Weekly Market Insights

Happy New Year!

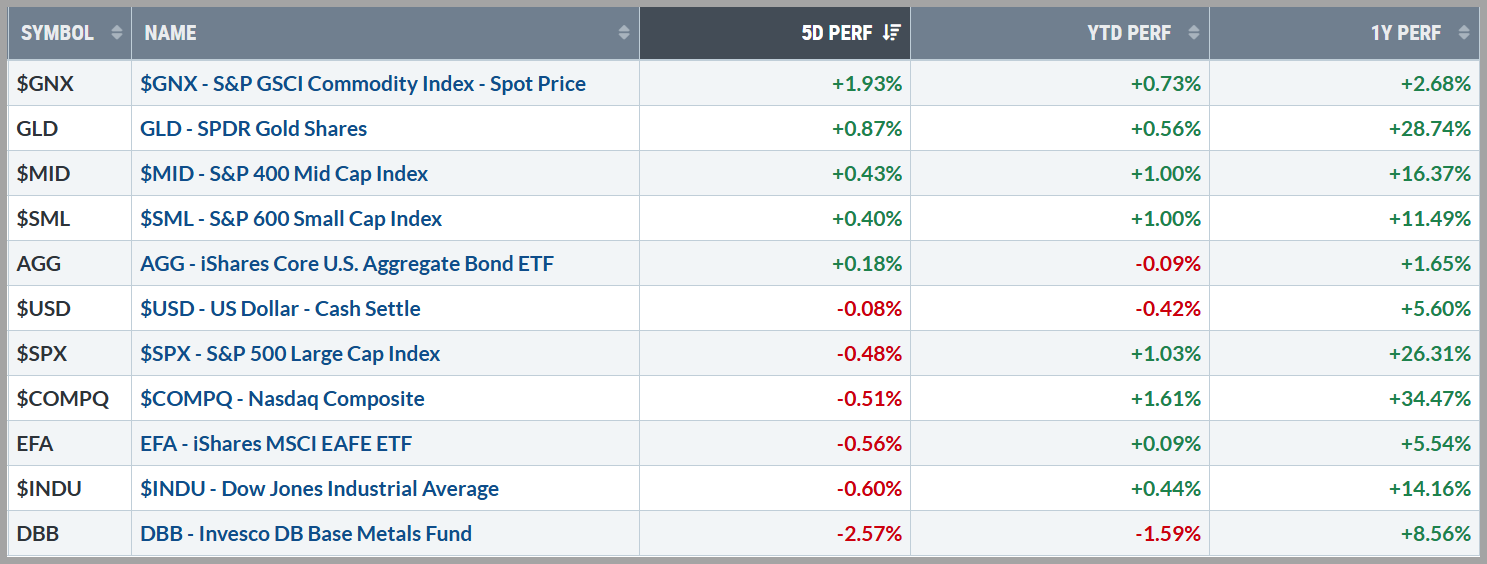

Stocks continued to trade in a volatile fashion last week to close out the year with another holiday-shortened trading week and low volumes across the board. Opinions are mixed as to whether the recent heavy tone is due to year-end profit and loss taking, the Fed’s more hawkish tone, valuation concerns, or recent economic data; but following two strong years of market growth, a pause was really never out of the realm of expectations.

Certainly, adding to all the stock market volatility is the fact that Treasury yields have been rising with the US Dollar following suit. 10-year Treasury yields remained above 4.5% last week and the US Dollar surged to its highest level in over a year. Higher Treasury yields can reduce the relative attractiveness of stocks and commodities as they affect the cost of borrowing and provide competition for capital. Higher domestic yields can also make the US Dollar more attractive compared to other currencies which can diminish the value of foreign earnings by multinationals and impact the prices of commodities around the world.

Despite the strong dollar, commodities generally rose last week, led by a 5+% gain in oil. Gold also posted another solid weekly increase, seemingly due to renewed inflation concerns. Industrial Metals, however, lagged as weak global manufacturing data dampened growth expectations for raw materials in 2025.

