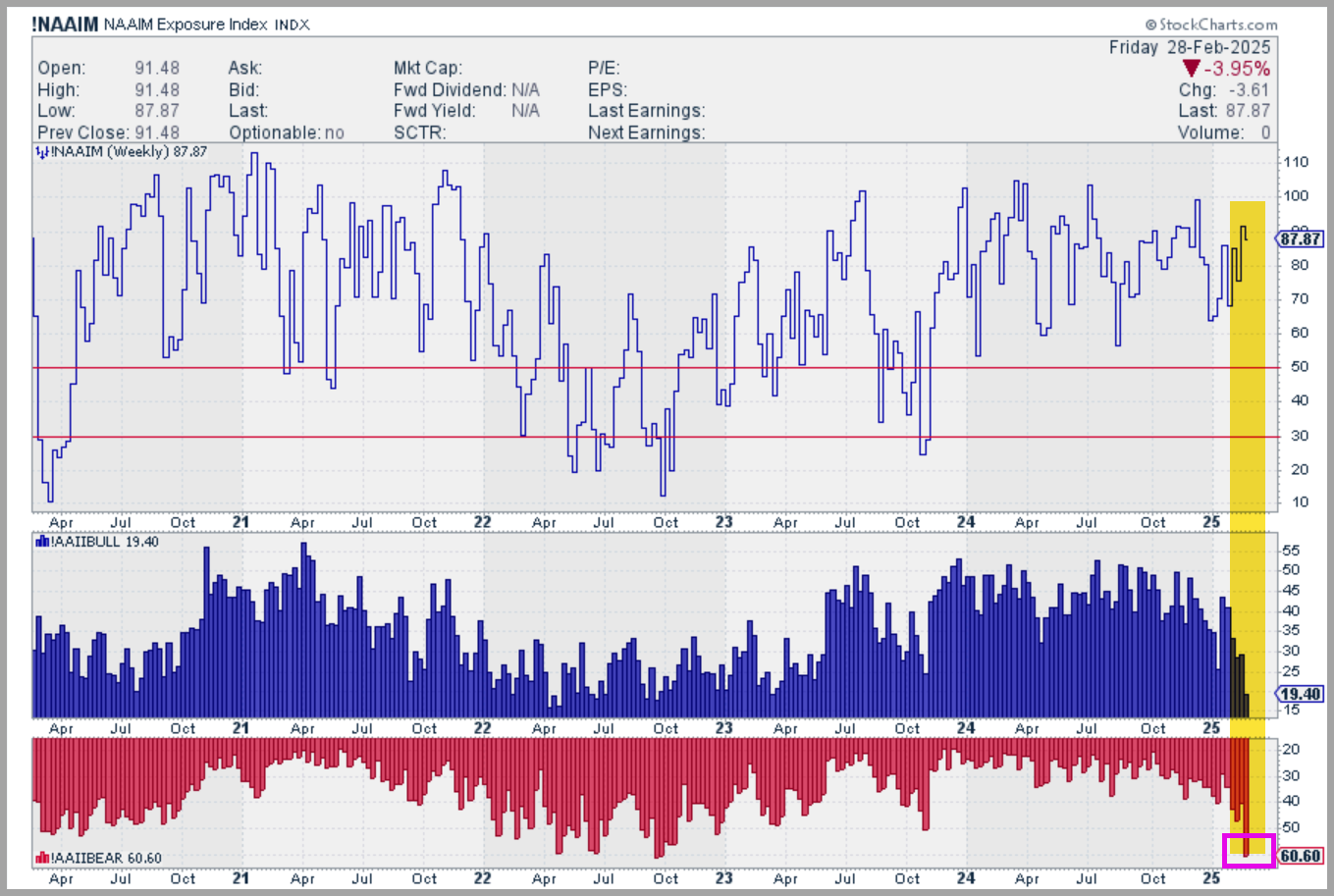

***Sentiment: Retail Investor optimism has been waning over the past few weeks. According to AAII, retail investors have recently flipped back to extremely bearish while active money managers appear to have put money back to work in stocks as the NAAIM Exposure index has increased rapidly. The CNN Fear & Greed index, which measures seven different aspects of market behavior to gauge the “mood” of the stock market, shows that overall, investors are currently extremely fearful.

Source: https://www.cnn.com/markets/fear-and-greed

Source: https://www.stockcharts.com

***Volatility & Speculative Demand: The VIX (CBOE Volatility Index), which is known to be Wall Street’s fear gauge, ticked up from its recent “complacency” levels. High-yield (or “junk”) bond credit spreads have once again risen, however, still remain near cycle lows.

Stocks

The major Indices (Dow Jones Industrial Average, S&P 500, and NASDAQ) are at or near all-time highs, signifying a positive trend. Outside of the US, Developed and Emerging Markets Indices, which peaked in late September, have spent the last month retreating with their currency-hedged counterparts seemingly holding up much better.

