The equity markets started strong last week following the attempted assassination of former President Trump and a favorable Retail Sales report. Major large-cap stock indices hit new highs, but the momentum shifted on Wednesday when mixed results from a couple of semiconductor companies seemingly caused a decline in some of the larger tech stocks, which significantly influence the S&P 500 and NASDAQ indices. As a result, the capitalization-weighted S&P 500 closed down nearly 2%. However, the equal-weighted S&P 500 only fell by 0.2%, and many value-oriented and cyclical stocks posted gains for the week, driving the Dow Jones Industrial Average up nearly three quarters of a percent.

The Dollar Index and Treasury yields were relatively calm last week with the 10-year yield closing up a few basis points at 4.23%. This along with a mixed-up geopolitical picture allowed gold to reach new highs while oil and industrial metals continued their drift lower due to the uncertain global demand.

Key Takeaway:

The market rotation trade continues to gain momentum. Small-cap stocks, which were down by for the year just two weeks ago, are now up around 10% year-to-date. Mid-caps have risen similarly from showing just modest gains two weeks ago and the Dow is now up nearly 7% year-to-date.

Although the S&P 500 and Nasdaq are still leading, the performance gap has narrowed significantly in a very short period of time. I’ve been writing for a long time about the very narrow leadership with major indices being driven by just a few large tech firms and I view this “rotation” into the rest of the market as possibly, a healthy sign of things to come.

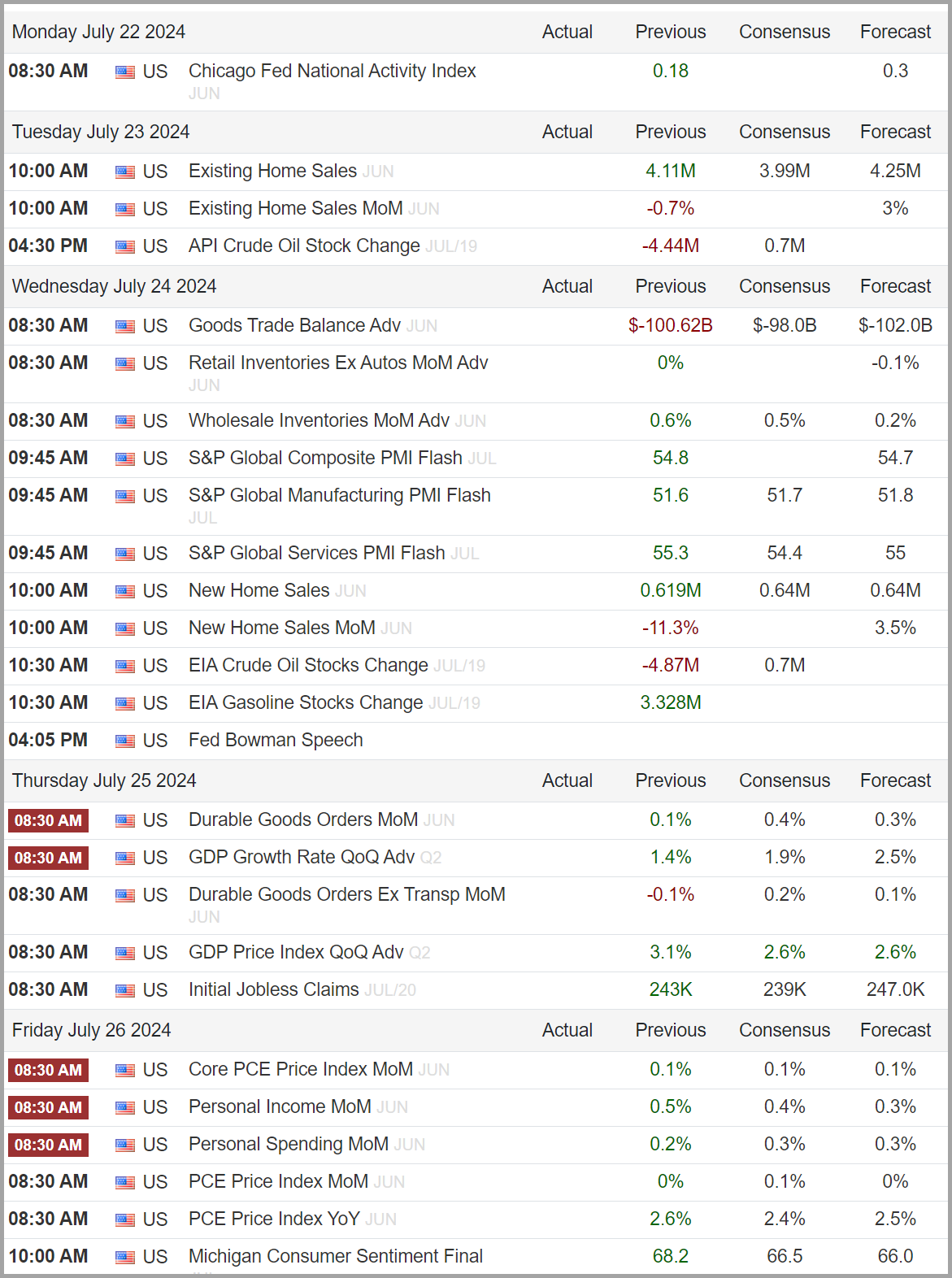

The Week Ahead:

A busy week of data starts Thursday with Durable Goods and Preliminary GDP estimates. These important growth metrics will be accompanied by Thursday’s jobless claims, which have been attracting more attention lately. On Friday we will get Personal Income and Spending reports along with the Fed’s preferred inflation gauge, the Core PCE Index. And if all that wasn’t enough, the University of Michigan will release its Consumer Sentiment report on Friday, which provides a dynamic look at how the actual consumer views their own financial situation and prospects for the future economy.

