Market Recap: Markets Hit Record Highs Before Retreating

Major stock indices reached new record highs during the week, with the S&P 500, Dow, and Nasdaq all touching unprecedented levels before retreating in the final trading sessions. This surge was apparently fueled by strong earnings reports in the artificial intelligence sector following Nvidia’s quarterly results and hopes that the Federal Reserve may soon cut interest rates. However, late in the week, momentum faded as disappointing tech earnings and renewed caution about economic data weighed on investor sentiment, while sector rotation was evident, with money flows shifting away from mega-cap technology toward more cyclical and value names.

The past week featured several notable economic releases, including reports on Durable Goods, GDP, and Core PCE. The Durable Goods release on Tuesday indicated that orders for non-defense capital goods, excluding aircraft — a widely regarded proxy for business investment — rose by 1.1% month-over-month, substantially exceeding expectations. On Wednesday, the second-quarter GDP report showed that the U.S. economy continued to expand at a moderate pace, with real GDP growth underpinned by resilient consumer spending and a marked increase in imports. Thursday’s labor market data revealed jobless claims that were lower than anticipated, while Friday’s Core PCE Price Index (the Federal Reserve’s preferred measure of underlying inflation) registered a 2.9% year-over-year increase, its fastest annual pace since February.

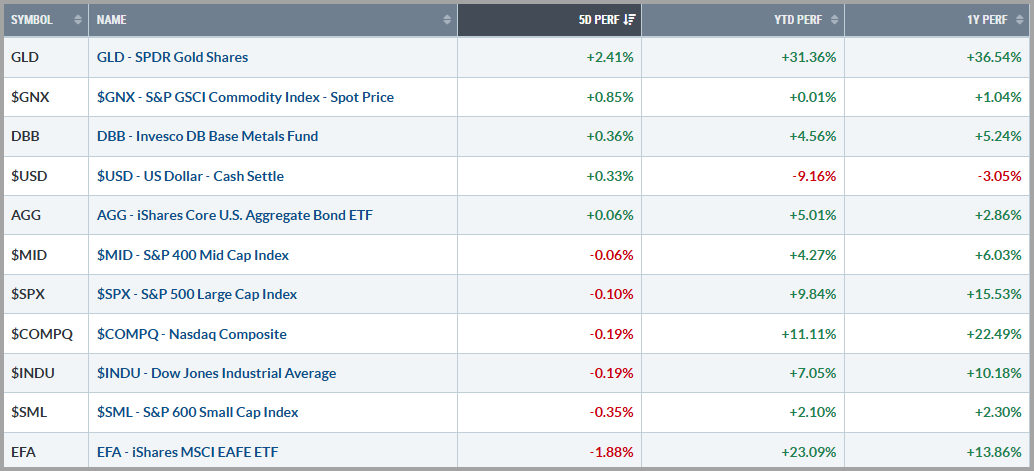

Bond yields dropped, with the 10-year Treasury yield nearing cycle lows around the 4.2% mark. The US Dollar softened over the week, supporting commodity prices on the global stage. Gold made headlines with a new record high above $3,500/oz, as investors presumably sought safe havens amidst uncertainty and speculation around rate cuts. Oil traded just below $64 per barrel by week’s end, pressured by supply concerns and mixed demand signals, while industrial metals showed a mixed response, with copper rebounding on tariff shifts but struggling due to weak Chinese demand.

Collectively, last week’s economic data reinforced concerns over the future path of Federal Reserve policy, as moderate growth, a resilient labor market, and persistently elevated inflation continue to pose challenges for policymakers. At the same time, renewed worries about stretched valuations in the technology sector and unsustainable fiscal dynamics in major economies added to investor unease.

Source: stockcharts.com

The Week Ahead: The Labor Market in Focus

This week, the most anticipated economic report is the August jobs report (Nonfarm Payrolls and Unemployment Rate), due Friday. This report will provide a crucial read on labor market health, especially important as the Federal Reserve members debate whether to begin cutting interest rates at the mid-September Federal Open Market Committee (FOMC) meeting. Job growth has moderated in recent months, so investors will be watching for any surprise weakness or signs that hiring remains resilient, as this could directly sway the Fed’s decision to move rates.

Other key releases on the calendar include the ISM Manufacturing Index (Tuesday), ISM Services Index (Thursday), job openings data (JOLTS), and weekly jobless claims. The ISM numbers are closely watched for early signals of economic momentum or slowdown in both the factory and services sides of the economy. All told, this week’s economic reports have the potential to spark significant market moves, as a strong or weak jobs print, combined with forward-looking signals from ISM surveys, will likely clarify just how aggressively the Fed may act on rates at their September meeting and beyond.

Broad Overview: Optimistically Attentive

So far this summer, markets have shown remarkable resilience, reaching record highs as steady consumer spending, solid corporate earnings, and growing expectations for potential Fed rate cuts supported sentiment. Large-cap stocks, particularly in technology and AI, led the way, while international markets benefited from easing inflation and a softer U.S. dollar. It’s an encouraging backdrop, but looking closer, the picture is a little more nuanced.

Inflation appears “sticky” while tariff costs may have just shown up in the recent producer prices report. Hiring is slowing down and unemployment is on the rise with modest GDP growth this year. These factors are likely the reason consumer confidence has leveled off. This mix of slower growth and persistent inflation is why the Fed remains cautious, waiting for more data before committing to rate changes. Meanwhile, trade tensions and geopolitical uncertainty continue to exacerbate the whole issue.

Despite the challenges, the stock market continues to carve out new highs and the rally appears to be spilling over to sectors other than technology that have been left behind. A broadening rally is a powerful force that historically tends to move further than most believe possible.

As investors, it’s important to be aligned with the market’s trend while gathering clues from economic data and corporate signals to adapt should conditions shift. We will continue to gather data and report our findings in these missives, but should you have any questions regarding your current strategy or the markets in general, please reach out to your CIAS Investment Adviser Representative.

Important Disclosures:

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The statements contained herein are solely based upon the opinions of Edward J. Sabo and the data available at the time of publication of this report, and there is no assurance that any predicted or implied results will actually occur. Information was obtained from third-party sources, which are believed to be reliable, but are not guaranteed as to their accuracy or completeness.

The actual characteristics with respect to any particular client account will vary based on a number of factors including but not limited to: (i) the size of the account; (ii) investment restrictions applicable to the account, if any; and (iii) market exigencies at the time of investment. Capital Investment Advisory Services, LLC (CIAS) reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. The information provided in this report should not be considered a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

CIAS is a registered investment advisor. More information about the advisor, including its investment strategies and objectives, can be obtained by visiting www.capital-invest.com. A copy of CIAS’s disclosure statement (Part 2 of Form ADV) is available, without charge, upon request. Our Form ADV contains information regarding our Firm’s business practices and the backgrounds of our key personnel. Please contact us at (919) 831-2370 if you would like to receive this information.

Capital Investment Advisory Services, LLC

100 E. Six Forks Road, Ste. 200; Raleigh, North Carolina 27609

Securities offered through Capital Investment Group, Inc. & Capital Investment Brokerage, Inc.