This week’s inflation data could prove to be pivotal in shaping the market’s short-term trajectory and deserves careful monitoring.

Tim Whetro

Weekly Market Insights

I’ve been writing the past few weeks about the fact that when valuations get a little ahead of themselves and everyone gets complacent, conditions are potentially ripe for volatility to rear its ugly head. That’s exactly what we got last week as the equity markets digested geopolitical tensions in the Middle East and a bout of tough Federal Reserve rhetoric. In fact, the economic data we received was decidedly positive for growth, however, that can be a double-edged sword when trying to combat inflation…

Key Takeaway:

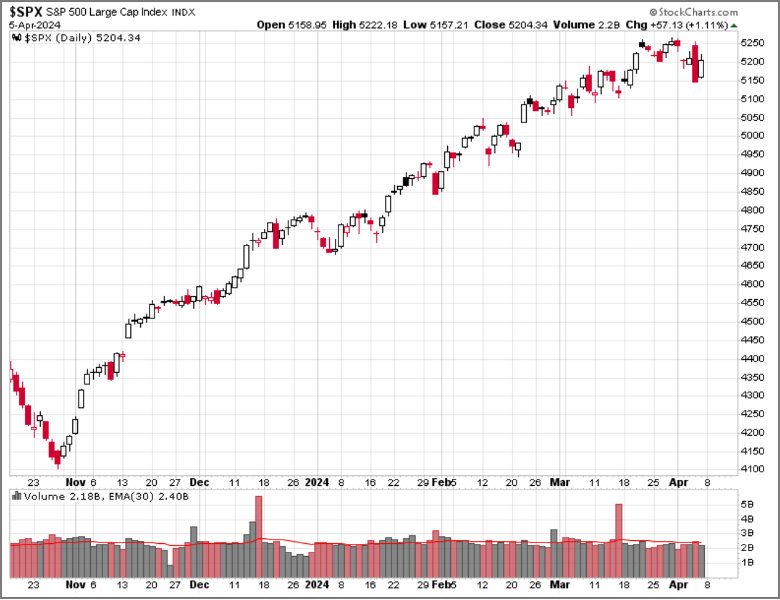

The chart above demonstrates the consistent advance in the S&P 500 since late October. Last Thursday’s decline stands out on the chart, however, a look at the volume indicator in the bottom pane tells us there was not a lot of involvement. Market internals are still trending upward and the economic backdrop is still positive so, for now, we may view this most recent bout of volatility as the markets simply blowing off some steam.

The Week Ahead:

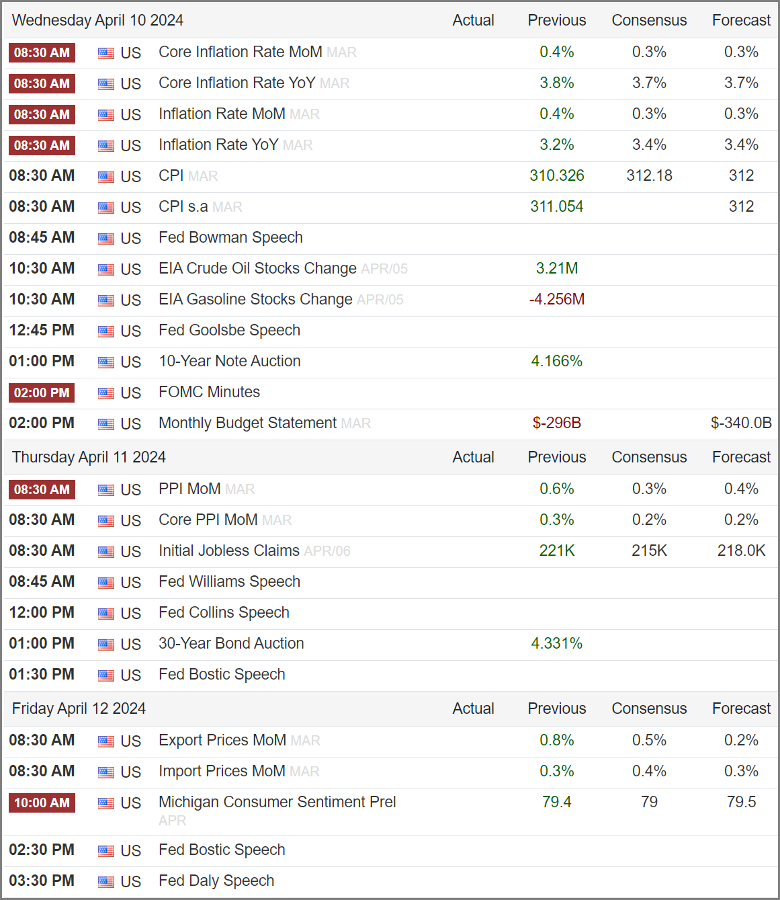

All eyes will be on Wednesday’s Consumer Price Index (CPI) and Thursday’s Producer Price Index (PPI) which give us a glimpse into everyone’s favorite topic, inflation. We will also get the FOMC minutes, a look at consumer confidence and, of course, Thursday’s jobless claims. Most importantly, we want to see a continuing trend of lower inflation – any surprises here could send markets into a tizzy when considering the already heightened alert status from last week.

Source: Trading Economics (https://tradingeconomics.com/united-states/calendar#)

Tidbits & Technicals: (New developments will be denoted via***)

Current Headwinds:

- Valuations are frothy given the current rate environment, leaving the markets subject to a potential swift pullback.

