Weekly Market Insights

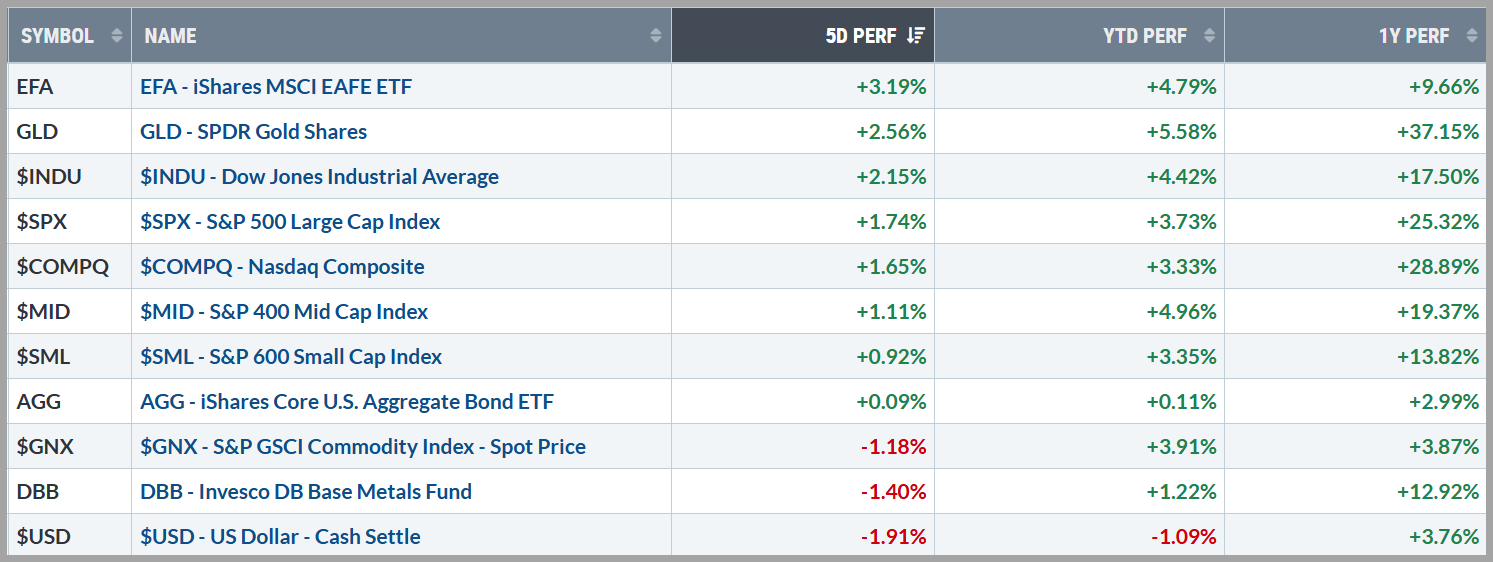

Stocks in the US continued advancing with all three major indices up over 1.5% for the week after a round of strong earnings reports and President Trump’s proposed policy changes which would avoid tariffs on China and some of our EU trading partners. This change in tone was well received by investors as it removed some fears of sparking another wave of inflation due to higher input costs. On the data front, growth in the manufacturing sector resumed after six months of contraction, while the services sector cooled off a tad. Despite elevated mortgage rates, existing home sales in the US rose to a 10-month high.

