Weekly Market Insights

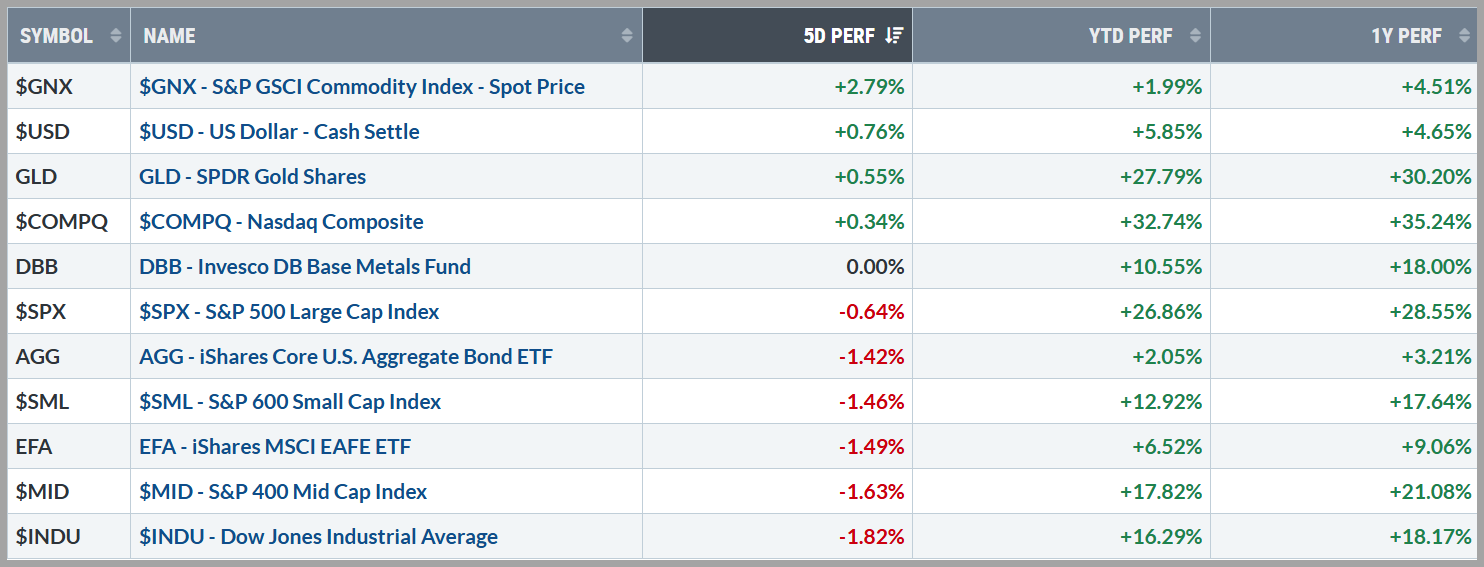

Stocks traded in a mixed manner last week, driven by contrasting sector performance. Positive developments from some major technology companies, particularly around semiconductor chip sales and advancements in quantum computing chip development, supported the tech-heavy NASDAQ, keeping it in positive territory for the week. These gains also helped limit losses in the S&P 500.

On the other hand, cyclical sectors faced pressure due to inflationary data concerns, which weighed heavily on the Dow Jones Industrial Average, pushing it down nearly 2%.

10-year Treasury yields soared nearly .25% by the end of the week, along with the US Dollar and Gold on the the inflation data. Further sanctions on Russian oil gave a lift to the energy markets, while industrial metals remained largely unchanged.

Source: Stockcharts.com

Key Takeaway:

Last week’s inflation data presented a mixed picture. The Consumer Price Index (CPI), which measures retail inflation, came in as anticipated but showed a modest increase compared to the prior month. Meanwhile, the Producer Price Index (PPI), which tracks wholesale inflation, appeared to exceed expectations and posted an even larger rise over the previous month.

Despite these developments, market expectations for the Federal Reserve to cut rates another .25% on Wednesday remain unchanged with the CME FedWatch tool indicating a 96.0% probability of this outcome.

Source: Optuma with DTN IQ data

The Week Ahead:

