Weekly Market Insights

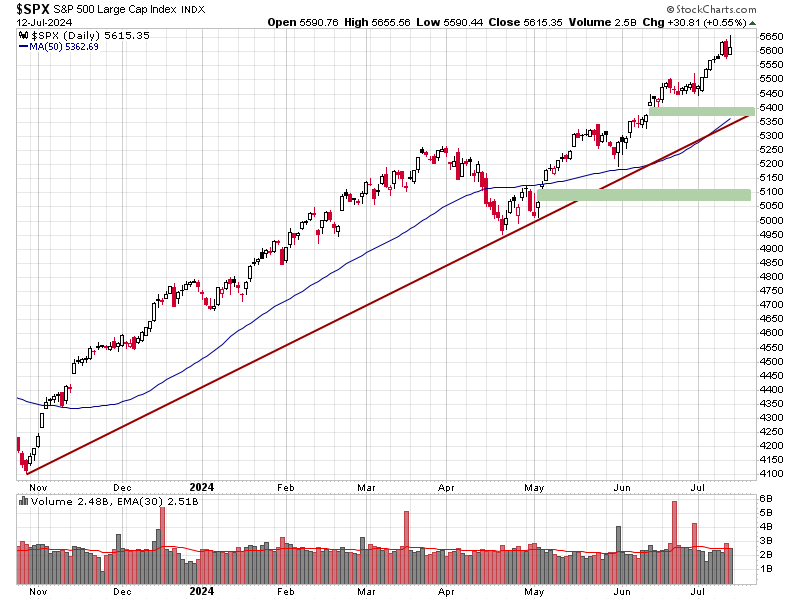

The S&P 500 reached another record high as the Consumer Price Index (CPI) rose less than expected, indicating slowing inflation, while Jobless Claims came in smaller than anticipated. Stocks shrugged off Friday’s slightly hot Producer Price Index (PPI) report as investor expectations for a September rate cut and potentially one more in 2024 grew. A notable rotation away from mega-cap tech stocks towards the “rest of the market” took place with cyclical stocks and interest rate sensitive issues outperforming.

The Dollar Index declined following the better-than-expected CPI report, as markets priced in two rate cuts in 2024. Treasury yields dropped moderately as the smaller-than-expected increase in CPI pressured yields, and the 10-year yield plunged to the lowest levels since March of this year.

Despite a weaker dollar, commodities in general experienced a modest decline due to concerns about global growth. Oil prices were seemingly weighed down by these worries, while gold saw a modest rally thanks to the lower dollar rallying back towards the 2024 record highs.

Key Takeaway:

The horrific attempted assassination of former President Trump over the weekend has sent equity futures higher. Markets tend to favor Republican candidates as they are seen as pro-business. The events of the weekend are largely being viewed as increasing the odds of a Trump win and a republican sweep in the November elections, but I will caution you that political events are typically very short-lived market factors.

What really drives the markets longer term are economic trends and last week’s demonstration of cooling inflation, coupled with a strong labor market, were no doubt a positive. Investors and analyst also tend to begin focusing on next year’s corporate earnings mid-summer and those estimates are looking strong. Most important to me was the rotation into other areas of the market, namely the cyclical stocks and smaller companies as rotations such as these indicate overall positive sentiment and are the building blocks of broad-based rallies.

The Week Ahead:

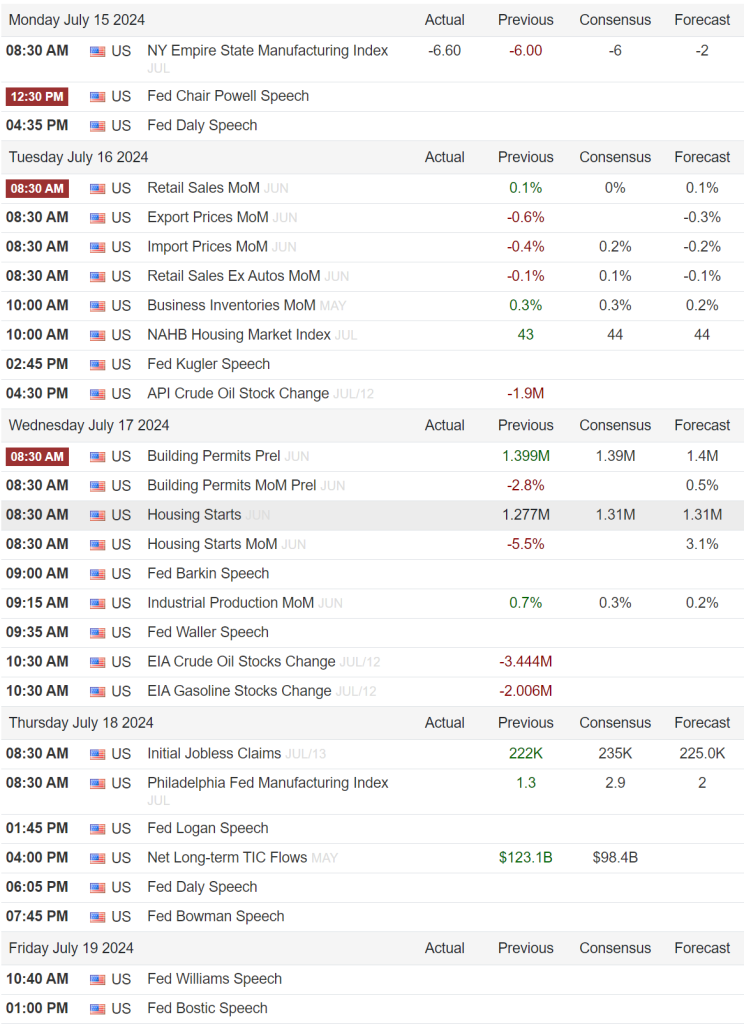

This week’s key report will be Tuesday’s Retail Sales as we want to see a strong consumer on the heels of “growth” reports from the past few weeks that have showed a potential loss of momentum occurring in the economy. We will also get a look at recent growth metrics via the Empire Manufacturing Index and the Philly Fed Survey on Monday and Wednesday. These reports give the first glimpse at this month’s activity, however, they can be volatile so are not deemed as important as other key data points

Source: Trading Economics (https://tradingeconomics.com/united-states/calendar#)

Tidbits & Technicals: (New developments will be denoted via***)

Current Headwinds:

- Valuations seem frothy given the current rate environment, leaving the markets subject to a potential swift pullback!

- “Higher for Longer” – Risk that the Federal Reserve waits too long to begin lowering rates and threatens economic growth.

- ***10-year Treasury yields declined last week to their lowest levels since March of this year.

- ***Very narrow market participation, apparently driven primarily by mega cap tech and AI-related companies, has dominated the indices; however, last week we witnessed a broadening effect with “the rest of the market” showing stronger returns.

Current Tailwinds:

- Optimism surrounding Artificial Intelligence (AI)

- The Federal Reserve potentially cutting rates in the future.

- Strong Labor Market

- Solid Economic Growth

- Continued Earnings Growth (the pace of which may be slowing)

- Momentum

Sentiment:

- Credit Spreads remain tight, hitting their lowest levels recently since peaking in 2022 signaling the bond market (aka “Smart Money”) is not worried about a recession in the near future.

- The VIX (CBOE Volatility Index) remains near the lower levels of the complacency zone.

- ***The CNN FEAR & Greed Index ticked up into the Greed category as investor sentiment grew on the positive inflation data and strong employment numbers last week.

Intermarket Trends:

- The major Indices (Dow Jones Industrial Average, S&P 500, and NASDAQ) recently posted new highs signifying a positive trend.

- Interest rates have been volatile lately but appear to be retreating at the present time.

- The US Dollar is trading near the upper end of this year’s trading range due to foreign central banks being the first to cut rates.

- Gold has been consolidating near record highs.

- Industrial Metals, which raced higher recently, have consolidated gains and are largely trading sideways

- Oil futures are in the middle of their one-year trading band, but have “perked up” lately and are gaining momentum

Tying it all together:

Four main factors have seemingly been supporting the markets — strong growth, falling inflation, expectations of Fed rate cuts, and AI enthusiasm. These drivers remain intact; however, some key economic data points are flashing warning signals at the present time. While the economy is not weak, some of the data suggests a weakening trend and this is a concern given the markets are not acknowledging the possibility of any sort of economic contraction. Current valuations have certain equities priced for perfection, so it would be fair to say that any type of growth scare could result in rather extreme volatility in the short run.

The past weeks rotation into sectors of the market that have underperformed is a welcomed sight. Markets need broad-based participation to be “healthy”, so we will definitely want to keep an eye on this potential new trend, as it could lead to much higher prices in the future and provide insights into expectations of future economic expansion.

In the long term, economic growth is the primary driver and, while growth remains robust, we must remain vigilant for signs of a slowdown, as this could end the current bull market we are all currently enjoying. For now, the positives meaningfully outweigh the negatives and as long as these conditions persist, the environment remains favorable for risk assets.

Historically, the best approach in such environments is to ensure that one’s overall portfolio aligns with their risk tolerance and long-term goals.

Please feel free to share these commentaries with friends and family and, should you have any questions regarding your current strategy or the markets in general, please reach out to your CIAS Investment Adviser Representative.

Important Disclosures:

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The statements contained herein are solely based upon the opinions of Edward J. Sabo and the data available at the time of publication of this report, and there is no assurance that any predicted or implied results will actually occur. Information was obtained from third-party sources, which are believed to be reliable, but are not guaranteed as to their accuracy or completeness.

The actual characteristics with respect to any particular client account will vary based on a number of factors including but not limited to: (i) the size of the account; (ii) investment restrictions applicable to the account, if any; and (iii) market exigencies at the time of investment. Capital Investment Advisory Services, LLC (CIAS) reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. The information provided in this report should not be considered a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

CIAS is a registered investment advisor. More information about the advisor, including its investment strategies and objectives, can be obtained by visiting www.capital-invest.com. A copy of CIAS’s disclosure statement (Part 2 of Form ADV) is available, without charge, upon request. Our Form ADV contains information regarding our Firm’s business practices and the backgrounds of our key personnel. Please contact us at (919) 831-2370 if you would like to receive this information.

Capital Investment Advisory Services, LLC

100 E. Six Forks Road, Ste. 200; Raleigh, North Carolina 27609

Securities offered through Capital Investment Group, Inc. & Capital Investment Brokerage, Inc.

100 East Six Forks Road; Raleigh, North Carolina 27609

Members FINRA and SIPC