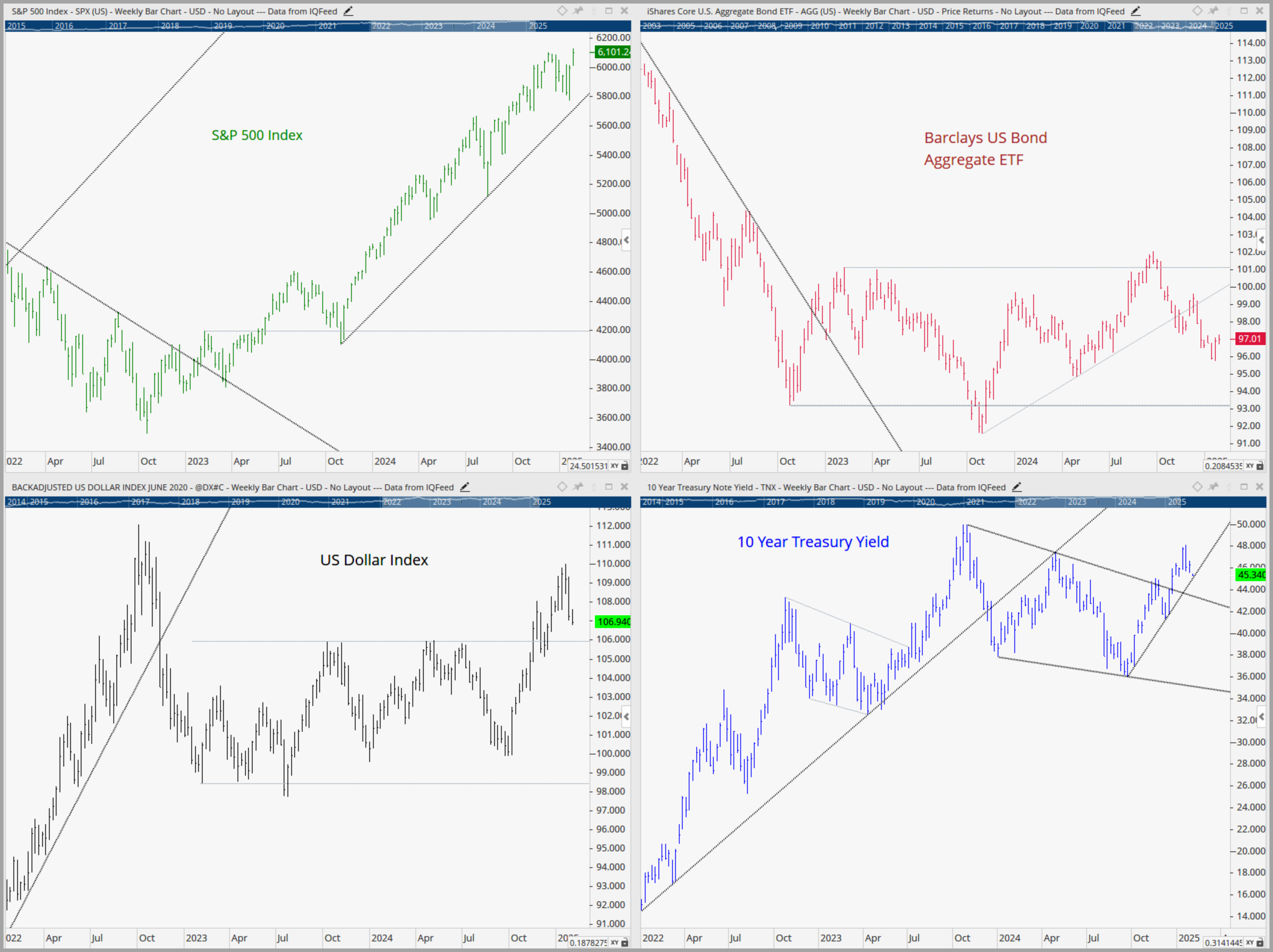

Optimism spread over to the bond market as well with longer term treasury yields holding steady despite year-ahead inflation expectations rising to an eight-month high per the UofM survey released on Friday. 10-year Treasury yields have come down ~.2% since their recent highs, taking a little wind out of the sails that have been pushing the US dollar higher recently. The positive dynamics of steady growth, a weaker dollar, steady inflation, and rates ticking down a bit have no doubt given a boost to Gold prices, which are nearing all-time highs once again, but didn’t seem to spill over to the Oil and Industrial Metals markets which both traded down on the week.

Source: Stockcharts.com

Key Takeaway:

Markets have rebounded in the past two weeks with the major indices testing all-time highs as investors begin to see how the new administration is working with tariffs, longer term yields have backed off a bit, and corporate earnings continue to come in strong. Investors are still grappling with the fact the Fed will likely pause their rate cutting campaign given the strength in the overall economy and AI optimism isn’t quite as strong as it’s been the past two years. The positive backdrop appears to be providing a tailwind for cyclical stocks as market breadth has expanded (read- more companies stock prices are advancing), and investor optimism has returned.

