Markets Digest Year-End Pullback Gives Way to New Year Reset

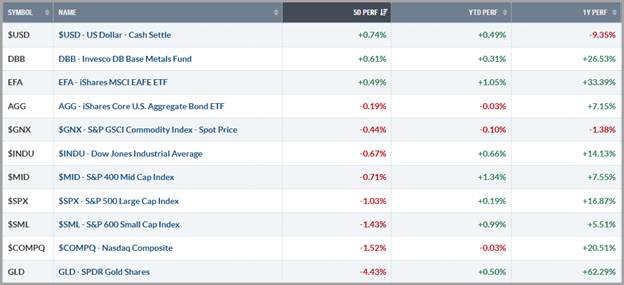

Stocks in the US generally drifted lower through the final trading days of 2025 as thin holiday liquidity and year-end profit-taking weighed on risk appetite before stocks stabilized and rebounded modestly to start the first session of 2026. The S&P 500 finished the week down around -1.00% as investors repositioned portfolios for the new year. While the late-December pullback was persistent, price action appeared orderly and consistent with rotation rather than a shift in the broader trend.

Early-week weakness was driven by stronger-than-expected housing data and a rise in Treasury yields. Ongoing geopolitical developments including tensions involving Venezuela and surprise Chinese military drills near Taiwan added to investor caution but failed to spark any sustained risk-off move. The December Federal Reserve minutes were largely shrugged off despite appearing “tough”, seemingly reinforcing the view that policy uncertainty remains familiar rather than destabilizing.

Selling pressure intensified into Wednesday’s final session of 2025 as a solid jobless claims report further challenged expectations for near-term Fed easing. However, markets opened 2026 on firmer footing Friday, supported by renewed AI enthusiasm, strength in NVIDIA, and a sharp rally in Micron shares. Overall, last week’s action reflected a healthy reset going into the new year rather than a deterioration in underlying market conditions.

Rates, Dollar & Commodities

Treasury yields moved modestly higher last week, with the 10-year yield rising about 5 basis points (0.05%) to finish just under 4.20%. The move was driven more by positioning and solid economic data than inflation concerns, leaving yields squarely within a neutral range for stocks. The U.S. Dollar Index edged higher as year-end book squaring dominated otherwise quiet currency markets.

Commodities experienced notable volatility as precious metals were pressured by surprise increases in CME margin requirements, which triggered forced liquidations across silver and gold futures. Silver saw especially sharp swings before finishing the week lower, while gold also pulled back amid profit-taking after a strong year. Despite the volatility, longer-term uptrends seem to have remained intact, though momentum has clearly cooled.

Energy markets were steadier by comparison as oil posted a modest weekly gain as geopolitical tensions including developments in Venezuela and the Middle East provided a bit of support.

Takeaway

Last week’s market action was emblematic of a year-end transition rather than a change in trend. Profit-taking, portfolio rebalancing, and light holiday volumes exaggerated moves, but the underlying economic backdrop remains relatively stable as the new year begins.

While expectations for aggressive Fed easing have moderated, economic data continues to support a “good enough” growth narrative. AI-driven leadership remains intact, though volatility highlights a market that is increasingly discriminating rather than broadly risk-on.

With yields and the dollar both starting 2026 in neutral territory, financial conditions remain supportive enough to frame recent weakness as consolidation, setting the stage for renewed opportunity as fresh capital is deployed in the weeks ahead.

Source: stockcharts.com

This Week – What Matters for Markets

The new year begins with a busy and important stretch of economic data, highlighted by the return of the full slate of monthly releases. A key report will be Friday’s jobs report, which will play a central role in shaping expectations for Fed policy in early 2026.

Markets may be looking for steady but unspectacular job growth and a stable unemployment rate (data that reinforces economic resilience without reigniting inflation concerns). A materially weaker report could revive rate-cut expectations but also raise growth worries, while an overly strong report could push yields higher and pressure equities.

In addition to jobs data, ISM Manufacturing and Services PMIs will be closely watched. While both remain in generally healthy territory, they sit close enough to key thresholds that any meaningful deterioration could raise caution flags. Overall, this week’s data will help define the economic tone for the opening chapter of 2026.

Broad Overview

Markets enter the new year navigating a familiar but still constructive landscape. Economic growth remains stable, the labor market continues to operate in a “no hire, no fire” equilibrium, and inflation pressures appear contained enough to keep Fed policy flexible going into the year.

At the same time, 2026 brings a subtle shift. Global central banks appear to be transitioning from a rate-cutting phase to a pause, placing greater emphasis on the durability of growth rather than policy support. That makes incoming economic data more important but also reinforces the importance of fundamentals over headlines.

AI remains a powerful long-term driver, though leadership is increasingly focused on companies with visible earnings leverage rather than pure narrative momentum. With yields and the dollar holding in neutral ranges and volatility resetting expectations, the backdrop remains constructive as investors begin the year with a fresh slate.

As we turn the page to 2026, we wish you a Happy New Year and look forward to navigating the markets ahead together. If you have any questions about your portfolio or the outlook, please contact your CIAS Investment Adviser Representative.

Important Disclosures:

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The statements contained herein are solely based upon the opinions of Edward J. Sabo and the data available at the time of publication of this report, and there is no assurance that any predicted or implied results will actually occur. Information was obtained from third-party sources, which are believed to be reliable, but are not guaranteed as to their accuracy or completeness.

The actual characteristics with respect to any particular client account will vary based on a number of factors including but not limited to: (i) the size of the account; (ii) investment restrictions applicable to the account, if any; and (iii) market exigencies at the time of investment. Capital Investment Advisory Services, LLC (CIAS) reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. The information provided in this report should not be considered a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

CIAS is a registered investment advisor. More information about the advisor, including its investment strategies and objectives, can be obtained by visiting www.capital-invest.com. A copy of CIAS’s disclosure statement (Part 2 of Form ADV) is available, without charge, upon request. Our Form ADV contains information regarding our Firm’s business practices and the backgrounds of our key personnel. Please contact us at (919) 831-2370 if you would like to receive this information.

Capital Investment Advisory Services, LLC

100 E. Six Forks Road, Ste. 200; Raleigh, North Carolina 27609

Securities offered through Capital Investment Group, Inc. & Capital Investment Brokerage, Inc.