Bonds & Interest Rates

Bonds have had a relatively rough time since the Fed cut rates in September. A wave of overwhelmingly positive economic data and governmental policy concerns have rekindled inflation fears, causing investors to recalibrate their upcoming rate cut expectations. Recent data has taken some of the luster away and longer-term yields, which recently peaked at their highest levels in nearly two years, have eased to multi-month lows.

Commodities & Currencies

The relatively weak Chinese economy (2nd largest in the world) and strong US dollar continue to weigh on certain “growth driven” commodities, such as oil and industrial metals, while the recent stronger inflation readings and falling yields have provided a tailwind for Gold, which is trading at all-time highs.

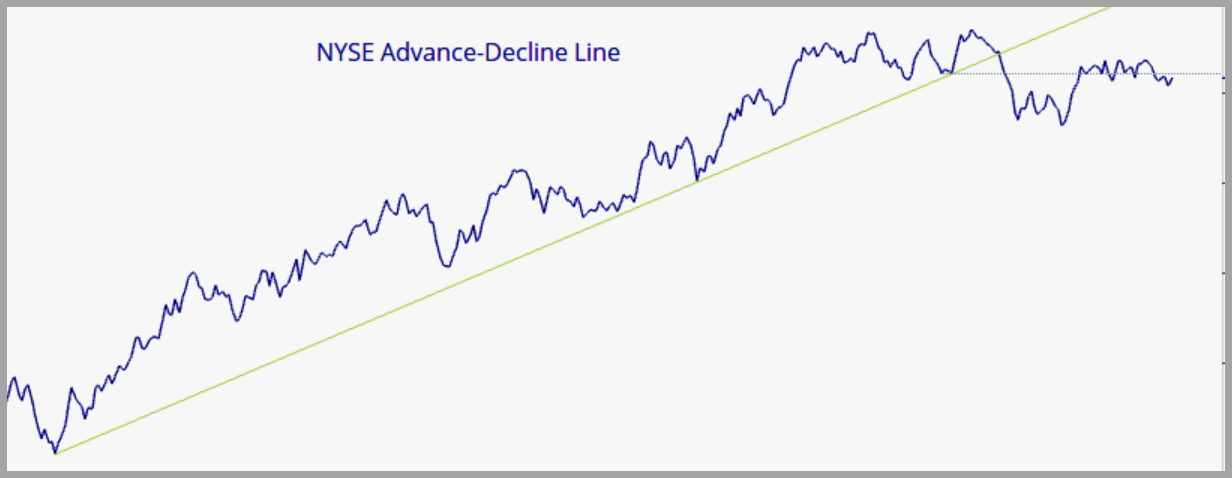

Breadth & Technicals

One of the major themes since the markets sold off in August has been expanding breadth. A lack of widespread support for the rally has recently appeared, however, with the past several weeks showing a “mixed” picture.

Source: Optuma with DTN IQ data

Tying it all together:

Investor sentiment has been buoyed by cooling inflation, interest rate cuts, solid economic growth, a strong labor market, and impressive corporate profits. The markets have responded positively with the Federal Reserve’s efforts to steer the economy toward a “soft landing” appearing successful so far. However, recent economic data and market dynamics have raised some cautionary signals, which will require careful monitoring moving forward. This is nothing unusual, just a natural part of a strong business cycle and an extended market run. Having seen these conditions many times over the past decades, I’ve learned that it’s best not to make bold predictions but to stay flexible, adjust strategies as needed, and remain vigilant. As always, we will continue to monitor the markets and economic trends closely, providing you with valuable insights and updates to support well-informed decision-making.

Please feel free to share these commentaries with friends and family and, should you have any questions regarding your current strategy or the markets in general, please reach out to your CIAS Investment Adviser Representative.

Important Disclosures:

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The statements contained herein are solely based upon the opinions of Edward J. Sabo and the data available at the time of publication of this report, and there is no assurance that any predicted or implied results will actually occur. Information was obtained from third-party sources, which are believed to be reliable, but are not guaranteed as to their accuracy or completeness.

The actual characteristics with respect to any particular client account will vary based on a number of factors including but not limited to: (i) the size of the account; (ii) investment restrictions applicable to the account, if any; and (iii) market exigencies at the time of investment. Capital Investment Advisory Services, LLC (CIAS) reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. The information provided in this report should not be considered a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

CIAS is a registered investment advisor. More information about the advisor, including its investment strategies and objectives, can be obtained by visiting www.capital-invest.com. A copy of CIAS’s disclosure statement (Part 2 of Form ADV) is available, without charge, upon request. Our Form ADV contains information regarding our Firm’s business practices and the backgrounds of our key personnel. Please contact us at (919) 831-2370 if you would like to receive this information.

Capital Investment Advisory Services, LLC

100 E. Six Forks Road, Ste. 200; Raleigh, North Carolina 27609

Securities offered through Capital Investment Group, Inc. & Capital Investment Brokerage, Inc.

100 East Six Forks Road; Raleigh, North Carolina 27609

Members FINRA and SIPC