Weekly Market Insights

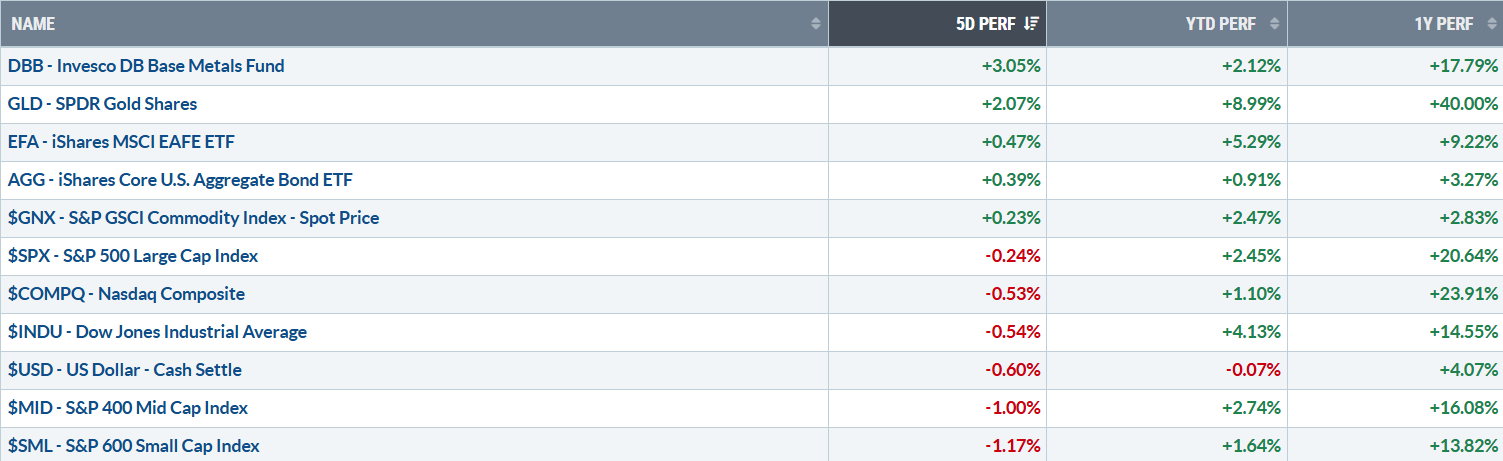

Stocks traded in a mixed fashion last week as investors navigated trade and tariff developments, varied earnings, and generally favorable economic data. The S&P 500 slipped 0.24% over the week but remained 2.45% year-to-date.

The week began with sharp declines due to the implementation of tariffs by the U.S. on Mexico, Canada, and China. However, markets recovered as the U.S. and Mexico reached an agreement to delay tariffs, easing immediate concerns about an escalating trade war. Additional relief came when Canada postponed its tariffs, and China signaled a delay in its retaliatory measures, leading to a rebound in equities midweek.

Earnings results from major tech companies weighed on investor sentiment, but softer inflation data and a global bond rally provided support. The market also responded positively to dovish signals from central banks, including the Bank of England’s downgraded growth outlook for 2025, which helped stocks stabilize after a bout of volatility.

The week closed on a mixed note. A lukewarm jobs report initially buoyed markets on Friday, but rising consumer inflation expectations triggered selling pressure, leaving the S&P 500 down by the end of the session.

Bonds were mostly flat with the 10-year treasury yield losing about .10% for the week while the US Dollar is trading at if lowest level in weeks. Tariffs and trade war talks coupled with fears of inflation and a falling USD provided the perfect backdrop for gold to rally to new highs with industrial metals performing even better. Oil was the clear looser in the commodity space, trading down nearly 4% for the week.

This week, all eyes are on inflation data with the CPI (retail inflation) due on Wednesday and the PPI (wholesale inflation) on Thursday, Recently, the declining trend of inflation has stalled, even ticking up slightly, leading to a pause in rate cuts making every inflation and jobs report crucial. President Trump is also expected to announce reciprocal tariffs on countries imposing tariffs on U.S. goods, likely affecting the EU, Thailand, Taiwan, Vietnam, Japan, Malaysia, and India who are some of our largest trading partners. This could certainly cause some volatility along with the 778 companies that will be reporting earnings this week.

Please feel free to share these commentaries with friends and family and, should you have any questions regarding your current strategy or the markets in general, please reach out to your CIAS Investment Adviser Representative.

Important Disclosures:

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The statements contained herein are solely based upon the opinions of Edward J. Sabo and the data available at the time of publication of this report, and there is no assurance that any predicted or implied results will actually occur. Information was obtained from third-party sources, which are believed to be reliable, but are not guaranteed as to their accuracy or completeness.

The actual characteristics with respect to any particular client account will vary based on a number of factors including but not limited to: (i) the size of the account; (ii) investment restrictions applicable to the account, if any; and (iii) market exigencies at the time of investment. Capital Investment Advisory Services, LLC (CIAS) reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. The information provided in this report should not be considered a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

CIAS is a registered investment advisor. More information about the advisor, including its investment strategies and objectives, can be obtained by visiting www.capital-invest.com. A copy of CIAS’s disclosure statement (Part 2 of Form ADV) is available, without charge, upon request. Our Form ADV contains information regarding our Firm’s business practices and the backgrounds of our key personnel. Please contact us at (919) 831-2370 if you would like to receive this information.

Capital Investment Advisory Services, LLC

100 E. Six Forks Road, Ste. 200; Raleigh, North Carolina 27609

Securities offered through Capital Investment Group, Inc. & Capital Investment Brokerage, Inc.

100 East Six Forks Road; Raleigh, North Carolina 27609

Members FINRA and SIPC