Source: Optuma with DTN IQ data

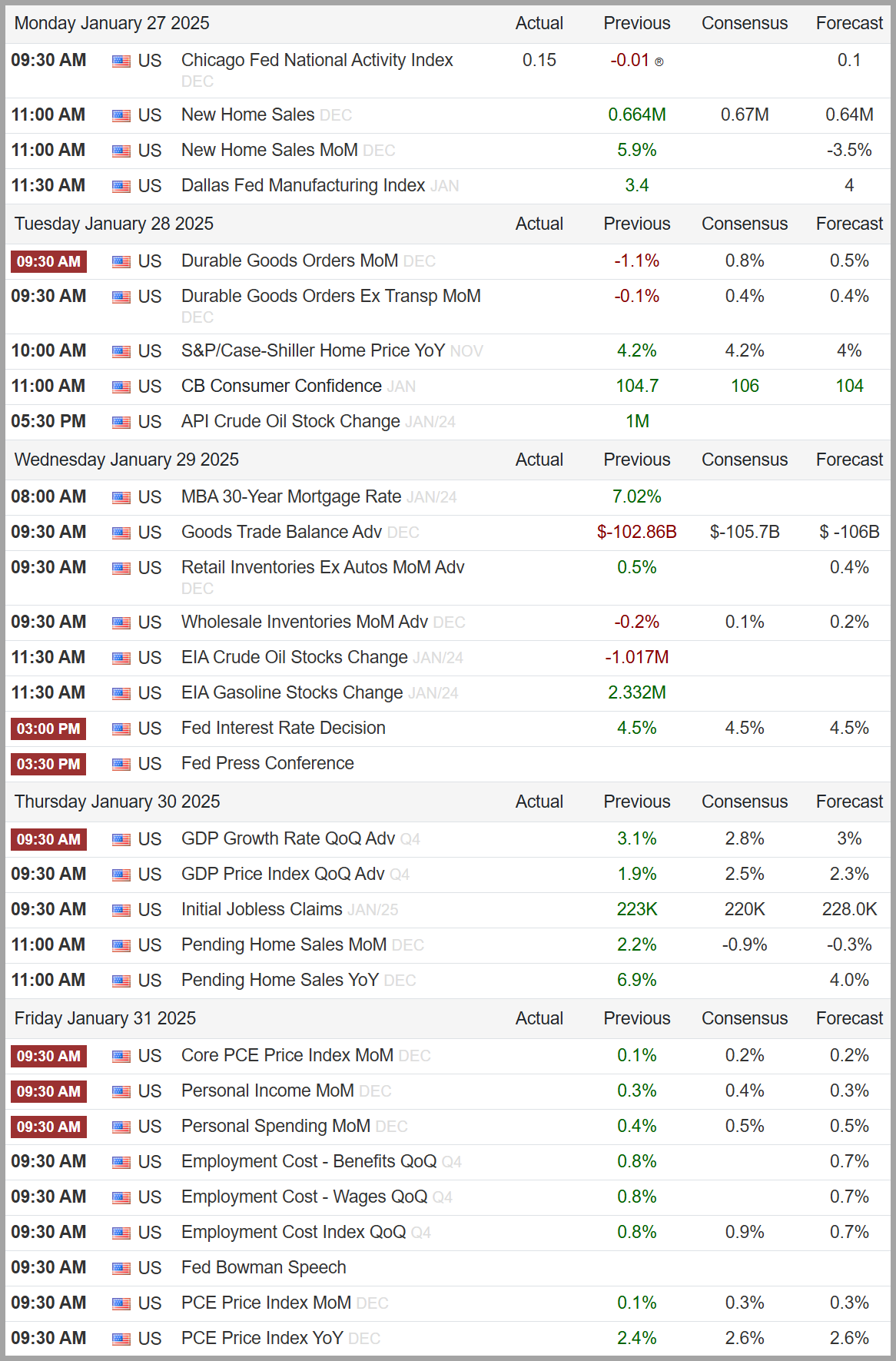

The Week Ahead:

This week, traders will focus on President Trump’s policy announcements, central bank decisions, and corporate earnings from mega cap tech giants including Microsoft, Meta, Tesla, and Apple. The Fed is expected to maintain rates on Tuesday, while the ECB and BoC may cut borrowing costs by an additional 0.25%. Key economic data releases include a peak at growth via GDP for the US and many key Eurozone countries along with a look at inflation via the Feds preferred measuring stick, Core PCE.

