Weekly Market Insights

From the recent correction lows, on August 5, 2024, to last week’s close, the Dow has gained over 5.50%, the S&P 500 is up 8.50%, and the Nasdaq has surged 12.24%. Small and Mid-Cap stock indices have also risen more than 7% during this period.

Weaker-than-expected employment data a few weeks ago initially rekindled recession fears while the Bank of Japan sparked an unwinding of the yen carry trade, just as investors were rotating out of big tech and the markets tumbled as a result. Those concerns have seemingly been dismissed as the markets have staged an impressive rebound based on last week’s Goldilocks inflation data, combined with a very strong Retail Sales report, while earnings continued to surprise to the upside.

Treasuries were rather quiet as the data really offered nothing new with regards to forward rate cut expectations. The 10-year Treasury yield closed 2 basis points lower on the week, near 3.9%. The dollar fell less than 1% and surprisingly, given the positive economic data, commodities were close to flat for the week as Oil was essentially unchanged. Industrial metals posted gains for the second week in a row and Gold surged to all-time highs once again.

Source: www.stockcharts.com

Key Takeaway:

Stocks rallied sharply last week, seemingly driven by improved economic data and short-term momentum/short covering. This bounce retraced much of the recent decline which was fueled by concerns over slowing economic growth, the Bank of Japan’s interest rate policy, and AI-related sector unwinding. While these factors have temporarily eased, it’s important to note that underlying economic challenges persist.

The Week Ahead:

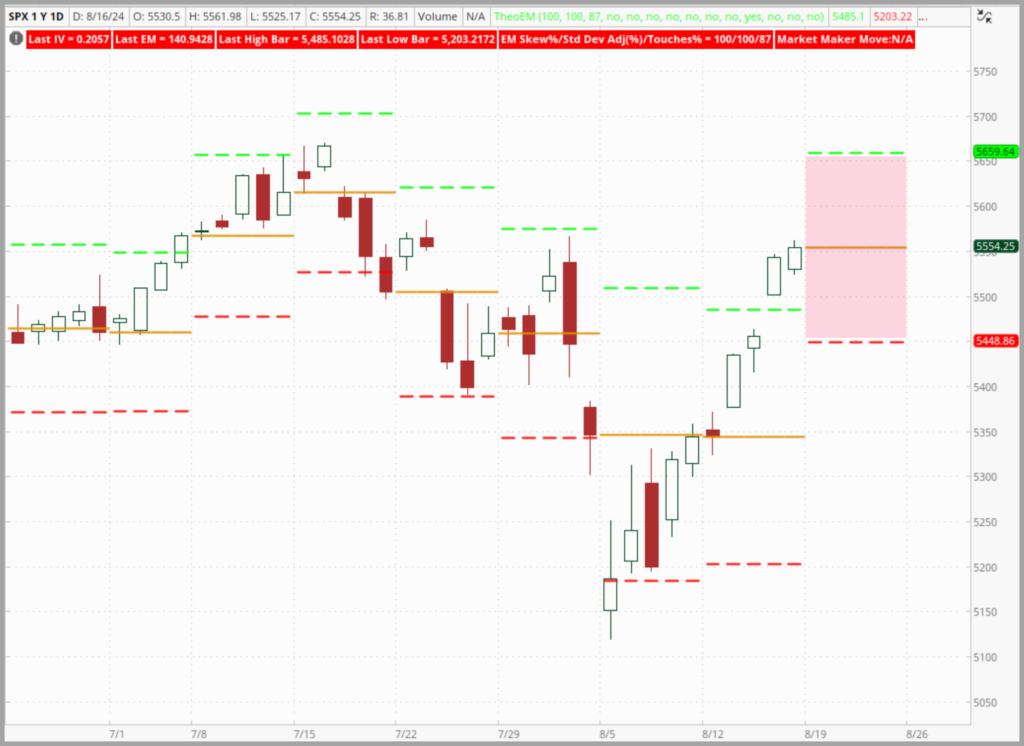

According to statistics derived from the options market, this week’s “Expected Move” (EM) for the S&P 500 is +/- 105 points, 36 points less than last week’s EM, but still large at nearly 2%. The chart below highlights the potential range for each week, based on Friday’s implied volatility values, using the green and red dashed lines. The yellow line is simply Friday’s closing value for reference. This week’s expected range is highlighted in magenta. Last week the S&P 500 exceeded the expected move by nearly 65 points — this was the first time since last November that such a move occurred and highlights just how extreme volatility is presently.