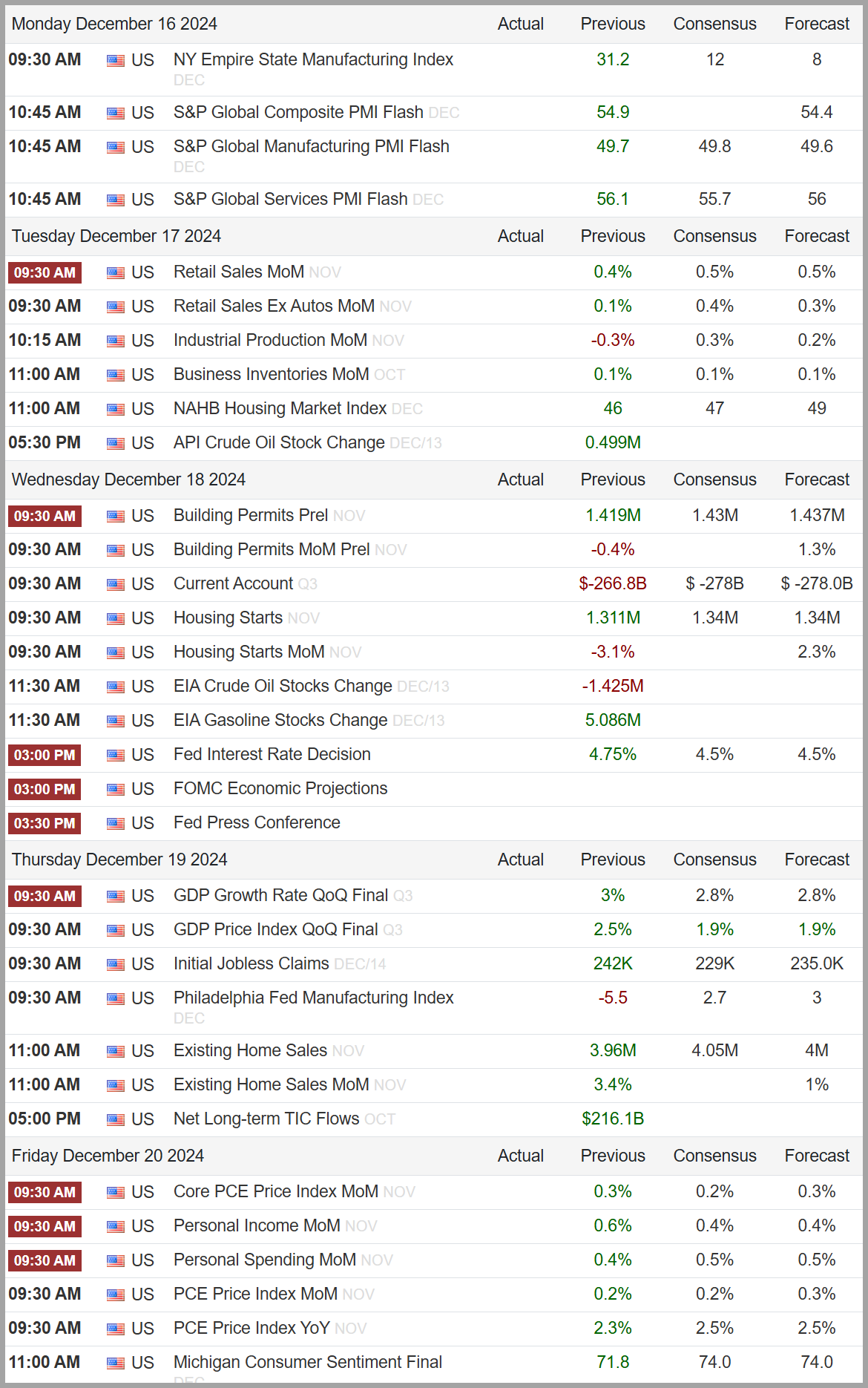

The Federal Reserve’s decision on Wednesday will be this week’s central focus and a 25-basis-point rate cut is almost universally expected. Any deviation from that would be a major surprise. Investors will be more focused on how many future rate cuts the Fed signals through its updated dot plot projections.

Beyond the Fed, two critical data releases round out the week. On Tuesday, Retail Sales data will provide insight into consumer spending. As long as spending remains steady and unemployment stays low, the likelihood of a recession remains nominal. On Friday, the Core PCE Price Index—the Fed’s preferred inflation gauge—will take center stage. Unlike CPI, Core PCE places less emphasis on housing, offering a broader perspective on inflation trends. A stable report here could ease some of last weeks fears that arose from the rather hot wholesale inflation data.

Source: www.tradingeconomics.com

Current Observations (Updates denoted by ***)

Economic Growth: The economy appears to be growing at a moderate pace, not too hot. GDP expanded 2.7% year-on-year in the third quarter of 2024, slowing slightly from a 3% rise in the previous period and has averaged 3.16 percent from 1948 until 2024. (source: U.S. Bureau of Economic Analysis)

***Inflation: Inflation has been cooling over the past year but appears to be a little “sticky” in recent months. The annual inflation rate in the US rose for a 2nd consecutive month to 2.7% in November 2024 from 2.6% in October. Core inflation, which excludes some of the more volatile items such as food and energy, increased to 2.40 percent in November from 2.30 percent in October.

( source: U.S. Bureau of Labor Statistics)

Employment: The jobs market remains robust despite the recent rise in unemployment from historically low levels and the decreasing number of job openings. Put simply, the labor market was on fire just a few months ago and is cooling off to sustainable levels. The unemployment rate in the United States ticked up to 4.2% in November 2024, up from 4.1% in the previous month.

(source: U.S. Bureau of Labor Statistics)

Monetary Policy: The Fed lowered the federal funds target range by 25 basis points to 4.5%-4.75% at its November 2024 meeting, following a jumbo 50 basis point cut in September in an effort to balance inflation confidence with labor market concerns. An effective Fed Funds Rate of 4.625% is still considered “restrictive policy”, yet the Fed has telegraphed this is only the beginning of a rate cut cycle.