Source: Stockcharts.com

Key Takeaway:

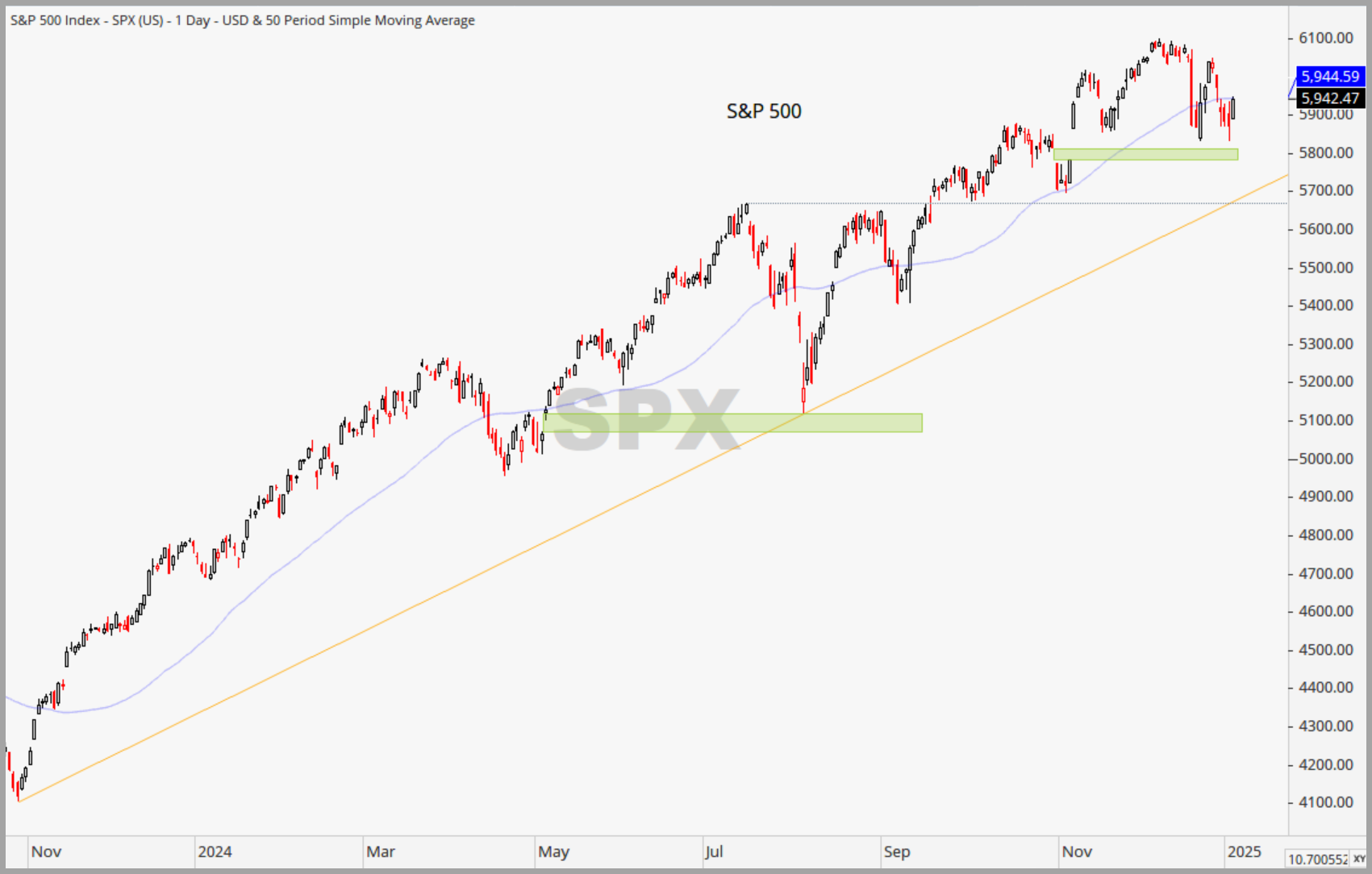

Volatility has been rising the past few weeks and investor sentiment appears to be waning. At this point, the result has been nothing more than a pause in the stock market’s bullish momentum as key trends still remain positive. This shift in psychology warrants our close attention as the bond market (aka “smart money”) is signaling high interest rates might stick around for longer than recently anticipated, while the commodities market is showing signs of global economic slowdown fears.

While this may sound scary on the surface, it’s important to remember that some of the issues, like sticky inflation, are due to the strong economy and labor market, which is really a positive thing. Current volatility is seemingly being created due to a “resetting of expectations” as to future actions of the Fed and a new regime coming to office with new policies that investors would like to have more clarity about such as tariffs and taxation.