Source: www.tradingeconomics.com

Current Observations (Updates denoted by ***)

Economic Growth: The economy appears to be growing at a moderate pace, not too hot. GDP expanded 2.7% year-on-year in the third quarter of 2024, slowing slightly from a 3% rise in the previous period and has averaged 3.16 percent from 1948 until 2024. (source: U.S. Bureau of Economic Analysis)

***Inflation: Inflation has been cooling over the past year but appears to be a little “sticky” in recent months. The annual inflation rate in the US rose for a 3rd consecutive month to 2.9% in December 2024 from 2.7% in November, in line with expectations, yet concerningly the Fed’s 2% target. This marks the third increase in inflation in seven months, while core consumer prices, which exclude volatile items such as food and energy, remained unchanged at 2.40 percent in December.

( source: U.S. Bureau of Labor Statistics)

Employment: The jobs market remains robust despite the recent rise in unemployment from historically low levels. The US economy added 256K jobs in December 2024, the most in nine months, following a downwardly revised 212K in November, and once again beating market forecasts of 160K. The unemployment rate in the United States went down to 4.1% in December of 2024 from 4.2% in the previous month, below market expectations of 4.2%.

(source: U.S. Bureau of Labor Statistics)

Monetary Policy: According to minutes from the December 2024 FOMC meeting, nearly all Federal Reserve officials concluded that the risks of higher inflation had risen, citing the potential effects of changes in trade and immigration policies with the new administration coming in. While participants expected inflation to continue progressing toward the 2% target, they acknowledged that the timeline for achieving this goal might be longer than previously anticipated. Several members voiced concerns that the disinflationary trend may have stalled temporarily or warned of the possibility of further delays. Additionally, officials indicated that the Fed was approaching a point where slowing the pace of policy easing would be appropriate. In December, the Fed implemented another 25-basis-point cut to the federal funds rate, bringing it to a range of 4.25%-4.5%, and signaled plans for just two additional rate cuts in 2025, totaling 50 basis points.

(source: Federal Reserve)