(source: Federal Reserve)

***Sentiment: Investor psychology is presently bullish. According to AAII, retail investor Bulls currently outweigh the Bears by a decent margin, while active money managers appear to be nearly fully invested in stocks with the NAAIM Exposure index nearing the 100% level. The CNN Fear & Greed index, which measures seven different aspects of market behavior to gauge the “mood” of the stock market, is in “Neutral” territory.

Volatility & Speculative Demand: The VIX (CBOE Volatility Index), which is known to be Wall Street’s Fear Gauge, remains “Complacent” following election week. This falls in line with what Yield Spreads, the difference (or spread) between yields for junk bonds and safer government bonds, have been signaling all year – as they are at historical lows – a sign that investors may be willing to take on more risk with regards to their fixed income investments and confidence in the overall economy.

Stocks

The major Indices (Dow Jones Industrial Average, S&P 500, and NASDAQ) near all-time highs signifying a positive trend. Outside of the US, Developed and Emerging Markets Indices, which peaked in late September, have spent the last month retreating with their currency-hedged counterparts holding up much better.

Bonds & Interest Rates

Bonds have had a relatively rough time since the Fed cut rates in September. A wave of overwhelmingly positive economic data and governmental policy concerns have rekindled inflation fears, causing investors to recalibrate their upcoming rate cut expectations. (Just a reminder, bond prices and interest rates have an inverse relationship)

Commodities & Currencies

The weak Chinese economy (2nd largest in the world) and strong US dollar continue to weigh on commodities. Oil, the largest component in the commodities space, along with industrial metals (a key global growth gauge), have been under pressure while precious metals are trading near all-time highs.

The US Federal Reserve is currently being viewed as the most “Hawkish” (high rates) central bank in the world. This stance is keeping a bid under the US Dollar as it trades near cycle highs.

Breadth & Technicals

One of the major themes since the markets sold off in August has been expanding breadth. More and more stocks have joined the parade to higher prices and that’s a good thing. Recent economic data supports this breadth expansion to the more cyclical areas of the market while the overall trend towards economic expansion and lower interest rates is supporting the cyclical trade.

Advancing stocks have been outpacing decliners for the past several months while the pace of net new 52-week highs continues to expand. This positive momentum is also shadowed by a healthy reading of stocks with a Point & Figure “buy” rating (an objective measure of bullish price patterns and demand). ***Over the past couple of weeks, our breadth measures have been declining, potentially threatening the longer-term trends.***

Tying it all together:

Stock market momentum is riding relatively high, and the conditions for a festive “Santa Claus Rally” this year seem to be in place. Currently, inflation is cooling, interest rate cuts are fueling optimism, economic growth remains robust, and the job market is steadily resilient. Adding to the holiday cheer, corporate earnings projections are on the rise. It’s as if the Fed’s soft-landing strategy—a gentle slowdown to curb inflation without a recession—could be playing Santa, delivering exactly what the market wished for.

The belief that the economy can avoid a severe downturn seems to be still driving the rally, setting the stage for a potential “Goldilocks” scenario: not too hot, not too cold, but just right for stocks. Investor sentiment is optimistic, but not over-the-top, while gains are broadening across sectors, hinting at more sustainable growth. This all comes during the historically strong November-to-April period, where the “Santa Claus rally” has often brought an extra sprinkle of market magic. Add in the recent un-inversion of the yield curve—the first in over two years—and the market is positively sleigh-ing it. Challenges remain, but for now, the stockings on Wall Street are filled with hope and plenty of green!

Please feel free to share these commentaries with friends and family and, should you have any questions regarding your current strategy or the markets in general, please reach out to your CIAS Investment Adviser Representative.

Important Disclosures:

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The statements contained herein are solely based upon the opinions of Edward J. Sabo and the data available at the time of publication of this report, and there is no assurance that any predicted or implied results will actually occur. Information was obtained from third-party sources, which are believed to be reliable, but are not guaranteed as to their accuracy or completeness.

The actual characteristics with respect to any particular client account will vary based on a number of factors including but not limited to: (i) the size of the account; (ii) investment restrictions applicable to the account, if any; and (iii) market exigencies at the time of investment. Capital Investment Advisory Services, LLC (CIAS) reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. The information provided in this report should not be considered a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

CIAS is a registered investment advisor. More information about the advisor, including its investment strategies and objectives, can be obtained by visiting www.capital-invest.com. A copy of CIAS’s disclosure statement (Part 2 of Form ADV) is available, without charge, upon request. Our Form ADV contains information regarding our Firm’s business practices and the backgrounds of our key personnel. Please contact us at (919) 831-2370 if you would like to receive this information.

Capital Investment Advisory Services, LLC

100 E. Six Forks Road, Ste. 200; Raleigh, North Carolina 27609

Securities offered through Capital Investment Group, Inc. & Capital Investment Brokerage, Inc.

100 East Six Forks Road; Raleigh, North Carolina 27609

Members FINRA and SIPC