- “Higher for Longer”- Risk that the Federal Reserve waits too long to begin lowering rates and threatens economic growth.

- *** 10-year Treasury Yields broke out to new highs for the year signaling that bond investors may be beginning to believe in the “Higher for Longer” thesis.

Current Tailwinds:

- Optimism surrounding Artificial Intelligence (AI)

- Federal Reserve pivoting from raising rates to potentially cutting in the future.

- Strong Labor Market

- Solid Economic Growth

- Continued Earnings Growth (the pace of which may be slowing)

- Momentum

- Participation is Broadening with value, cyclicals, and smaller sized companies beginning to show a strong upward bias

Sentiment:

- Credit Spreads remain tight, signaling the bond market (aka “Smart Money”) is not worried about a recession in the near future.

- ***The VIX (CBOE Volatility Index) exploded higher last week, breaking through these years “complacency zone”.

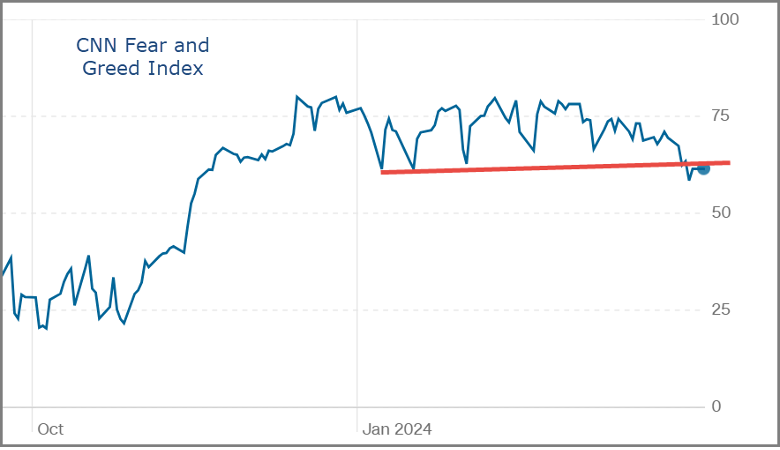

- ***The CNN FEAR & Greed Index remains above neutral in the “Greed” category showing investors current appetite for risk is strong, however, the index has broken below these years “complacency zone” as can be seen below.

Intermarket Trends:

- The major Indices (Dow Joines Industrial Average, S&P 500, and NASDAQ) all posted new highs in the past few weeks signifying a positive trend.

- ***Bond investors have been pricing in the idea of higher for longer recently with 10-year treasury yields above this year’s trading range to make new highs.

- The US Dollar is trading near the upper end of this year’s trading range due to foreign central banks being the first to cut rates and others taking further rate hikes off the table while the Fed continues its campaign of tough rhetoric.

- Gold continues to set record highs.

- Industrial Metals caught a bid recently and copper recently broke out of a multi-month trading range.

- Oil is trading near the top of its 2024 range but well below last year’s highs.

Tying it all together:

The recent uptick in market volatility, marking the first significant fluctuation since the rally began in October ’23, isn’t unexpected given the high equity valuations and recent investor complacency. Concerns about the prospect of prolonged higher interest rates are emerging among bond investors, evident in the surge of longer-term interest rates to new yearly highs. If these concerns spill over into the equity markets, we could see some turbulence ahead. While robust economic indicators are generally positive, they do present a challenge to the Federal Reserve’s efforts to combat inflation and warrant our attention.

This week’s inflation data could prove to be pivotal in shaping the market’s short-term trajectory and deserves careful monitoring. I’ve been advocating for profit trimming and reallocation to levels where investors feel comfortable for the past few weeks, and I still believe this is the prudent course of action. Please know these adjustments are essential risk management strategies for navigating potentially volatile markets in the near future and do not imply any imminent disaster. In fact, I believe any near-term market weakness could be seen as an opportunity to increase exposure to areas of the market that may currently be underweight in ones portfolio given the favorable economic conditions and historical trends during election years.

Please feel free to share these commentaries with friends and family and, should you have any questions regarding your current strategy or the markets in general, please reach out to your CIAS Investment Adviser Representative.

Important Disclosures:

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The statements contained herein are solely based upon the opinions of Edward J. Sabo and the data available at the time of publication of this report, and there is no assurance that any predicted or implied results will actually occur. Information was obtained from third-party sources, which are believed to be reliable, but are not guaranteed as to their accuracy or completeness.

The actual characteristics with respect to any particular client account will vary based on a number of factors including but not limited to: (i) the size of the account; (ii) investment restrictions applicable to the account, if any; and (iii) market exigencies at the time of investment. Capital Investment Advisory Services, LLC (CIAS) reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. The information provided in this report should not be considered a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

CIAS is a registered investment advisor. More information about the advisor, including its investment strategies and objectives, can be obtained by visiting www.capital-invest.com. A copy of CIAS’s disclosure statement (Part 2 of Form ADV) is available, without charge, upon request. Our Form ADV contains information regarding our Firm’s business practices and the backgrounds of our key personnel. Please contact us at (919) 831-2370 if you would like to receive this information.

Capital Investment Advisory Services, LLC

100 E. Six Forks Road, Ste. 200; Raleigh, North Carolina 27609

Securities offered through Capital Investment Group, Inc. & Capital Investment Brokerage, Inc.

100 East Six Forks Road; Raleigh, North Carolina 27609

Members FINRA and SIPC