Source: Trading Economics (https://tradingeconomics.com/united-states/calendar#)

Tidbits & Technicals: (New developments will be denoted via***)

Current Headwinds:

- Valuations seem frothy given the current rate environment, leaving the markets subject to a potential swift pullback!

- “Higher for Longer” – Risk that the Federal Reserve waits too long to begin lowering rates and threatens economic growth.

- ***Very narrow market participation, apparently driven primarily by mega cap tech and AI-related companies, has dominated the indices; however, over the last couple of weeks we have witnessed a significant broadening effect with “the rest of the market” showing stronger returns.

Current Tailwinds:

- Optimism surrounding Artificial Intelligence (AI)

- The Federal Reserve potentially cutting rates in the future.

- Strong Labor Market

- Solid Economic Growth

- Continued Earnings Growth (the pace of which may be slowing)

- Momentum

- ***10-year Treasury yields continue to hover near their lowest levels since March of this year.

Sentiment:

- Credit Spreads remain tight, hitting their lowest levels recently since peaking in 2022 signaling the bond market (aka “Smart Money”) is not worried about a recession in the near future.

- ***The VIX (CBOE Volatility Index) exploded higher last week on mixed semiconductor earnings reports and political unrest

- ***The CNN FEAR & Greed Index returned to Neutral last week

Intermarket Trends:

- The major Indices (Dow Jones Industrial Average, S&P 500, and NASDAQ) recently posted new highs signifying a positive trend.

- Interest rates have been volatile lately but appear to be retreating at the present time.

- The US Dollar is trading near the upper end of this year’s trading range due to foreign central banks being the first to cut rates.

- ***Gold broke out of its trading range to record highs.

- ***Industrial Metals, which raced higher recently, have retraced all recent gains and are back in the middle of the large consolidation zone of the past year

- ***Oil futures are in the middle of their one-year trading band and appear to be stuck in a trading range

Tying it all together:

Four main factors have seemingly been supporting the markets — strong growth, falling inflation, expectations of Fed rate cuts, and AI enthusiasm. These drivers remain intact; however, some key economic data points are flashing warning signals at the present time. While the economy is not weak, some of the data suggests a weakening trend and this is a concern given the equity markets are not acknowledging the possibility of any sort of economic contraction. Interestingly, commodities seem to be reacting to the data. Current valuations have certain equities priced for perfection, so it would be fair to say that any type of growth scare could result in rather extreme volatility in the short run.

The past couple of weeks’ rotation into sectors of the market that have underperformed is a welcomed sight. Markets need broad-based participation to be “healthy”, so we will definitely want to keep an eye on this potential new trend, as it could lead to much higher prices in the future and provide insights into expectations of future economic expansion.

In the long term, economic growth is the primary driver and, while growth remains robust, we must remain vigilant for signs of a slowdown, as this could end the current bull market we are all currently enjoying. For now, the positives meaningfully outweigh the negatives and as long as these conditions persist, the environment remains favorable for risk assets.

Historically, the best approach in such environments is to ensure that one’s overall portfolio aligns with their risk tolerance and long-term goals.

Please feel free to share these commentaries with friends and family and, should you have any questions regarding your current strategy or the markets in general, please reach out to your CIAS Investment Adviser Representative.

Important Disclosures:

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The statements contained herein are solely based upon the opinions of Edward J. Sabo and the data available at the time of publication of this report, and there is no assurance that any predicted or implied results will actually occur. Information was obtained from third-party sources, which are believed to be reliable, but are not guaranteed as to their accuracy or completeness.

The actual characteristics with respect to any particular client account will vary based on a number of factors including but not limited to: (i) the size of the account; (ii) investment restrictions applicable to the account, if any; and (iii) market exigencies at the time of investment. Capital Investment Advisory Services, LLC (CIAS) reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. The information provided in this report should not be considered a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

CIAS is a registered investment advisor. More information about the advisor, including its investment strategies and objectives, can be obtained by visiting www.capital-invest.com. A copy of CIAS’s disclosure statement (Part 2 of Form ADV) is available, without charge, upon request. Our Form ADV contains information regarding our Firm’s business practices and the backgrounds of our key personnel. Please contact us at (919) 831-2370 if you would like to receive this information.

Capital Investment Advisory Services, LLC

100 E. Six Forks Road, Ste. 200; Raleigh, North Carolina 27609

Securities offered through Capital Investment Group, Inc. & Capital Investment Brokerage, Inc.