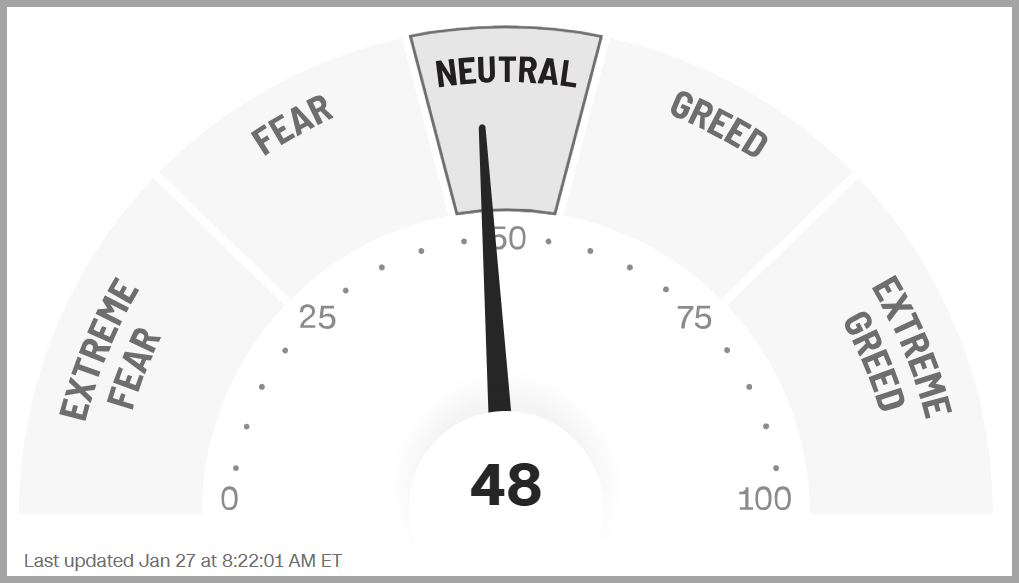

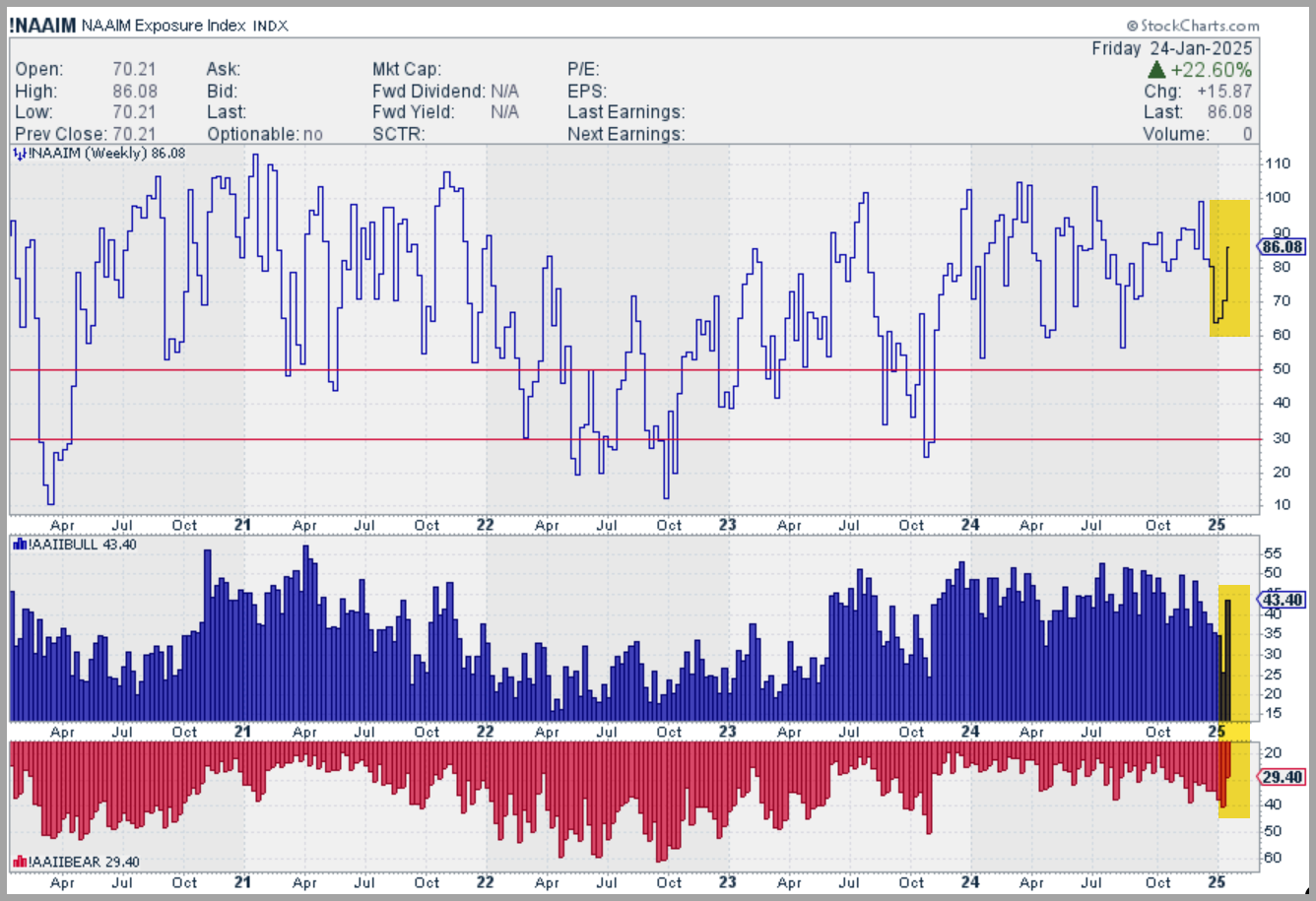

***Sentiment: Investor optimism has been rising over the past couple of weeks. According to AAII, retail investor have recently flipped from Bearish to bullish on the margin while active money managers appear to have put money back to work in stocks as the NAAIM Exposure index has increased rapidly. The CNN Fear & Greed index, which measures seven different aspects of market behavior to gauge the “mood” of the stock market, shows investors are who were recently fearful, have returned to a more “Neutral” stance.

Source: https://www.cnn.com/markets/fear-and-greed

Source: https://www.stockcharts.com

***Volatility & Speculative Demand: The VIX (CBOE Volatility Index), which is known to be Wall Street’s fear gauge, has fallen to “complacency” levels recently and high-yield (or “junk”) bond credit spreads have once again fallen to new cycle lows after recently showing signs of possible deterioration.

