Weekly Market Insights

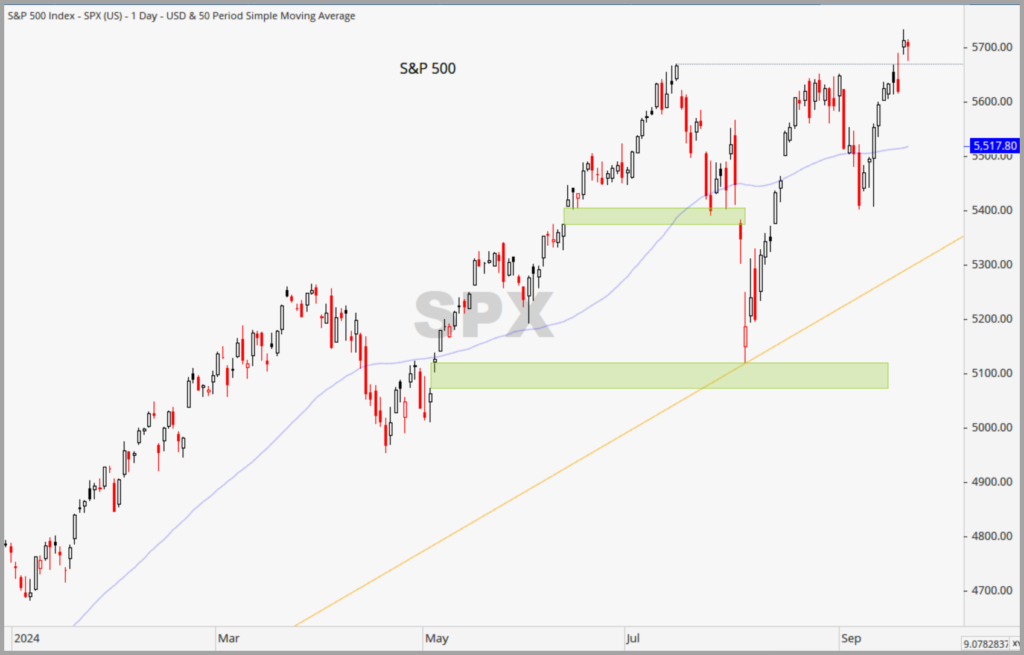

Markets rallied to fresh all-time highs last week on the heels of the FOMC meeting where the Fed cut rates for the first time in over four years and did so by a decisive measure of 0.50%. While the odds favored the 50-bps cut, many were still thinking we’d only get 25-bps. The message to the markets was clear, the Fed does not want to fall behind the curve and hurt growth. “Soft Landing” hopes were reinvigorated, and money flowed into risk assets as can be seen in the grid below.

The commodity space welcomed the larger cut and saw growth sensitive assets, such as oil and industrial metals, post gains. Gold benefitted from lower short-term rates and increased inflation odds, while the dollar traded mostly flat. Longer-dated Treasury yields actually ticked up a bit, however, they had already moved to new yearly lows ahead of the announcement and may have been a little ahead of themselves.

Source: Stockcharts.com

Source: Optuma and DTN IQ

Key Takeaway:

At the moment, the short-term outlook for stocks remains broadly favorable. The primary risk to this rally (outside of geopolitical issues) is unexpectedly weak economic growth. However, with a relatively quiet economic calendar between now and early October, it may take a major negative surprise to trigger a wave of selling. Moreover, Q3 earnings season doesn’t kick off until the second week of October, and no major market-moving companies seem to be reporting before then. Given these conditions, the market is currently benefiting from:

- Moderating inflation

- A more dovish Federal Reserve

- Decelerating, but steady, economy

- Overall solid corporate earnings

- Enthusiasm surrounding AI

- Positive momentum

As such, we could see stocks continue to climb the “wall of worry” gradually in the near-term, even if this leads to stretched valuations.

From a tactical perspective, if the rally persists, we would expect cyclical and value sectors to take the lead, with broader market segments potentially outperforming the tech sector. Sectors such as materials, consumer discretionary, industrials, staples, and real estate investment trusts (REITs) are positioned to benefit, as investors seemingly remain hopeful for stronger growth and lower interest rates.

In summary, the market is inclined to push higher, and the Fed’s recent rate cut only strengthens this drive. It may take relatively significant negative economic data to disrupt this bullish trend, and with few major catalysts currently on the horizon before October, that risk appears limited for now.