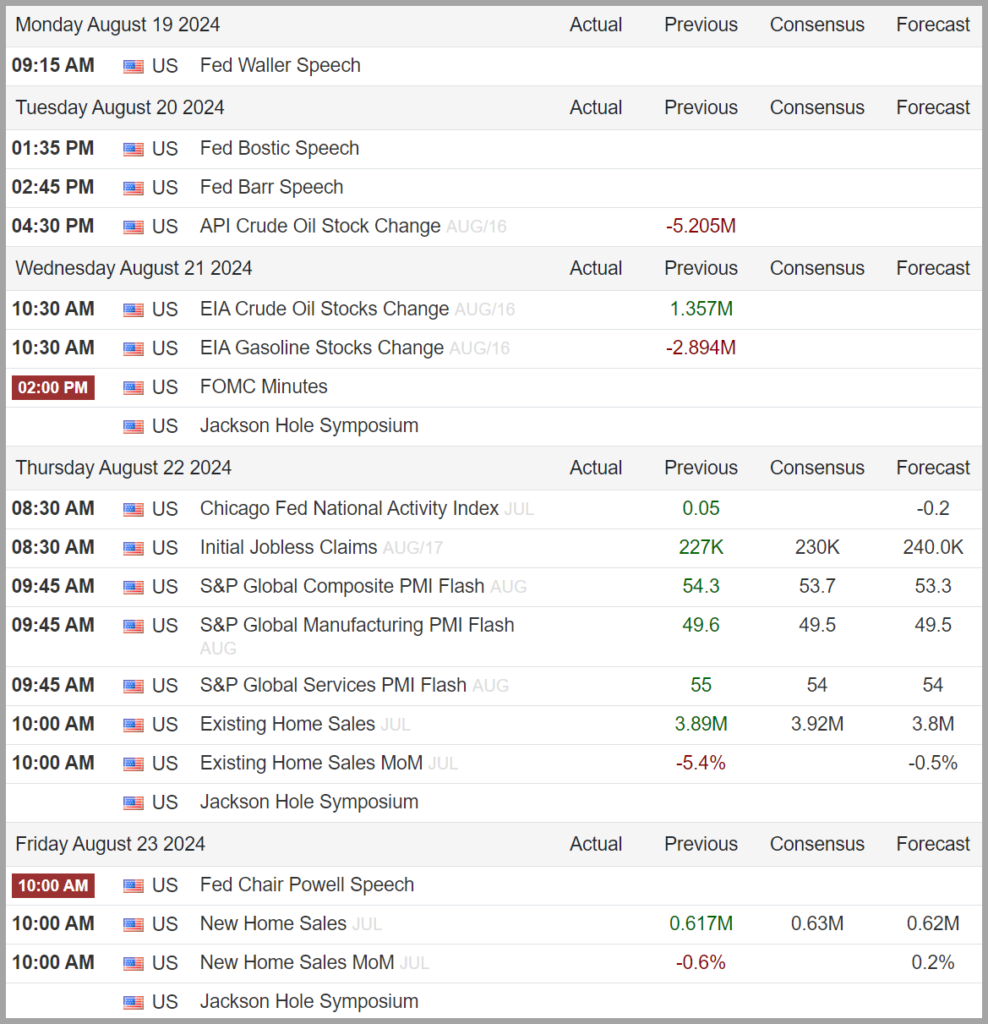

This week, two key events could significantly impact the markets: the August Flash PMIs on Thursday and Fed Chair Powell’s Jackson Hole speech on Friday. For the rally to persist, investors are looking for stable economic data and clear indications from Powell of a rate cut in September. The August PMIs will need to show stability to prevent growing concerns about a weakening U.S. economy and Powell needs to further signal a September rate cut and keep a relatively dovish tone, or markets may not respond favorably.

Source: Trading Economics (https://tradingeconomics.com/united-states/calendar#)

Tidbits & Technicals: (New developments will be denoted via***)

Current Headwinds:

- Valuations seem frothy given the current rate environment, leaving the markets subject to a potential swift pullback!

- “Higher for Longer” – Risk that the Federal Reserve waits too long to begin lowering rates and threatens economic growth.

- ***Very narrow market participation, apparently driven primarily by mega cap tech and AI-related companies, has dominated the indices; however, over the last couple of weeks we have witnessed a significant broadening effect with “the rest of the market” participating in returns.

Current Tailwinds:

- Optimism surrounding Artificial Intelligence (AI)

- The Federal Reserve potentially cutting rates in the future.

- Strong Labor Market

- Solid Economic Growth

- Continued Earnings Growth (the pace of which may be slowing)

- Momentum

- 10-year Treasury yields continue to hover near their lowest levels since March of this year.

Sentiment:

- ***Credit Spreads have widened significantly in recent weeks as bond investors are requiring higher risk premium for holding the debt of less creditworthy companies.