Stocks

The major Indices (Dow Jones Industrial Average, S&P 500, and NASDAQ) are at or near all-time highs, signifying a positive trend. Outside of the US, Developed and Emerging Markets Indices, which peaked in late September, have spent the last month retreating with their currency-hedged counterparts holding up much better.

***Bonds & Interest Rates

Bonds have had a relatively rough time since the Fed cut rates in September. A wave of overwhelmingly positive economic data and governmental policy concerns have rekindled inflation fears, causing investors to recalibrate their upcoming rate cut expectations. Longer-term yields recently peaked at their highest levels in nearly two years but have eased the past couple of week.

Commodities & Currencies

The weak Chinese economy (2nd largest in the world) and strong US dollar continue to weigh on commodities. Oil, the largest component in the commodities space, along with industrial metals (a key global growth gauge), have been under pressure while precious metals are trading near all-time highs.

The US Federal Reserve is currently being viewed as the most “hawkish” (high rates) central bank in the world. This stance is keeping a bid under the US Dollar as it trades near cycle highs.

***Breadth & Technicals

One of the major themes since the markets sold off in August has been expanding breadth. A lack of widespread support for the rally had recently appeared, however, the past couple of weeks are showing improvement as advancing stocks are once again outpacing decliners.

Source: Optuma with DTN IQ data

Tying it all together:

The stock market has shown remarkable strength historically, and for good reason. Inflation is steadily cooling, interest rate cuts are underway, economic growth remains solid, and the job market continues to demonstrate resilience, supported by strong corporate earnings projections.

Markets have responded favorably to the Federal Reserve’s strategy of guiding the economy toward a “soft landing.” This approach involves using monetary policy tools to slow economic activity just enough to curb inflation without triggering a recession. These tools primarily involve adjustments to short-term interest rates aimed at achieving full employment and price stability (i.e., low inflation). However, monetary policy changes often carry complex ripple effects, making it challenging for the Fed to anticipate all potential outcomes.

Prudent investors must analyze the Fed’s decisions—along with other variables—and allocate capital based on their forecasts. When Wall Street’s collective expectations align, clear price trends emerge.

Although recent trends in the stock market have been positive, overall valuations have reached historically elevated levels, suggesting the need for caution. It’s worth noting that bull markets don’t typically end due to stretched valuations alone (and sometimes valuations can surpass even the most optimistic projections). However, they often succumb to concerns over future monetary policy shifts and slowing economic growth. For this reason, it’s critical to watch for warning signs in the later stages of a bull market to help manage risk effectively.

As always, we will continue monitoring the markets and economic trends closely, sharing our insights and analyses through these weekly briefings to help guide informed decision-making.

Please feel free to share these commentaries with friends and family and, should you have any questions regarding your current strategy or the markets in general, please reach out to your CIAS Investment Adviser Representative.

Important Disclosures:

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The statements contained herein are solely based upon the opinions of Edward J. Sabo and the data available at the time of publication of this report, and there is no assurance that any predicted or implied results will actually occur. Information was obtained from third-party sources, which are believed to be reliable, but are not guaranteed as to their accuracy or completeness.

The actual characteristics with respect to any particular client account will vary based on a number of factors including but not limited to: (i) the size of the account; (ii) investment restrictions applicable to the account, if any; and (iii) market exigencies at the time of investment. Capital Investment Advisory Services, LLC (CIAS) reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. The information provided in this report should not be considered a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

CIAS is a registered investment advisor. More information about the advisor, including its investment strategies and objectives, can be obtained by visiting www.capital-invest.com. A copy of CIAS’s disclosure statement (Part 2 of Form ADV) is available, without charge, upon request. Our Form ADV contains information regarding our Firm’s business practices and the backgrounds of our key personnel. Please contact us at (919) 831-2370 if you would like to receive this information.

Capital Investment Advisory Services, LLC

100 E. Six Forks Road, Ste. 200; Raleigh, North Carolina 27609

Securities offered through Capital Investment Group, Inc. & Capital Investment Brokerage, Inc.

100 East Six Forks Road; Raleigh, North Carolina 27609

Members FINRA and SIPC