Another Good Week for Stocks

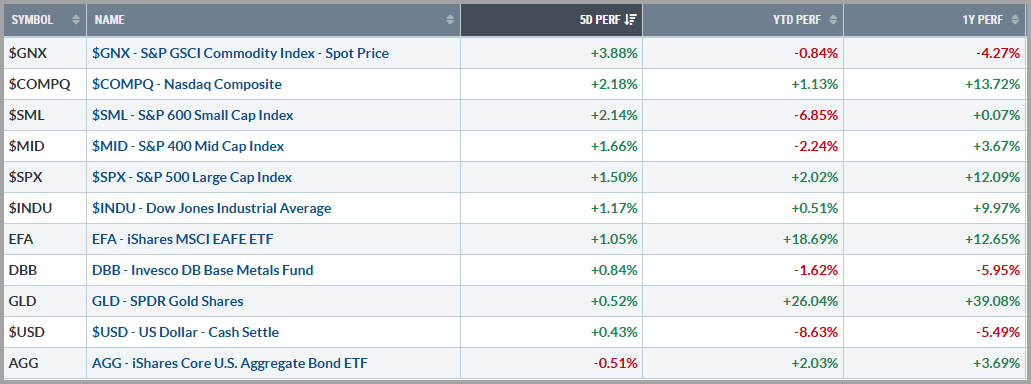

The stock market had another good week, with the S&P 500 rising more than 1.5% and reaching levels we haven’t seen in months. That’s especially encouraging considering the mix of economic data and ongoing concerns around global tensions and trade.

Early in the week, we saw some signs of weakness in the economy. A key report on U.S. manufacturing came in a bit worse than expected, suggesting factories aren’t quite as busy as hoped, while hiring by private companies (as measured by the ADP report) was relatively much weaker than expected, hitting its lowest level in years. And, another report that tracks the much larger services-side of the economy also showed a slowdown. These are potential warning signs that parts of the economy may be cooling off. There was a positive surprise in job openings, which means companies are still looking to hire, but new claims for unemployment benefits climbed to their highest level in several months, while the number of people still collecting benefits remained elevated in the weekly reports. Despite those concerns, Friday’s main monthly jobs report offered some relief as it showed 139,000 new jobs were added in May, more than economists had predicted.

On the global front, markets were encouraged by a positive phone call between Presidents Trump and Xi, with both sides agreeing to keep trade talks going. There’s also hope for new trade deals with other countries and, overseas, the European Central Bank cut interest rates again.

Friday’s strong jobs report sent 10-year Treasury yields up over 4.5%, as a resilient labor market could mean the Federal Reserve keeps rates higher for longer, but there was little movement in the US Dollar last week. Gold moved up once again on trade war and geopolitical uncertainties and oil futures traded to multi-month highs on the heels of Ukraine’s offensive strike.

Source: stockcharts.com

The Week Ahead:

This week is a pivotal one for inflation data, which is especially important with the upcoming Federal Reserve meeting next week. Key economic reports, including the Consumer Price Index (CPI), Producer Price Index (PPI), and the University of Michigan’s inflation expectations will provide important insights into current price trends. The CPI report, set for release Wednesday morning, is expected to show a slight increase in both core and headline inflation. These figures will be closely watched as a gauge of how tariffs may be contributing to inflation in 2025. Similarly, Thursday’s PPI data and Friday’s consumer inflation expectations could also influence market sentiment and policy outlook if they come in higher than anticipated.

Jamie Dimon Issued a Stark Warning

Last week, JPMorgan CEO Jamie Dimon warned about the growing U.S. national debt and looming bond market turmoil, a concern long echoed by economists. His comments drew attention due to his influence on Wall Street.

In my view, we can no longer delay serious fiscal reform. For too long, leaders have kicked the can down the road, prioritizing short-term politics over long-term responsibility. Without action, we face rising interest costs, slower growth, and declining global credibility.

Fixing this won’t be painless. Spending cuts, tax reform, and entitlement restructuring are tough but necessary in my mind, just as households must tighten their belts to escape debt. The payoff is a stronger economy, lower inflation, and a sustainable future.

Yes, reform is politically risky. Voters resist changes to benefits that feel like “free money,” but continuing down this path is unsustainable. Leaders must speak hard truths and make tough choices now to preserve economic freedom and stability.

There’s still time. Responsible action today — reining in spending, reforming entitlements, and balancing the budget, can restore confidence without causing panic. Markets typically reward clarity, not dysfunction.

Short-term pain is real, but long-term gain is greater. A government that lives within its means can lay the foundation for a healthier, more resilient America.

Tying it all together:

Investor sentiment has apparently taken a welcome turn for the better since reaching historically low levels just a few weeks ago, as encouraging progress on tariffs and the U.S.-China trade front suggests we may finally be moving past the threat of a full-blown trade war.

Despite recent market volatility, the underlying economic picture seemingly remains resilient. Key data like job growth, consumer spending, and inflation have remained relatively strong, reinforcing the purported idea that the economy continues to rest on solid ground. These hard numbers reflect real activity and have seemingly helped markets recover from recent turbulence.

While forward-looking indicators like business surveys and consumer sentiment have shown some weakness, they’re often influenced by short-term uncertainty. As the broader outlook improves, we may see confidence rebound. However, with markets approaching recent highs, valuations are likely to come back into focus. Continued strength in earnings and supportive corporate guidance will be key to justifying current prices.

Going forward, staying disciplined, aligning portfolios with one’s risk tolerance, and focusing on fundamentals will be essential for navigating what remains an evolving and cautiously opportunistic environment.

Please feel free to share these commentaries and, should you have any questions regarding your current strategy or the markets in general, please reach out to your CIAS Investment Adviser Representative.

Important Disclosures:

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The statements contained herein are solely based upon the opinions of Edward J. Sabo and the data available at the time of publication of this report, and there is no assurance that any predicted or implied results will actually occur. Information was obtained from third-party sources, which are believed to be reliable, but are not guaranteed as to their accuracy or completeness.

The actual characteristics with respect to any particular client account will vary based on a number of factors including but not limited to: (i) the size of the account; (ii) investment restrictions applicable to the account, if any; and (iii) market exigencies at the time of investment. Capital Investment Advisory Services, LLC (CIAS) reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. The information provided in this report should not be considered a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

CIAS is a registered investment advisor. More information about the advisor, including its investment strategies and objectives, can be obtained by visiting www.capital-invest.com. A copy of CIAS’s disclosure statement (Part 2 of Form ADV) is available, without charge, upon request. Our Form ADV contains information regarding our Firm’s business practices and the backgrounds of our key personnel. Please contact us at (919) 831-2370 if you would like to receive this information.

Capital Investment Advisory Services, LLC

100 E. Six Forks Road, Ste. 200; Raleigh, North Carolina 27609

Securities offered through Capital Investment Group, Inc. & Capital Investment Brokerage, Inc.