Source: Optuma with DTN IQ data

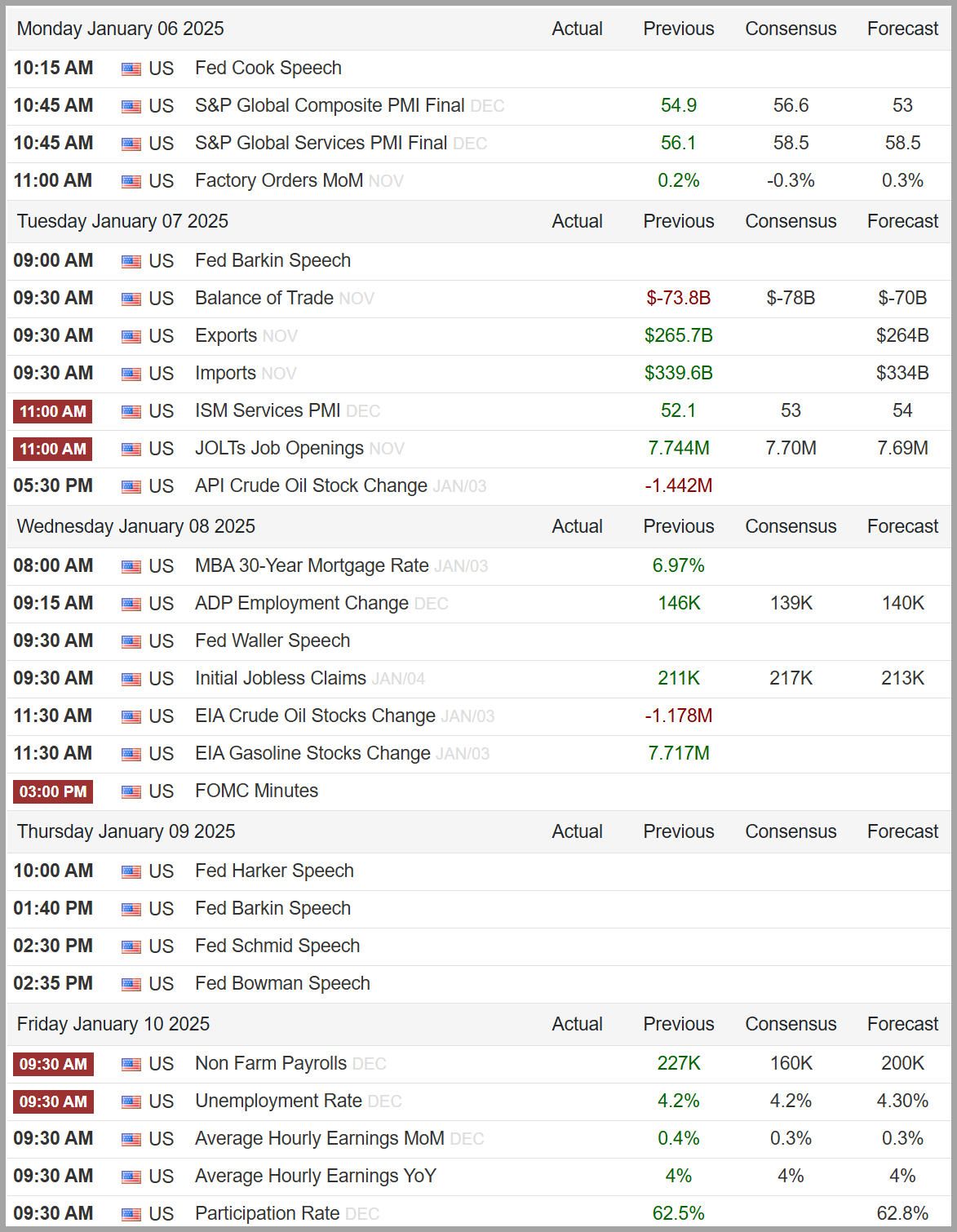

The Week Ahead:

This week, a busy slate of economic reports is expected, with the most anticipated being Friday’s Employment Situation report. This report is crucial as it provides key insights into the labor market, which is essential for shaping the Federal Reserve’s monetary policy. While progress on inflation has recently slowed, job reports have been mixed, with November’s readings well above expectations, following October’s weaker results that were impacted by strikes and hurricanes. Given these inconsistencies, there’s significant interest in the December data, as stronger job growth could suggest that the Fed might pause rate cuts, while a miss could imply economic weakness and indicate a need for more rate cuts. We will also get some of the key inflation reports this week, including the PPI and CPI, which provide further information as to the Fed’s actions in managing the economy.