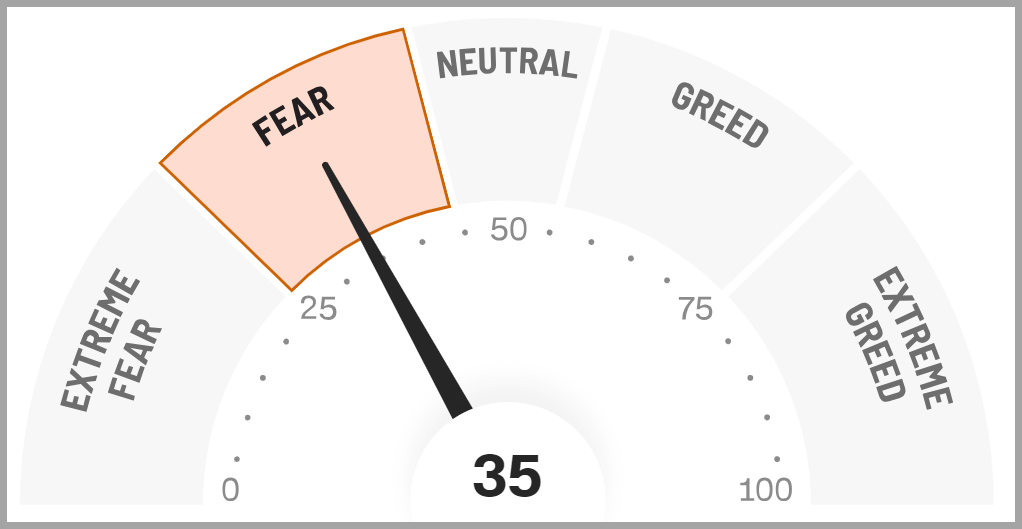

- The VIX (CBOE Volatility Index) has lept higher suggesting fear among investors at the present time

- The CNN FEAR & Greed Index has moved to Extreme Fear

Source: https://www.cnn.com/markets/fear-and-greed

Intermarket Trends:

- The major Indices (Dow Jones Industrial Average, S&P 500, and NASDAQ) recently posted new highs signifying a positive long-term trend, however, in the short-term they are trending downward.

- Interest rates have been volatile lately and appear to be trending lower.

- The US Dollar has broken its upward trend line over the past several weeks and is beginning to trend downward

- ***Gold recently broke out of its trading range to record highs

- ***Industrial Metals, which have been trending lower lately, have stabilized

- Oil futures are in the middle of their one-year trading band and appear to be stuck in a trading range

Tying it all together:

Despite the recent rally, we maintain a cautious outlook on the market as some of the recent factors which caused the pullback don’t just disappear overnight. The Bank of Japan’s divergent monetary policy and the ongoing slowdown in the U.S. economy pose some significant risks to markets going forward. Also of note, at the present time, it appears investors may be potentially factoring in a more aggressive interest rate easing cycle than the Fed might deliver while several historically relevant “warning signals” have been fired off recently. These realities, coupled with late-stage business cycle dynamics, have historically created a more challenging environment for stocks in the intermediate-term.

In the long term, economic growth is the primary driver and, while growth remains robust, we now seen signs of moderation. This does not mean everything is falling apart, in fact, this was the Federal Reserve Board’s intention. They have held interest rates high for a long time to combat inflation and the expected result of such policies is economic moderation and a cooling of the labor market. The Fed is shooting for a soft landing, a scenario whereby inflation returns towards their 2% target without destroying economic growth, and so far, that scenario appears most likely.

I’m keeping this paragraph below from my prior reports, as it really sums up expectations and what is currently taking place:

“Four main factors have seemingly been supporting the markets — strong growth, falling inflation, expectations of Fed rate cuts, and AI enthusiasm. These drivers remain intact; however, some key economic data points, like rising unemployment, are flashing warning signals at the present time. While the economy is not weak, some of the data suggests a weakening trend and this is a concern given the equity markets are not acknowledging the possibility of any sort of economic contraction. Current valuations have certain equities priced for perfection, so it would be fair to say that any type of growth scare could result in rather extreme volatility in the short run.”

I will reiterate that the best approach in these environments is to ensure that one’s overall portfolio aligns with their risk tolerance and long-term goals and add to this the importance of keeping emotions at bay. Markets tend to overreact to both positive and negative data and keeping a calm perspective has always proven prudent.

Tactically, we recommend maintaining long-term investment exposure to equities focusing on lower volatility sectors and value factors at the present time. We also encourage a fair amount of duration and high quality, investment grade bonds in an effort to mitigate portfolio risk.

Please feel free to share these commentaries with friends and family and, should you have any questions regarding your current strategy or the markets in general, please reach out to your CIAS Investment Adviser Representative.

Important Disclosures:

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The statements contained herein are solely based upon the opinions of Edward J. Sabo and the data available at the time of publication of this report, and there is no assurance that any predicted or implied results will actually occur. Information was obtained from third-party sources, which are believed to be reliable, but are not guaranteed as to their accuracy or completeness.

The actual characteristics with respect to any particular client account will vary based on a number of factors including but not limited to: (i) the size of the account; (ii) investment restrictions applicable to the account, if any; and (iii) market exigencies at the time of investment. Capital Investment Advisory Services, LLC (CIAS) reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. The information provided in this report should not be considered a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

CIAS is a registered investment advisor. More information about the advisor, including its investment strategies and objectives, can be obtained by visiting www.capital-invest.com. A copy of CIAS’s disclosure statement (Part 2 of Form ADV) is available, without charge, upon request. Our Form ADV contains information regarding our Firm’s business practices and the backgrounds of our key personnel. Please contact us at (919) 831-2370 if you would like to receive this information.

Capital Investment Advisory Services, LLC

100 E. Six Forks Road, Ste. 200; Raleigh, North Carolina 27609

Securities offered through Capital Investment Group, Inc. & Capital Investment Brokerage, Inc.

100 East Six Forks Road; Raleigh, North Carolina 27609

Members FINRA and SIPC