The Week Ahead:

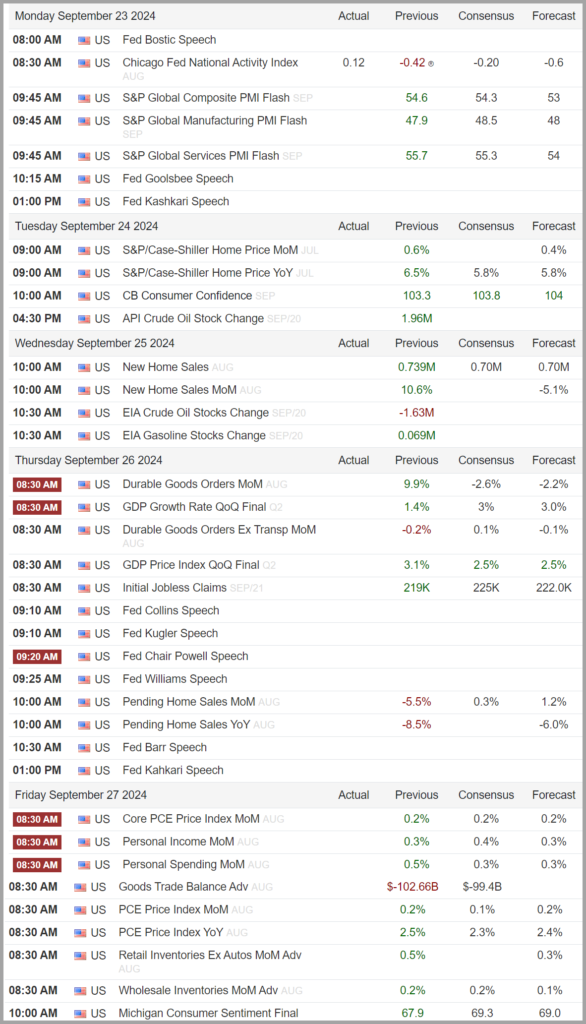

According to statistics derived from the options market, this week’s “Expected Move” (EM) for the S&P 500 is +/- 112 points, slightly up from last week’s 114-point EM.

This week is chock-full of key economic data. Thursday’s Durable Good’s report will give clues as to business spending trends while this morning’s Flash PMIs will offer a near term look at activity. Later in the week we will also hear from Fed Chair Powell and get another look at inflation via Core PCE, the Fed’s preferred inflation gauge.

Source: Trading Economics (https://tradingeconomics.com/united-states/calendar#)

Tidbits & Technicals: (New developments will be denoted via***)

Current Headwinds:

- Valuations seem frothy given the current rate environment, leaving the markets subject to a potential swift pullback!

- “Higher for Longer” – Risk that the Federal Reserve waited too long to begin lowering rates and threatens economic growth.

- Very narrow market participation, apparently driven primarily by mega cap tech and AI-related companies, has dominated the indices; however, over the last several weeks we have witnessed a significant broadening effect with “the rest of the market” participating in returns.

Current Tailwinds:

- Optimism surrounding Artificial Intelligence (AI) (recently waning)

- ***The Federal Reserve has begun their rate-cutting cycle and vows more cuts in the future

- Strong Labor Market (signs of rising unemployment are showing up, yet jobs are available)

- Solid Economic Growth

- Continued Earnings Growth (the pace of which may be slowing)

- Momentum

- ***10-year Treasury yields continue to trade lower to new annual lows

Sentiment:

- Credit Spreads which recently returned to historically low levels following a spike, have strangely been widening a bit lately.

- ***The VIX (CBOE Volatility Index) has settled down somewhat but remains elevated when compared to this year’s lower trend.

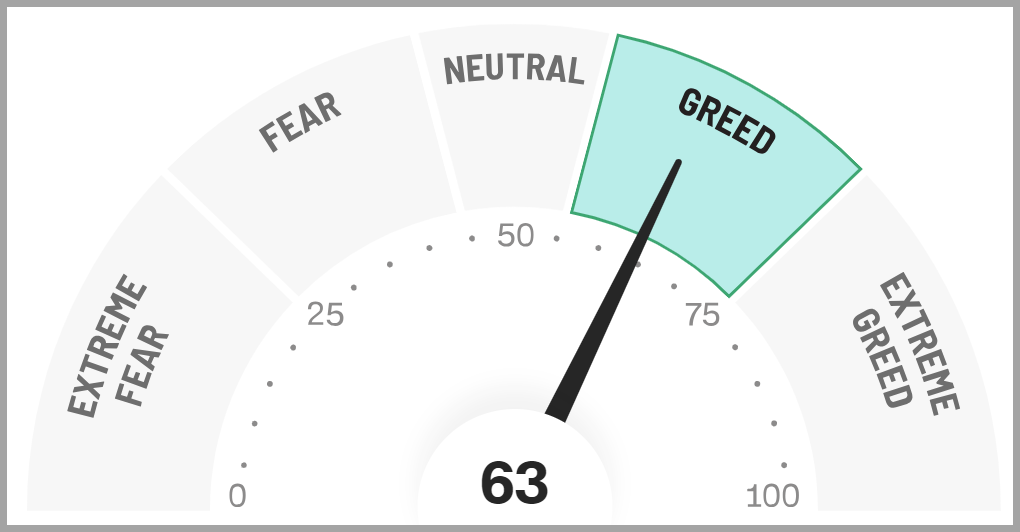

- ***The CNN FEAR & Greed Index has moved to Greed Status

Source: https://www.cnn.com/markets/fear-and-greed

Intermarket Trends:

- ***The major Indices (Dow Jones Industrial Average, S&P 500, and NASDAQ) are trading at or near all-time highs signifying a positive trend

- Interest rates have been volatile all year and appear to be trending lower.