Source: www.tradingeconomics.com

Current Observations (Updates denoted by ***)

Economic Growth: The economy appears to be growing at a moderate pace, not too hot. GDP expanded 2.7% year-on-year in the third quarter of 2024, slowing slightly from a 3% rise in the previous period and has averaged 3.16 percent from 1948 until 2024. (source: U.S. Bureau of Economic Analysis)

Inflation: Inflation has been cooling over the past year but appears to be a little “sticky” in recent months. The annual inflation rate in the US accelerated to 2.6% in October 2024, up from 2.4% in September which was the lowest rate since February 2021. This marks the first increase in inflation in seven months, while core consumer prices, which exclude volatile items such as food and energy, remain unchanged from September.

( source: U.S. Bureau of Labor Statistics)

Employment: The jobs market remains robust despite the recent rise in unemployment from historically low levels and the decreasing number of job openings. Put simply, the labor market was on fire just a few months ago and is cooling off to sustainable levels. The unemployment rate in the United States ticked up to 4.2% in November 2024, up from 4.1% in the previous month.

(source: U.S. Bureau of Labor Statistics)

Monetary Policy: The Fed lowered the federal funds target range by 25 basis points to 4.5%-4.75% at its November 2024 meeting, following a jumbo 50 basis point cut in September in an effort to balance inflation confidence with labor market concerns. An effective Fed Funds Rate of 4.625% is still considered “restrictive policy”, yet the Fed has telegraphed this is only the beginning of a rate cut cycle.

(source: Federal Reserve)

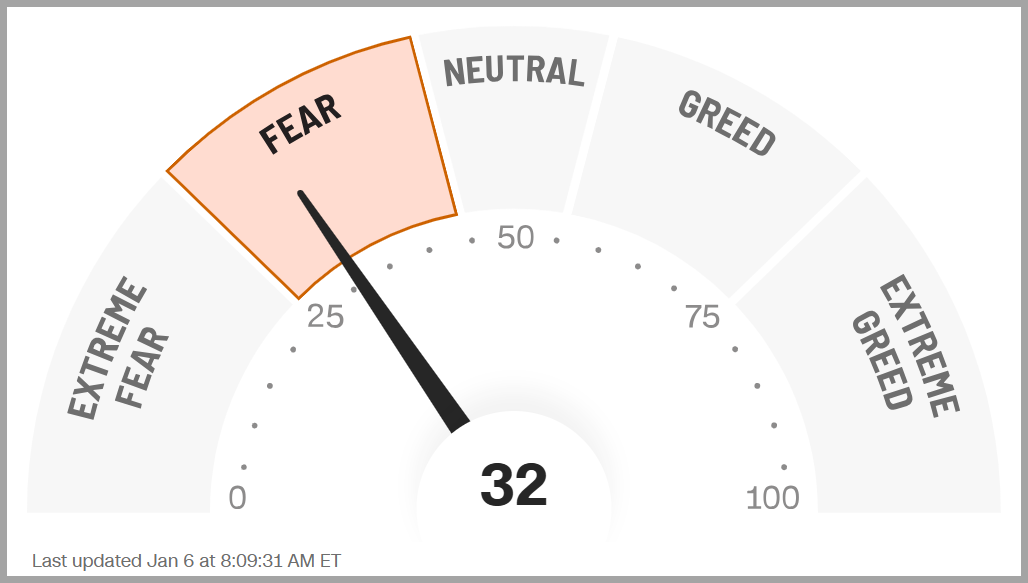

***Sentiment: Investor’s have been feeling a bit “moody”. According to AAII, retail investor Bulls currently only slightly outweigh the Bears and active money managers appear to be pulling money from stocks as the NAAIM Exposure index has been falling rapidly from recent strong levels. The CNN Fear & Greed index, which measures seven different aspects of market behavior to gauge the “mood” of the stock market, shows investors are currently in “Fear”.

Source: https://www.cnn.com/markets/fear-and-greed

***Volatility & Speculative Demand: The VIX (CBOE Volatility Index), which is known to be Wall Street’s fear gauge, remains “Complacent” following election week. This falls in line with what yield spreads, the difference (or spread) between yields for junk bonds and safer government bonds, have been signaling all year – as they are at historical lows – a sign that investors may be willing to take on more risk with regards to their fixed income investments and confidence in the overall economy. That being said, recently, high-yield (or “junk”) bond spreads have climbed to multi-month highs, while junk bond yields are at five-month peaks. This steady deterioration since Q4 2024 may be signaling growing stress in corporate credit markets—a development worth watching closely.