- The US Dollar has broken its upward trend line over the past several weeks and is trending downward

- Gold recently broke out of its trading range to record highs

- Industrial Metals, which have been trending lower lately, have reversed course and have been gaining traction

- Oil futures are in the middle of their one-year trading band and appear to be stuck in a trading range

Tying it all together:

The markets posted fresh all-time highs last week on the heels of the first rate cut in over four years, leaving the bulls with the proverbial torch amid historically high valuations and solid, yet moderating, economic backdrop. Employment is showing signs of cooling, the yield curve is emerging from inversion after a prolonged period and credit spreads are widening, yet optimism for equities remains strong.

My confidence in this current bull market remains cautiously optimistic, as the general trend is positive and the overall fundamental backdrop appears to support these levels. My conviction will strengthen if the new all-time highs can hold and we continue to push even higher. It’s important to recognize at this juncture that the recent rotation out of AI/technology-related stocks and into “other areas of the market’ increases the challenge for the indices to continue to make new highs, since the technology sector represents a huge portion of several of the indices we use to track the markets (S&P 500, NASDAQ, etc.), therefore, it will take a stronger “push” by the other sectors to obtain this goal.

One can measure that “push” by looking under the hood of the market to gauge the broader participation, using measures of “market internals”. The most widely-used measures of internal strength are things such as the Advance-Decline line and its corresponding AD Volume derivative. At the present time, the Advance Decline metrics are trending upward, which shows that more and more stocks are moving up and they are doing so with strong volume. compared to those that are taking a break or moving downward.

This broad participation is a healthy attribute and fits well within the context of the current fundamental backdrop where we have robust economic growth, historically low unemployment, and inflation trending down. During periods like this, we may expect companies tied to the more cyclical sectors (Industrials, Materials, Financials, etc.) to perform well, as it would be based on recent earnings reports. Capital is also flowing into these areas as we see stocks in these categories generally rising; however, we continue to see stronger flows into the more defensive sectors (Utilities, Healthcare and Consumer Staples). This emerging outperformance of defensive sectors is a dynamic we’d generally expect to see during the later stages of the business cycle, when concerns over future growth begin to appear.

This backdrop calls for careful monitoring, especially as stock valuations remain high and appear to be pricing in an optimistic outcome. The Federal Reserve faces the challenging task of achieving a “soft landing”—bringing inflation down to its target without stifling economic growth or increasing unemployment.

Our strategy blends macroeconomic insights with technical and intermarket analysis, and investor sentiment, to inform our tactical decisions in real time. At present, we generally recommend maintaining exposure to equities, with an emphasis on high-quality, low-volatility stocks. We also advocate for holding a healthy allocation to longer-duration, investment-grade bonds, which we believe can reduce portfolio risk while offering compelling returns.

Lastly, I want to emphasize that the most effective strategy in all market environments is to ensure one’s overall portfolio aligns with their risk tolerance and long-term goals while keeping emotions at bay. The markets often overreact to both positive and negative news, so having a sound plan, a cool head, and an understanding of the current sentiment is crucial. Staying disciplined and focused on your long-term objectives, rather than being swayed by short-term volatility, will help navigate uncertainty and capitalize on opportunities as they arise.

Please feel free to share these commentaries with friends and family and, should you have any questions regarding your current strategy or the markets in general, please reach out to your CIAS Investment Adviser Representative.

Important Disclosures:

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The statements contained herein are solely based upon the opinions of Edward J. Sabo and the data available at the time of publication of this report, and there is no assurance that any predicted or implied results will actually occur. Information was obtained from third-party sources, which are believed to be reliable, but are not guaranteed as to their accuracy or completeness.

The actual characteristics with respect to any particular client account will vary based on a number of factors including but not limited to: (i) the size of the account; (ii) investment restrictions applicable to the account, if any; and (iii) market exigencies at the time of investment. Capital Investment Advisory Services, LLC (CIAS) reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. The information provided in this report should not be considered a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

CIAS is a registered investment advisor. More information about the advisor, including its investment strategies and objectives, can be obtained by visiting www.capital-invest.com. A copy of CIAS’s disclosure statement (Part 2 of Form ADV) is available, without charge, upon request. Our Form ADV contains information regarding our Firm’s business practices and the backgrounds of our key personnel. Please contact us at (919) 831-2370 if you would like to receive this information.

Capital Investment Advisory Services, LLC

100 E. Six Forks Road, Ste. 200; Raleigh, North Carolina  7609

7609

Securities offered through Capital Investment Group, Inc. & Capital Investment Brokerage, Inc.

100 East Six Forks Road; Raleigh, North Carolina 27609

Members FINRA and SIPC