Stocks

The major Indices (Dow Jones Industrial Average, S&P 500, and NASDAQ) are near all-time highs, signifying a positive trend. Outside of the US, Developed and Emerging Markets Indices, which peaked in late September, have spent the last month retreating with their currency-hedged counterparts holding up much better.

***Bonds & Interest Rates

Bonds have had a relatively rough time since the Fed cut rates in September. A wave of overwhelmingly positive economic data and governmental policy concerns have rekindled inflation fears, causing investors to recalibrate their upcoming rate cut expectations. (Just a reminder, bond prices and interest rates have an inverse relationship). Interest rates have been rising and are near the highs of the past year.

Commodities & Currencies

The weak Chinese economy (2nd largest in the world) and strong US dollar continue to weigh on commodities. Oil, the largest component in the commodities space, along with industrial metals (a key global growth gauge), have been under pressure while precious metals are trading near all-time highs.

The US Federal Reserve is currently being viewed as the most “hawkish” (high rates) central bank in the world. This stance is keeping a bid under the US Dollar as it trades near cycle highs.

***Breadth & Technicals

One of the major themes since the markets sold off in August has been expanding breadth. Recently, fewer sectors and industries are contributing to overall gains, signaling a lack of widespread support for the rally and potential underlying weakness.

This can be witnessed by looking at:

- Advancing vs. Declining Stocks

- Bullish Percent Charts (the percentage of stocks on a Point & Figure “Buy” signal)

- Net new 52-week highs vs. lows

- Percentage of stocks above/below critical moving averages

Tying it all together:

The stock market has been historically strong, and for good reason. Inflation is steadily cooling, interest rate cuts are taking place, economic growth remains robust, and the job market has shown impressive resilience along with corporate earnings projections.

The markets have responded positively to the Fed’s strategy to steer the economy toward a “soft landing”— where they slow things down just enough to tame inflation without tipping into a recession utilizing their monetary policy tools. Those “tools” mostly involve the Fed changing short-term interest rates in an effort to promote full employment and price stability (i.e. low inflation). Monetary policy changes often come with confounding ramifications and it’s difficult for the Fed to foresee all the nuances their strategies will invoke.

Prudent investors must attempt to predict the potential outcomes of the Feds decisions (along with many other variables) and allocate capital according to their thesis. When Wall Street’s collective theses align, price trends emerge.

While recent price trends in the stock market have been very positive, overall valuations have become historically stretched, warranting a dose of caution. It’s important to understand that bull markets don’t end due to stretched valuations (in fact, sometimes valuations can exceed even the most optimistic expectations) but they do eventually fall victim to concerns over future monetary policy implications and growth deterioration, so it is important to look for cautionary signals during the later stages of a bull cycle to mitigate unnecessary risks. Of course, we will continue monitoring the markets and economic trends in an effort to help make informed decisions and report our findings in these briefings weekly.

Please feel free to share these commentaries with friends and family and, should you have any questions regarding your current strategy or the markets in general, please reach out to your CIAS Investment Adviser Representative.

Important Disclosures:

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The statements contained herein are solely based upon the opinions of Edward J. Sabo and the data available at the time of publication of this report, and there is no assurance that any predicted or implied results will actually occur. Information was obtained from third-party sources, which are believed to be reliable, but are not guaranteed as to their accuracy or completeness.

The actual characteristics with respect to any particular client account will vary based on a number of factors including but not limited to: (i) the size of the account; (ii) investment restrictions applicable to the account, if any; and (iii) market exigencies at the time of investment. Capital Investment Advisory Services, LLC (CIAS) reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. The information provided in this report should not be considered a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

CIAS is a registered investment advisor. More information about the advisor, including its investment strategies and objectives, can be obtained by visiting www.capital-invest.com. A copy of CIAS’s disclosure statement (Part 2 of Form ADV) is available, without charge, upon request. Our Form ADV contains information regarding our Firm’s business practices and the backgrounds of our key personnel. Please contact us at (919) 831-2370 if you would like to receive this information.

Capital Investment Advisory Services, LLC

100 E. Six Forks Road, Ste. 200; Raleigh, North Carolina 27609

Securities offered through Capital Investment Group, Inc. & Capital Investment Brokerage, Inc.

100 East Six Forks Road; Raleigh, North Carolina 27609

Members FINRA and SIPC